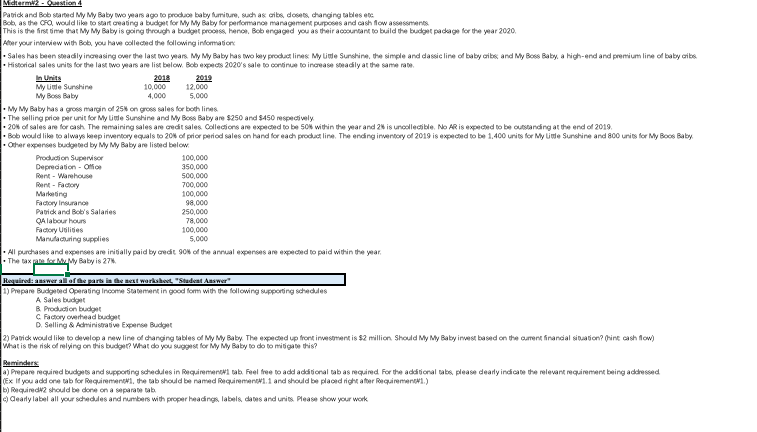

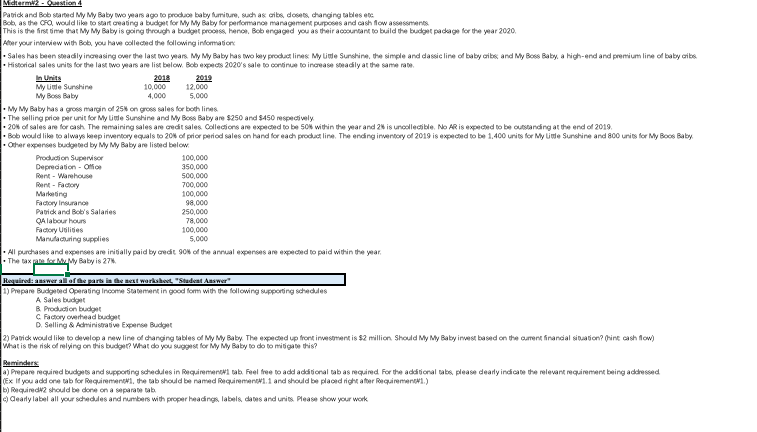

4.000 Midterm Man Patrick and Bob scared My My Baby two years ago to produce baby future such as cribs, des changing tables etc Bob as the CFO would like to start creating a budget for My My Baby for performance management purposes and cash flow assessments This is the first time that My My Baby is going through a budget process, heron Bob engaged you as their accountant to build the budget package for the year 2020 Her your interview with Bob you have collected the following information Sales has been adily increasing over the last two years. My My Baby has two bay product lines My Litle Sunshine, the simple and dassic line of baby cribe and My Boss Baby a high-end and premium line of baby crits . Historical sales units for the last two years are list below. Bob expects 2020's sale to continue to increase seadily at the same rate 2018 2019 My Utle Sunshine 10,000 12.000 My Boss Baby 5.000 My My Baby has a gross margin of 25% on gross sales for both lines The selling price per unit for My Little Sunshine and My Boss Baby are $250 and $450 respectively - 20% of sales are for cash. The remaining sales are credit sales Collections are expected to be 50% within the year and 2 is uncollectible No AR is expected to be outstanding at the end of 2019, - Bob would like to always beep inventory equals to 20% of prior period sales on hand for each product line. The ending inventory of 2019 is expected to be 1.400 units for Myline Sunshine and 800 units for My Boos Baby Other expenses budged by My My Baby are listed below Production Supervisor 100,000 Depreciation - Office 350,000 Rent - Warehouse 500,000 Rent Factory 700,000 Marting 100,000 Factory Insurano 98,000 Patrick and Bob's Salaries 250,000 A labour hours 78,000 Factory Ulities 100,000 Manufacturing supplies 5.000 All purchases and expenses are initially paid by credit 90% of the annual expenses are expected to paid within the year The taxe for M.My Baby is 27% Required: answer alor de part in the next workshet. "Student Answer 1) Prepare Budpod Operating Income Statement in good fom with the following supporting schedules A Sales budget B Production budget Factory overhead budet D. Selling & Administrative Expense But 2) Patrick would like to develop a new line of changing tables of My My Baby. The expected up front investment is $2 million should My My Baby invest based on the current financial situation? (hinc cash flow) What is the risk of relying on this budget? What do you suggest for by My Baby to do to mitigate this? Reminders a) Prepare required budges and supporting schedules in Requirement tab. Feel free to add additional tabasquined for the additional babe, please dearly indicate the relevant requirement being addressed (Exif you add one tab for Requirement, the tab should be named Requirement1.1 and should be placed right after Requirement.) b) Required2 should be done on a separate tab dearly label all your schedules and numbers with proper heading labels dates and units. Please show your work 4.000 Midterm Man Patrick and Bob scared My My Baby two years ago to produce baby future such as cribs, des changing tables etc Bob as the CFO would like to start creating a budget for My My Baby for performance management purposes and cash flow assessments This is the first time that My My Baby is going through a budget process, heron Bob engaged you as their accountant to build the budget package for the year 2020 Her your interview with Bob you have collected the following information Sales has been adily increasing over the last two years. My My Baby has two bay product lines My Litle Sunshine, the simple and dassic line of baby cribe and My Boss Baby a high-end and premium line of baby crits . Historical sales units for the last two years are list below. Bob expects 2020's sale to continue to increase seadily at the same rate 2018 2019 My Utle Sunshine 10,000 12.000 My Boss Baby 5.000 My My Baby has a gross margin of 25% on gross sales for both lines The selling price per unit for My Little Sunshine and My Boss Baby are $250 and $450 respectively - 20% of sales are for cash. The remaining sales are credit sales Collections are expected to be 50% within the year and 2 is uncollectible No AR is expected to be outstanding at the end of 2019, - Bob would like to always beep inventory equals to 20% of prior period sales on hand for each product line. The ending inventory of 2019 is expected to be 1.400 units for Myline Sunshine and 800 units for My Boos Baby Other expenses budged by My My Baby are listed below Production Supervisor 100,000 Depreciation - Office 350,000 Rent - Warehouse 500,000 Rent Factory 700,000 Marting 100,000 Factory Insurano 98,000 Patrick and Bob's Salaries 250,000 A labour hours 78,000 Factory Ulities 100,000 Manufacturing supplies 5.000 All purchases and expenses are initially paid by credit 90% of the annual expenses are expected to paid within the year The taxe for M.My Baby is 27% Required: answer alor de part in the next workshet. "Student Answer 1) Prepare Budpod Operating Income Statement in good fom with the following supporting schedules A Sales budget B Production budget Factory overhead budet D. Selling & Administrative Expense But 2) Patrick would like to develop a new line of changing tables of My My Baby. The expected up front investment is $2 million should My My Baby invest based on the current financial situation? (hinc cash flow) What is the risk of relying on this budget? What do you suggest for by My Baby to do to mitigate this? Reminders a) Prepare required budges and supporting schedules in Requirement tab. Feel free to add additional tabasquined for the additional babe, please dearly indicate the relevant requirement being addressed (Exif you add one tab for Requirement, the tab should be named Requirement1.1 and should be placed right after Requirement.) b) Required2 should be done on a separate tab dearly label all your schedules and numbers with proper heading labels dates and units. Please show your work