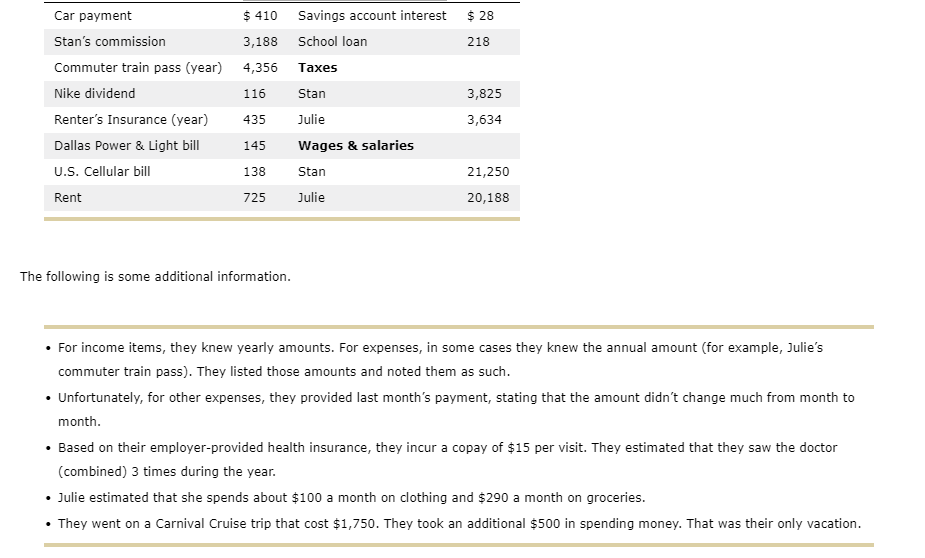

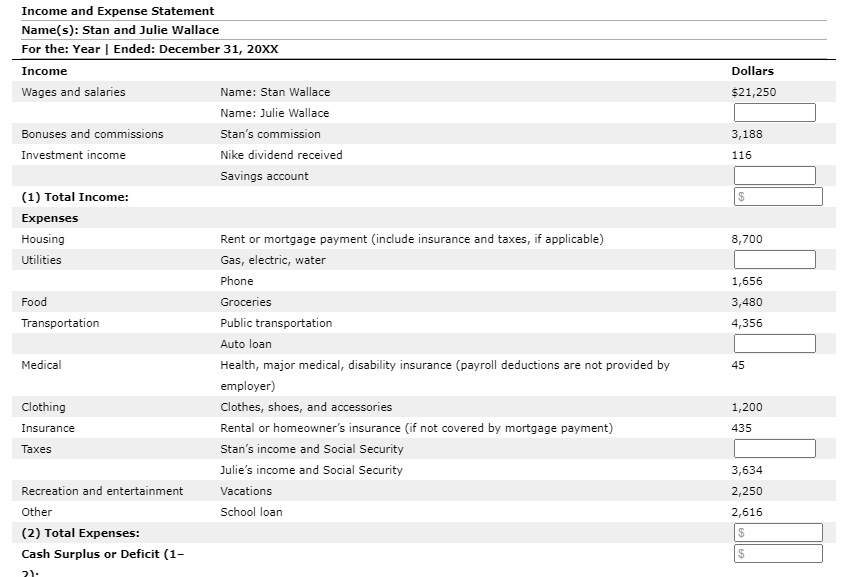

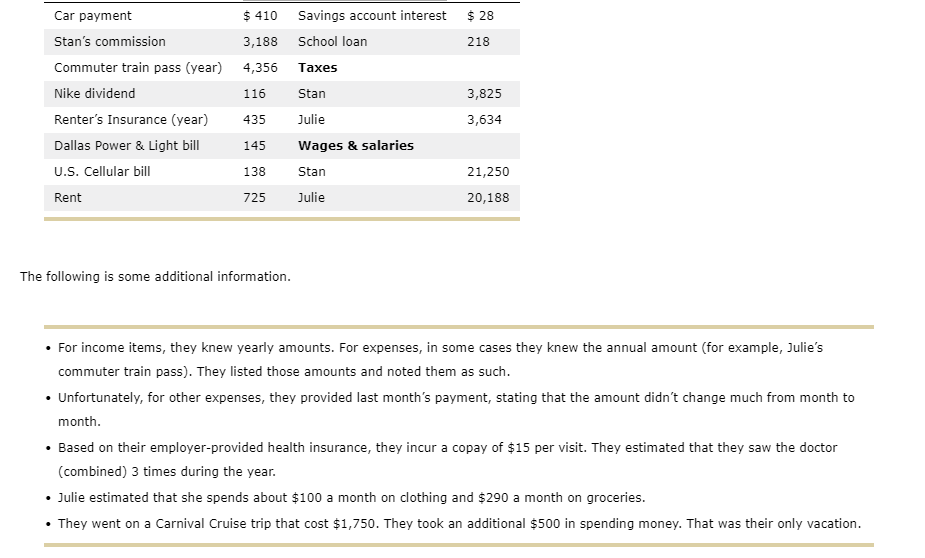

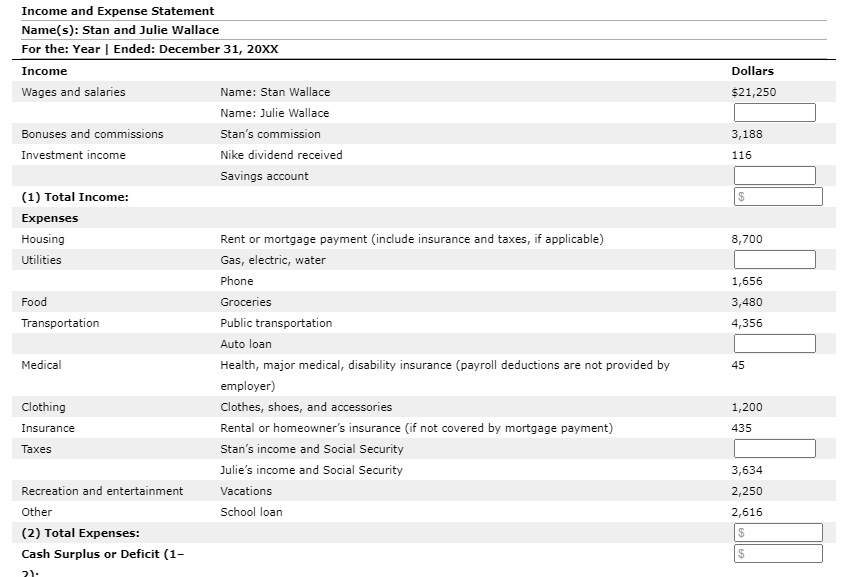

$ 410 $ 28 Savings account interest School loan 3,188 218 4,356 Taxes 116 3,825 Car payment Stan's commission Commuter train pass (year) Nike dividend Renter's Insurance (year) Dallas Power & Light bill U.S. Cellular bill Rent 435 3,634 145 Stan Julie Wages & salaries Stan Julie 138 21,250 725 20,188 The following is some additional information. For income items, they knew yearly amounts. For expenses, in some cases they knew the annual amount (for example, Julie's commuter train pass). They listed those amounts and noted them as such. Unfortunately, for other expenses, they provided last month's payment, stating that the amount didn't change much from month to month. . Based on their employer-provided health insurance, they incur a copay of $15 per visit. They estimated that they saw the doctor (combined) 3 times during the year. Julie estimated that she spends about $100 a month on clothing and $290 a month on groceries. They went on a Carnival Cruise trip that cost $1,750. They took an additional $500 in spending money. That was their only vacation. Dollars $21,250 3,188 116 $ 8,700 Income and Expense Statement Name(s): Stan and Julie Wallace For the: Year Ended: December 31, 20xx Income Wages and salaries Name: Stan Wallace Name: Julie Wallace Bonuses and commissions Stan's commission Investment income Nike dividend received Savings account (1) Total Income: Expenses Housing Rent or mortgage payment include insurance and taxes, if applicable) Utilities Gas, electric, water Phone Food Groceries Transportation Public transportation Auto loan Medical Health, major medical, disability insurance (payroll deductions are not provided by employer) Clothing Clothes, Shoes, and accessories Insurance Rental or homeowner's insurance (if not covered by mortgage payment) Taxes Stan's income and Social Security Julie's income and Social Security Recreation and entertainment Vacations Other School loan (2) Total Expenses: Cash Surplus or Deficit (1- 1,656 3,480 4,356 45 1,200 435 3,634 2,250 2,616 $ $ 2). $ 410 $ 28 Savings account interest School loan 3,188 218 4,356 Taxes 116 3,825 Car payment Stan's commission Commuter train pass (year) Nike dividend Renter's Insurance (year) Dallas Power & Light bill U.S. Cellular bill Rent 435 3,634 145 Stan Julie Wages & salaries Stan Julie 138 21,250 725 20,188 The following is some additional information. For income items, they knew yearly amounts. For expenses, in some cases they knew the annual amount (for example, Julie's commuter train pass). They listed those amounts and noted them as such. Unfortunately, for other expenses, they provided last month's payment, stating that the amount didn't change much from month to month. . Based on their employer-provided health insurance, they incur a copay of $15 per visit. They estimated that they saw the doctor (combined) 3 times during the year. Julie estimated that she spends about $100 a month on clothing and $290 a month on groceries. They went on a Carnival Cruise trip that cost $1,750. They took an additional $500 in spending money. That was their only vacation. Dollars $21,250 3,188 116 $ 8,700 Income and Expense Statement Name(s): Stan and Julie Wallace For the: Year Ended: December 31, 20xx Income Wages and salaries Name: Stan Wallace Name: Julie Wallace Bonuses and commissions Stan's commission Investment income Nike dividend received Savings account (1) Total Income: Expenses Housing Rent or mortgage payment include insurance and taxes, if applicable) Utilities Gas, electric, water Phone Food Groceries Transportation Public transportation Auto loan Medical Health, major medical, disability insurance (payroll deductions are not provided by employer) Clothing Clothes, Shoes, and accessories Insurance Rental or homeowner's insurance (if not covered by mortgage payment) Taxes Stan's income and Social Security Julie's income and Social Security Recreation and entertainment Vacations Other School loan (2) Total Expenses: Cash Surplus or Deficit (1- 1,656 3,480 4,356 45 1,200 435 3,634 2,250 2,616 $ $ 2)