Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4.12 Biomet Implants is planning new online patient diagnostics for surgeons while they operate. The new system will cost $300,000 to install in an

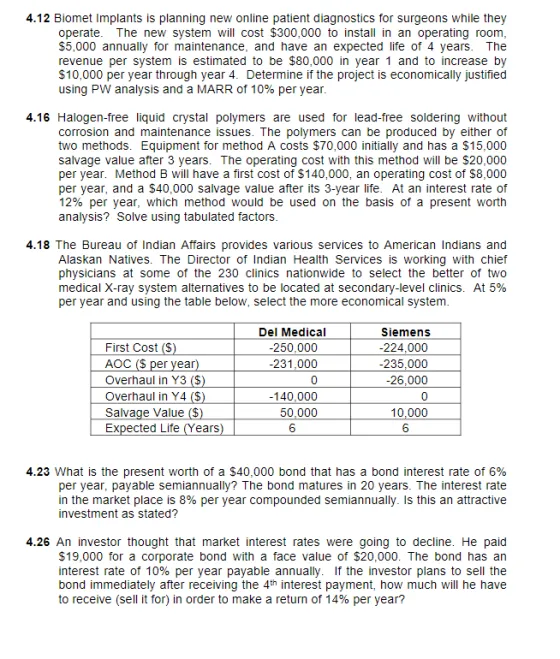

4.12 Biomet Implants is planning new online patient diagnostics for surgeons while they operate. The new system will cost $300,000 to install in an operating room, $5,000 annually for maintenance, and have an expected life of 4 years. The revenue per system is estimated to be $80,000 in year 1 and to increase by $10,000 per year through year 4. Determine if the project is economically justified using PW analysis and a MARR of 10% per year. 4.16 Halogen-free liquid crystal polymers are used for lead-free soldering without corrosion and maintenance issues. The polymers can be produced by either of two methods. Equipment for method A costs $70,000 initially and has a $15,000 salvage value after 3 years. The operating cost with this method will be $20,000 per year. Method B will have a first cost of $140,000, an operating cost of $8,000 per year, and a $40,000 salvage value after its 3-year life. At an interest rate of 12% per year, which method would be used on the basis of a present worth analysis? Solve using tabulated factors. 4.18 The Bureau of Indian Affairs provides various services to American Indians and Alaskan Natives. The Director of Indian Health Services is working with chief physicians at some of the 230 clinics nationwide to select the better of two medical X-ray system alternatives to be located at secondary-level clinics. At 5% per year and using the table below, select the more economical system. First Cost (S) AOC ($ per year) Overhaul in Y3 ($) Overhaul in Y4 ($) Salvage Value ($) Expected Life (Years) Del Medical -250,000 -231,000 0 -140,000 50,000 6 Siemens -224,000 -235,000 -26,000 0 10,000 6 4.23 What is the present worth of a $40,000 bond that has a bond interest rate of 6% per year, payable semiannually? The bond matures in 20 years. The interest rate in the market place is 8% per year compounded semiannually. Is this an attractive investment as stated? 4.26 An investor thought that market interest rates were going to decline. He paid $19,000 for a corporate bond with a face value of $20,000. The bond has an interest rate of 10% per year payable annually. If the investor plans to sell the bond immediately after receiving the 4th interest payment, how much will he have to receive (sell it for) in order to make a return of 14% per year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION 412 Biomet Implants To determine if the project is economically justified we need to calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started