Question

4-13 Unlevering and Relevering Equity Betas In 2006, the major airline carriers, with the principal exception of Southwest Airlines (LUV), continued to be in dire

4-13 Unlevering and Relevering Equity Betas In 2006, the major airline carriers, with the principal exception of Southwest Airlines (LUV), continued to be in dire financial condition following the attack on the World Trade Center in 2001.

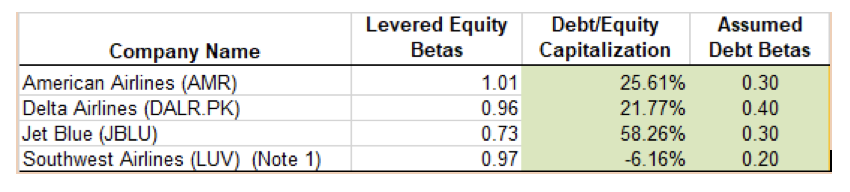

Given the following data for Southwest Airlines and three other airlines (for August 1, 2014), estimate the unlevered equity beta for Southwest Airlines. Use the procedure described in Table 4-1.

Based on your estimate of Southwest Airliness unlevered equity beta, relever the beta to get an estimate of the firms levered beta.

4-14 Estimating the Cost of Equity Using the Fama-French Method Telecom services is an industry under rapid transformation because telephone, Internet, and television services are being brought together under a common technology. In fall 2006, the telecom analyst for HML Capital, a private investment company, was trying to evaluate the cost of equity for two giants in the telecom industry: SBC Communications (AT&T) and Verizon Communications. Specifically, he wanted to look at two alternative methods for making the estimate: the CAPM and Fama-French three-factor model. The CAPM utilizes only one risk premium for the market as a whole, whereas the Fama-French model uses three (one for each of three factors). The factors are (1) a market risk premium, (2) a risk premium related to firm size, and (3) a market-to-book risk premium. Data for the risk premium sensitivities (b, s, and h) as well as the beta coefficient for the CAPM are listed in the following table:

If the risk-free rate of interest is 3%, what is the estimated cost of equity for the two firms using the CAPM?

What is the estimated cost of equity capital for the two firms using the Fama- French three-factor model? Interpret the meaning of the signs

4-17 Comprehensive Wacc Computation On behalf of your firm, you are evaluating a privately held takeover target. The table below contains cost of capital metrics for two comparable publicly traded firms that are in the same general business and are similar in size compared to the acquisition target. You decide to equally weight all the comp data to estimate the correct discount rate to use in valuing the target. The target will be financed with 20% debt, with a pretax cost of debt equal to 4%, and the debt beta is assumed to equal 0. Assume that all of the firms in your analysis are in the 35% tax bracket and that all of the firms have a policy to leave their debt ratio constant. Answer the following questions regarding the correct cost of capital to use in valuing the target. For all parts of this problem, assume a risk-free rate of 3% and a market risk premium of 6%.

What is the estimated firm or asset (unlevered equity) beta for the target firm based on the comp data?

What is the estimated levered cost of equity for the target based on the comp data and the targets debt/value ratio of 20%?

Using the equity cost already calculated and the information on the cost of debt in the problem, what is the WACC to use in discounting the targets projected firm free cash flows?

Company Name American Airlines (AMR) Delta Airlines (DALR.PK) Jet Blue (JBLU Southwest Airlines (LUV) (Note 1) Levered Equity Debt/Equity Assumed Betas Capitalization Debt Betas 1.01 0.30 25.61% 0.96 21.77% 0.40 58.26% 0.30 0.73 6.16% 0.20 0.97Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started