Answered step by step

Verified Expert Solution

Question

1 Approved Answer

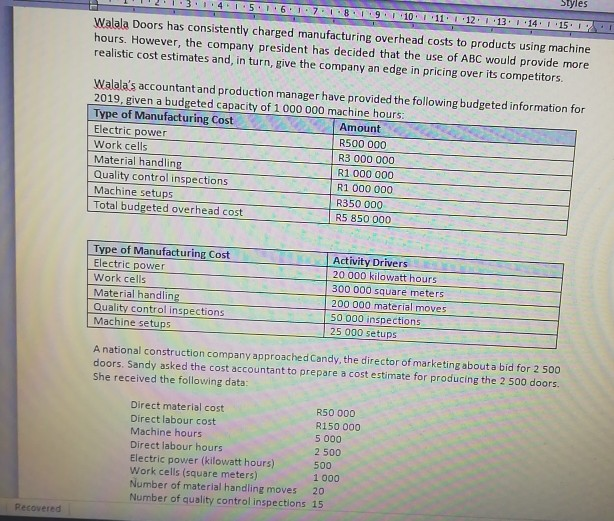

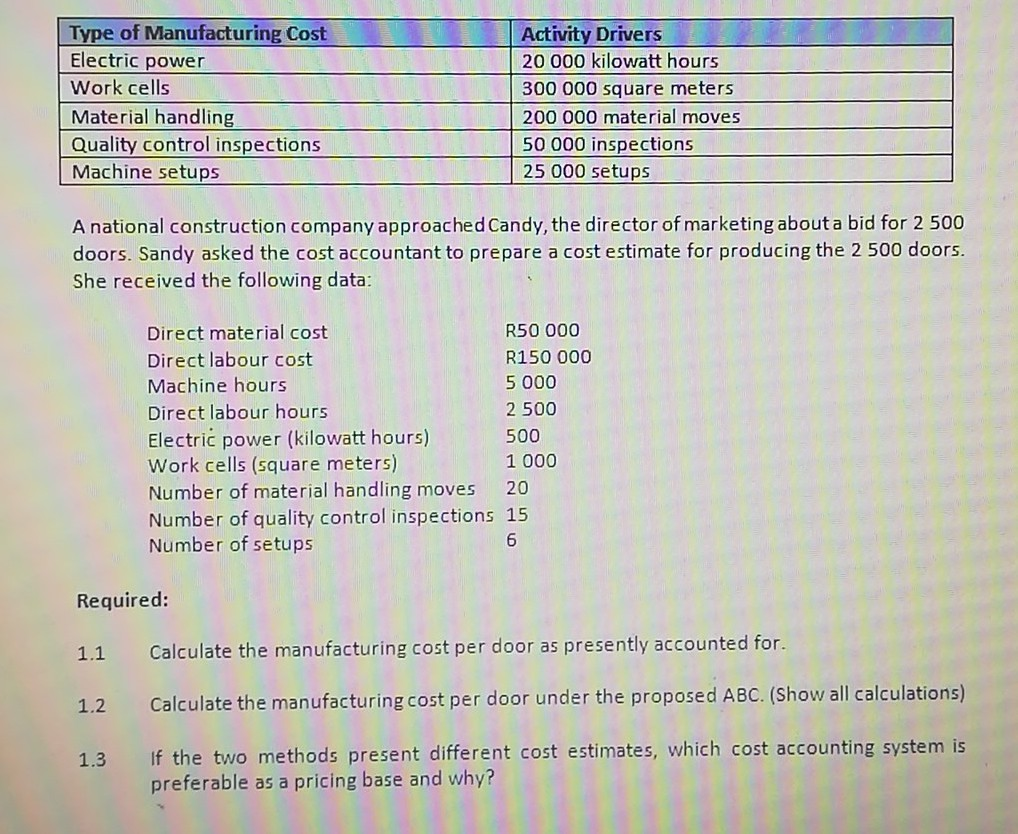

41516171910 111 112 113 114 115 1 Walala Doors has consistently charged manufacturing overhead costs to products using machine hours. However, the company president has

41516171910 111 112 113 114 115 1 Walala Doors has consistently charged manufacturing overhead costs to products using machine hours. However, the company president has decided that the use of ABC would provide more realistic cost estimates and, in turn, give the company an edge in pricing over its competitors. Walala's accountant and production manager have provided the following budgeted information for 2019, given a budgeted capacity of 1 000 000 machine hours: Type of Manufacturing Cost Amount Electric power R 500 000 Work cells R3 000 000 Material handling R1 000 000 Quality control inspections R1 000 000 Machine setups R350 000 Total budgeted overhead cost R5 850 000 EUR 2 Type of Manufacturing Cost Electric power Work cells Material handling Quality control inspections Machine setups Activity Drivers 0 000 kilowatt hours 300 000 square meters 200 000 material moves 50 000 inspections 25 000 setups A national construction company approached Candy, the director of marketing about a bid for 2 500 doors. Sandy asked the cost accountant to prepare a cost estimate for producing the 2 500 doors. She received the following data: Direct material cost R50 000 Direct labour cost R150 000 Machine hours 5000 Direct labour hours 2 500 Electric power (kilowatt hours) Work cells (square meters) 1 000 Number of material handling moves 20 Number of quality control inspections 15 500 Type of Manufacturing Cost Cost Electric power Work cells Material handling Quality control inspections Machine setups Activity Drivers 20 000 kilowatt hours 300 000 square meters 200 000 material moves 50 000 inspections 25 000 setups A national construction company approached Candy, the director of marketing about a bid for 2 500 doors. Sandy asked the cost accountant to prepare a cost estimate for producing the 2 500 doors. She received the following data: Direct material cost R50 000 Direct labour cost R150 000 Machine hours 5 000 Direct labour hours 2 500 Electric power (kilowatt hours) 500 Work cells (square meters) 1 000 Number of material handling moves 20 Number of quality control inspections 15 Number of setups Required: 1.1 Calculate the manufacturing cost per door as presently accounted for. 1.2 Calculate the manufacturing cost per door under the proposed ABC. (Show all calculations) 1.3 If the two methods present different cost estimates, which cost accounting system is preferable as a pricing base and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started