Answered step by step

Verified Expert Solution

Question

1 Approved Answer

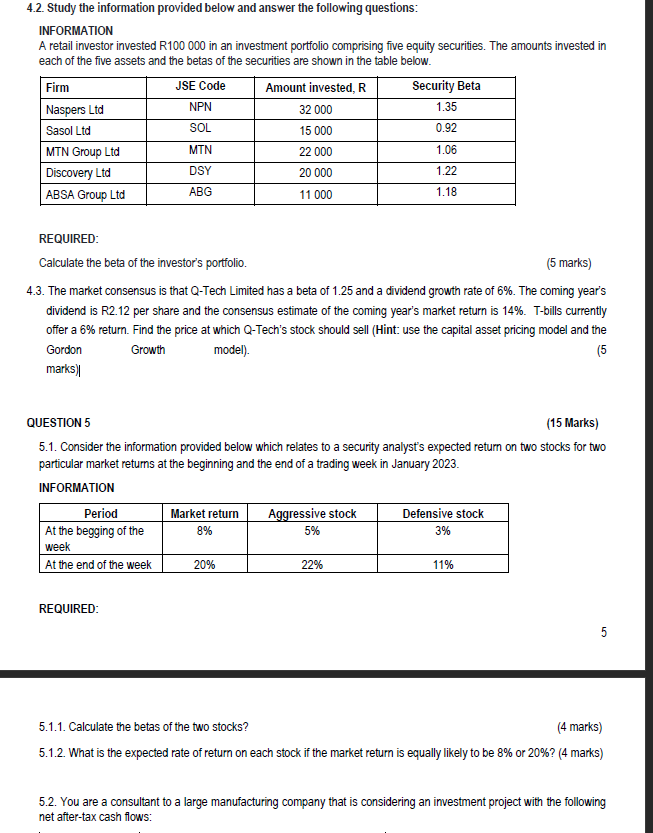

4.2. Study the information provided below and answer the following questions: INFORMATION A retail investor invested R100 000 in an investment portfolio comprising five equity

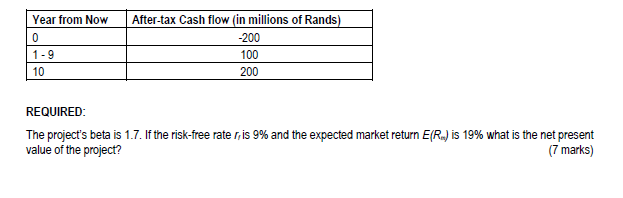

4.2. Study the information provided below and answer the following questions: INFORMATION A retail investor invested R100 000 in an investment portfolio comprising five equity securities. The amounts invested in each of the five assets and the betas of the securities are shown in the table below. REQUIRED: Calculate the beta of the investor's portfolio. (5 marks) 4.3. The market consensus is that Q-Tech Limited has a beta of 1.25 and a dividend growth rate of 6%. The coming year's dividend is R2.12 per share and the consensus estimate of the coming year's market return is 14\%. T-bills currently offer a 6% return. Find the price at which Q-Tech's stock should sell (Hint: use the capital asset pricing model and the Gordon Growth model). (5 marks)| QUESTION 5 (15 Marks) 5.1. Consider the information provided below which relates to a security analyst's expected return on two stocks for two particular market returns at the beginning and the end of a trading week in January 2023. INFORMATION REQUIRED: 5 5.1.1. Calculate the betas of the two stocks? (4 marks) 5.1.2. What is the expected rate of return on each stock if the market return is equally likely to be 8% or 20% ? (4 marks) 5.2. You are a consultant to a large manufacturing company that is considering an investment project with the following net after-tax cash flows: REQUIRED: The project's beta is 1.7. If the risk-free rate rr is 9% and the expected market return E(Rr) is 19% what is the net present value of the project? (7 marks)

4.2. Study the information provided below and answer the following questions: INFORMATION A retail investor invested R100 000 in an investment portfolio comprising five equity securities. The amounts invested in each of the five assets and the betas of the securities are shown in the table below. REQUIRED: Calculate the beta of the investor's portfolio. (5 marks) 4.3. The market consensus is that Q-Tech Limited has a beta of 1.25 and a dividend growth rate of 6%. The coming year's dividend is R2.12 per share and the consensus estimate of the coming year's market return is 14\%. T-bills currently offer a 6% return. Find the price at which Q-Tech's stock should sell (Hint: use the capital asset pricing model and the Gordon Growth model). (5 marks)| QUESTION 5 (15 Marks) 5.1. Consider the information provided below which relates to a security analyst's expected return on two stocks for two particular market returns at the beginning and the end of a trading week in January 2023. INFORMATION REQUIRED: 5 5.1.1. Calculate the betas of the two stocks? (4 marks) 5.1.2. What is the expected rate of return on each stock if the market return is equally likely to be 8% or 20% ? (4 marks) 5.2. You are a consultant to a large manufacturing company that is considering an investment project with the following net after-tax cash flows: REQUIRED: The project's beta is 1.7. If the risk-free rate rr is 9% and the expected market return E(Rr) is 19% what is the net present value of the project? (7 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started