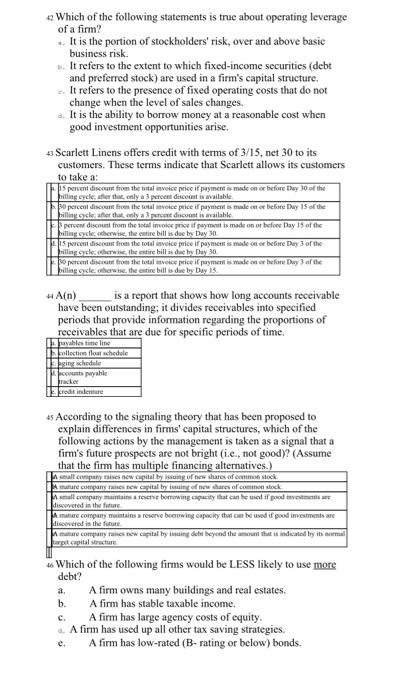

42 Which of the following statements is true about operating leverage of a firm? It is the portion of stockholders' risk, over and above basic business risk. b. It refers to the extent to which fixed-income securities (debt and preferred stock) are used in a firm's capital structure. c. It refers to the presence of fixed operating costs that do not change when the level of sales changes. d. It is the ability to borrow money at a reasonable cost when good investment opportunities arise. 43 Scarlett Linens offers credit with terms of 3/15, net 30 to its customers. These terms indicate that Scarlett allows its customers to take a 15 percent discount from the total invoice price if payment is made on or before Day 30 of the billing cycle, after that, caly a 3 percent discount is wailable. so percent discount from the total invece price if payment is made on or before Day 15 of the billing scle after that only a 3 percent discount is wailable percent discount from the total invoice price if payment is made on or before Day 15 of the hilling Sycle otherwise, the entire bill is due by Day 30 15 percent discount from the total invoice price if payment is made on or before Day 3 of the hilling cycle otherwise, the entire bill is due by Day 30 o percent discount from the total invoice price if payment is made on or before Day 3 of the billing cycle: otherwise, the entire bill is due by Day is 44 A(n) is a report that shows how long accounts receivable have been outstanding; it divides receivables into specified periods that provide information regarding the proportions of receivables that are due for specific periods of time. Truyables timeline collection float schedule schedule counts payable credit indenture 45 According to the signaling theory that has been proposed to explain differences in firms' capital structures, which of the following actions by the management is taken as a signal that a firm's future prospects are not bright (i.e., not good)? (Assume that the firm has multiple financing alternatives.) In small company raises new capital by issuing of new shares of common stock Mahare company rates how capital by internewares of common stock small company maintains a reserve borrowing capacity that can be used if goed investments are discovered in the future Amature company maintains a reserve borrowing capacity that can be used if good investments are discovered in the future mature company raises new capital by issuing debt beyond the amount that is indicated by its normal Ja capital structure * Which of the following firms would be LESS likely to use more debt? A firm owns many buildings and real estates. b. A firm has stable taxable income. c. A firm has large agency costs of equity. d. A firm has used up all other tax saving strategies. A firm has low-ra (B-rating or below) bonds. e