Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4.21 Suppose that S=$100,=30%,r=8%, and =0. Today you buy a contract which, 6 months from today, will give you one 3-month to expiration at-the-money call

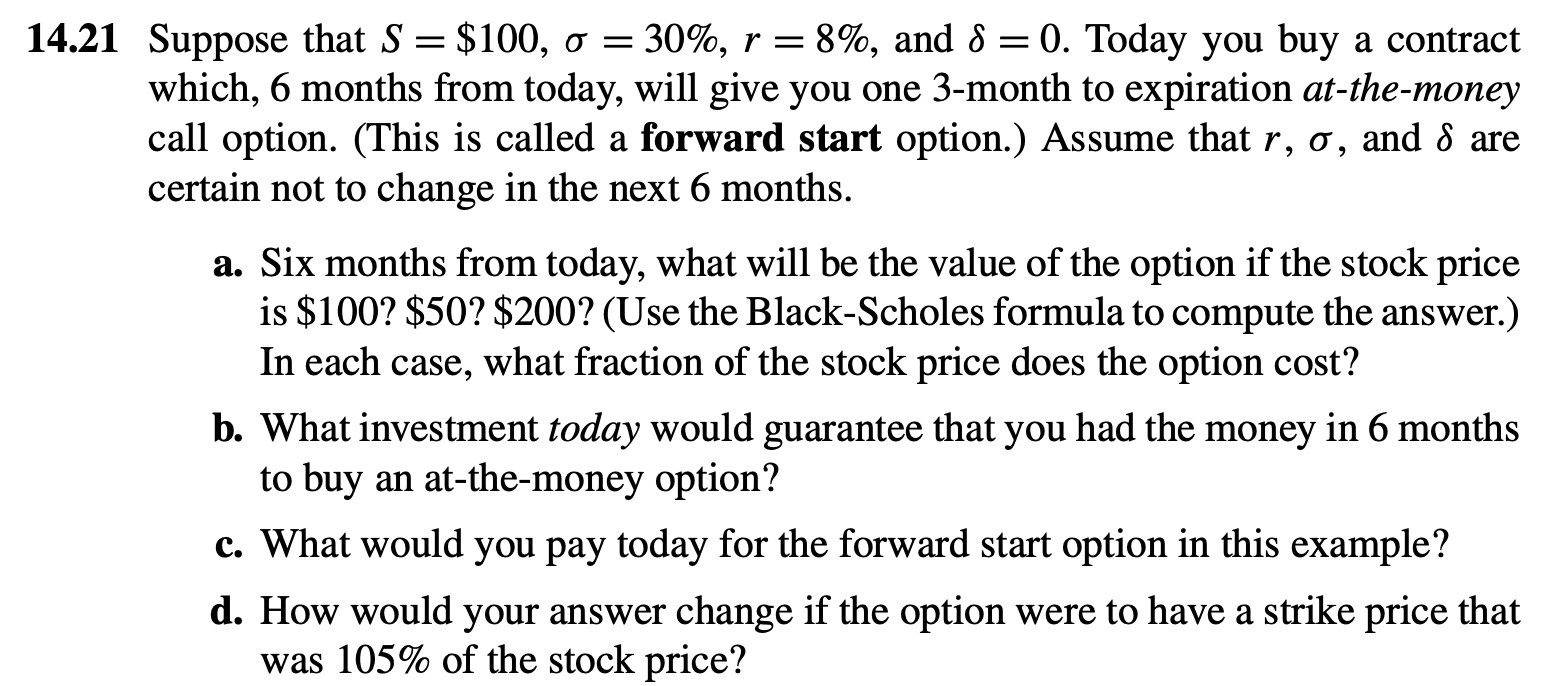

4.21 Suppose that S=$100,=30%,r=8%, and =0. Today you buy a contract which, 6 months from today, will give you one 3-month to expiration at-the-money call option. (This is called a forward start option.) Assume that r,, and are certain not to change in the next 6 months. a. Six months from today, what will be the value of the option if the stock price is \$100? \$50? \$200? (Use the Black-Scholes formula to compute the answer.) In each case, what fraction of the stock price does the option cost? b. What investment today would guarantee that you had the money in 6 months to buy an at-the-money option? c. What would you pay today for the forward start option in this example? d. How would your answer change if the option were to have a strike price that was 105% of the stock price

4.21 Suppose that S=$100,=30%,r=8%, and =0. Today you buy a contract which, 6 months from today, will give you one 3-month to expiration at-the-money call option. (This is called a forward start option.) Assume that r,, and are certain not to change in the next 6 months. a. Six months from today, what will be the value of the option if the stock price is \$100? \$50? \$200? (Use the Black-Scholes formula to compute the answer.) In each case, what fraction of the stock price does the option cost? b. What investment today would guarantee that you had the money in 6 months to buy an at-the-money option? c. What would you pay today for the forward start option in this example? d. How would your answer change if the option were to have a strike price that was 105% of the stock price Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started