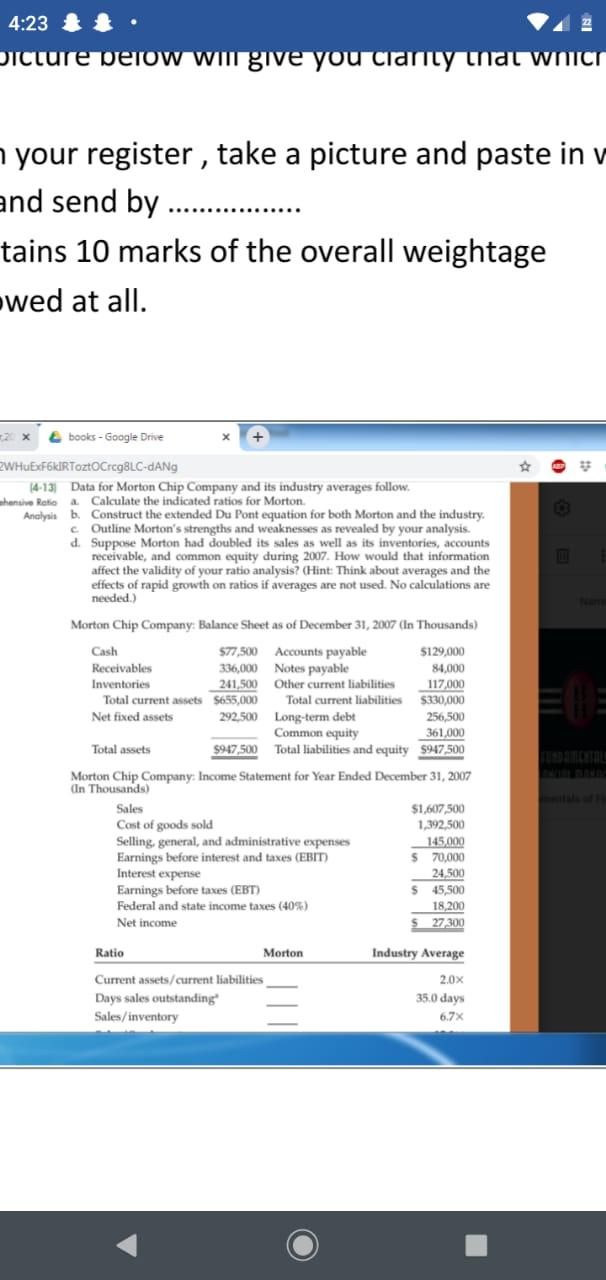

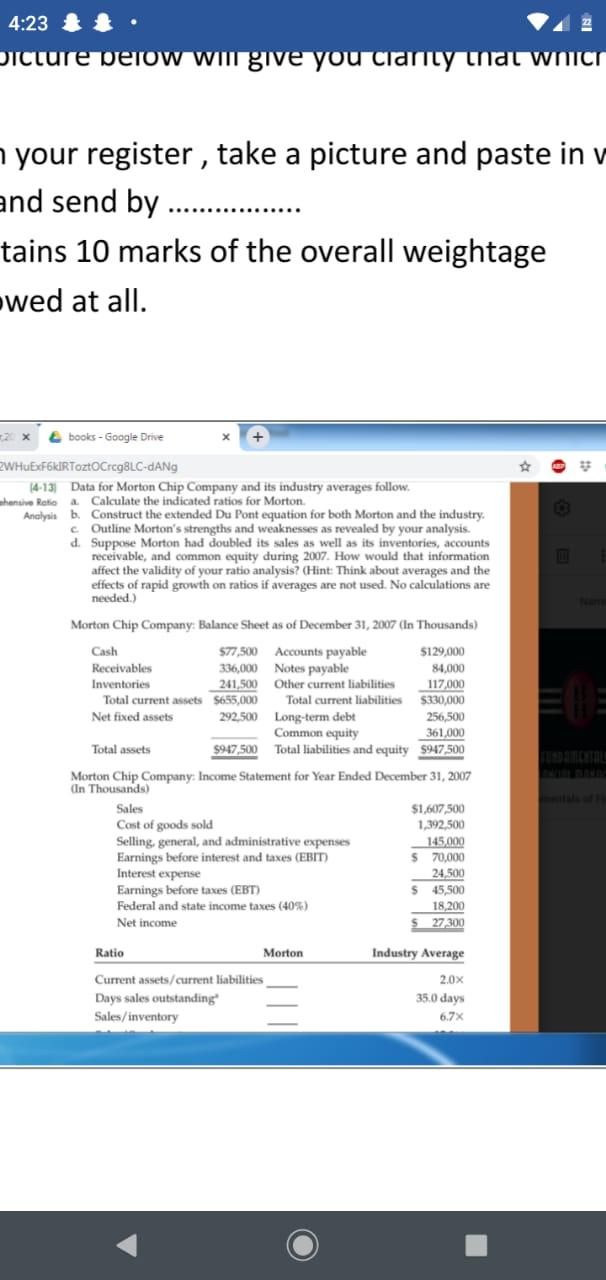

4:23 picture berow will give you cranty inat WNICI your register , take a picture and paste in v and send by tains 10 marks of the overall weightage wed at all. books - Google Drive WHuExF6kIRToztoCreg8LC-dANG (4-13) Data for Morton Chip Company and its industry averages follow. hensive Ratio a Calculate the indicated ratios for Morton. Analysis b. Construct the extended Du Pont equation for both Morton and the industry c Outline Morton's strengths and weaknesses as revealed by your analysis. d. Suppose Morton had doubled its sales as well as its inventories, accounts receivable, and common equity during 2007. How would that information affect the validity of your ratio analysis? (Hint: Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.) Morton Chip Company: Balance Sheet as of December 31, 2007 (In Thousands) Cash $77,500 Accounts payable $129,000 Receivables 336,000 Notes payable 84,000 Inventories 241,500 Other current liabilities 117.000 Total current assets $655,000 Total current liabilities $330,000 Net fixed assets 292,500 Long-term debt 256,500 Common equity 361,000 Total assets $947,500 Total liabilities and equity $947,500 Morton Chip Company: Income Statement for Year Ended December 31, 2007 (In Thousands) Sales $1,607,500 Cost of goods sold 1,392,500 Selling general, and administrative expenses 145.000 Earnings before interest and taxes (EBIT) $ 70,000 Interest pense 24,500 Earnings before taxes (EBT) $ 45,500 Federal and state income taxes (40%) Net income 18,200 27300 Ratio Morton Industry Average Current assets/current liabilities Days sales outstanding Sales/inventory 2.0x 35.0 days 6.7x 4:23 picture berow will give you cranty inat WNICI your register , take a picture and paste in v and send by tains 10 marks of the overall weightage wed at all. books - Google Drive WHuExF6kIRToztoCreg8LC-dANG (4-13) Data for Morton Chip Company and its industry averages follow. hensive Ratio a Calculate the indicated ratios for Morton. Analysis b. Construct the extended Du Pont equation for both Morton and the industry c Outline Morton's strengths and weaknesses as revealed by your analysis. d. Suppose Morton had doubled its sales as well as its inventories, accounts receivable, and common equity during 2007. How would that information affect the validity of your ratio analysis? (Hint: Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.) Morton Chip Company: Balance Sheet as of December 31, 2007 (In Thousands) Cash $77,500 Accounts payable $129,000 Receivables 336,000 Notes payable 84,000 Inventories 241,500 Other current liabilities 117.000 Total current assets $655,000 Total current liabilities $330,000 Net fixed assets 292,500 Long-term debt 256,500 Common equity 361,000 Total assets $947,500 Total liabilities and equity $947,500 Morton Chip Company: Income Statement for Year Ended December 31, 2007 (In Thousands) Sales $1,607,500 Cost of goods sold 1,392,500 Selling general, and administrative expenses 145.000 Earnings before interest and taxes (EBIT) $ 70,000 Interest pense 24,500 Earnings before taxes (EBT) $ 45,500 Federal and state income taxes (40%) Net income 18,200 27300 Ratio Morton Industry Average Current assets/current liabilities Days sales outstanding Sales/inventory 2.0x 35.0 days 6.7x