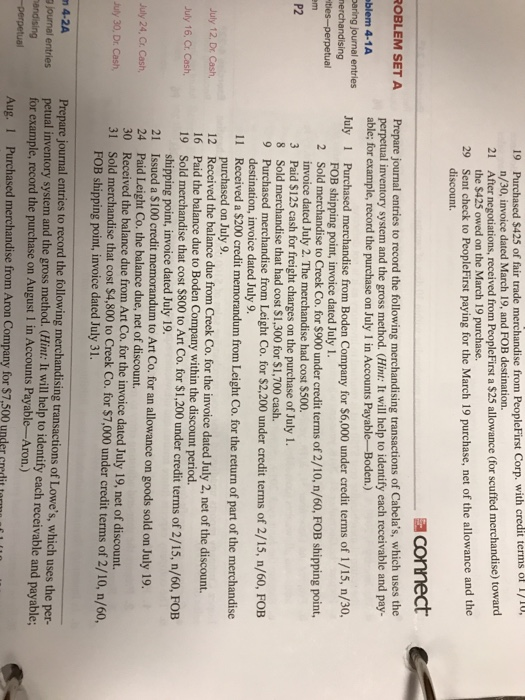

$425 of fair trade merchandise from PeopleFirst Corp. with credit terms of 1/10, 19 21 29 n/30, invoice dated March 19, and FOB destination. After negotiations, received from PeopleFirst a $25 allowance (for scuffed merchandise) toward the $425 owed on the March 19 purchase. Sent check to PeopleFirst paying for the March 19 purchase, net of the allowance and the discount ROBLEM SET A Prepare journal entries to record the following merchandising transactions of Cabela's, which uses the perpetual inventory system and the gross method. (Hint: It will help to identify each receivable and pay- able; for example, record the purchase on July 1 in Accounts Payable-Boden.) blem 4-1A aring journal entries July 1 Purchased merchandise from Boden Company for $6,000 under credit terms of 1/15, n/30 ng FOB shipping point, invoice dated July 1. Sold merchandise to Creek Co.for $900 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $500. Paid $125 cash for freight charges on the purchase of July 1 Sold merchandise that had cost $1,300 for $1,700 cash. Purchased merchandise from Leight Co. for $2,200 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. Received a $200 credit memorandum from Leight Co. for the return of part of the merchandise purchased on July 9. Received the balance due from Creek Co. for the invoice dated July 2, net of the discount. Paid the balance due to Boden Company within the discount period. Sold merchandise that cost $800 to Art Co. for $1,200 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. 2 3 8 9 Il 12 16 July 12, Dr. Cash, July 16, Cr. Cash, 19 21 Issued a $100 credit memorandum to Art Co. for an allowance on goods sold on July 19. 24 Paid Leight Co. the balance due, net of discount. 30 Received the balance due from Art Co. for the invoice dated July 19, net of discount. 31 Sold merchandise that cost July 30, Dr. Cash $4,800 to Creek Co. for $7,000 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31. n 4-2A a journal entries andising -perpetual g transactions of Lowe's, which uses the per- tual inventory system and the gross method. (Hint: It will help to identify each receivable and payable pet for example, record the purchase on August 1 in Accounts Payable-Aron. Aug. 1 Purchased merchandise from Aron Company for $7,500 under credit t