Answered step by step

Verified Expert Solution

Question

1 Approved Answer

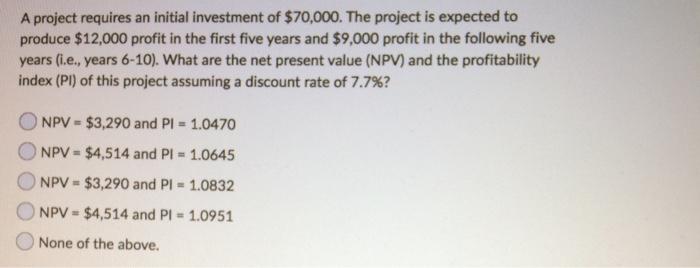

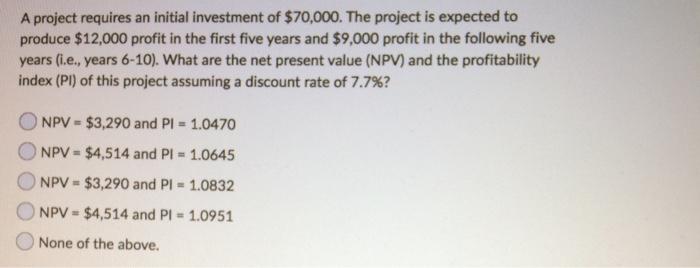

42.a b. c. d. A project requires an initial investment of $70,000. The project is expected to produce $12,000 profit in the first five years

42.a

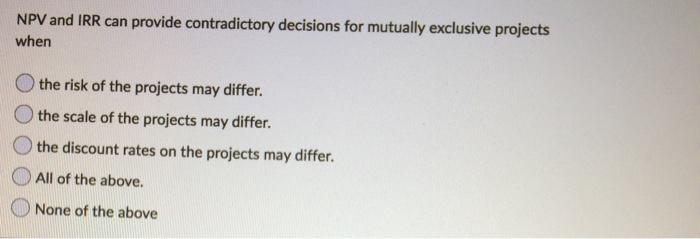

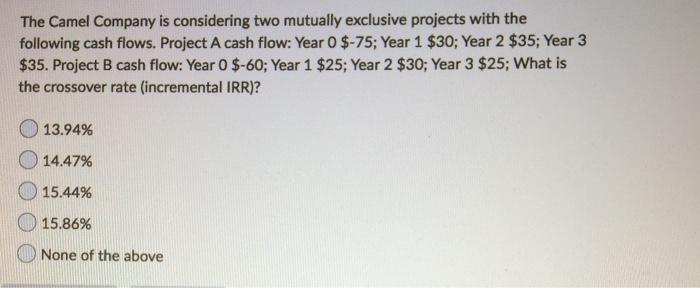

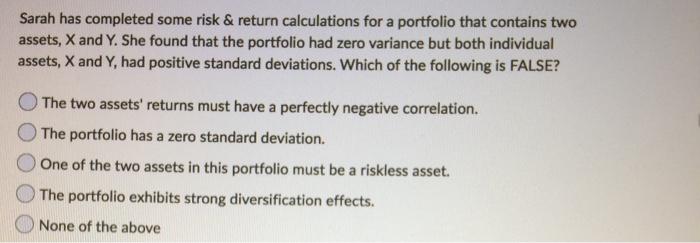

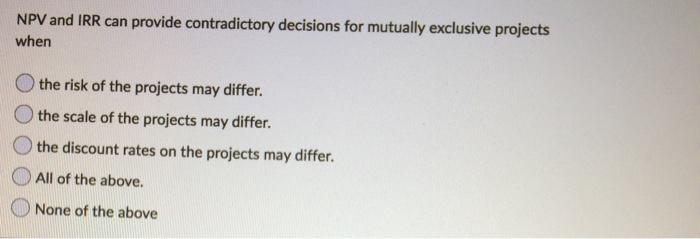

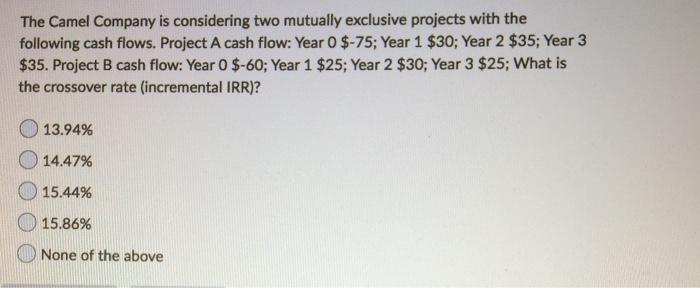

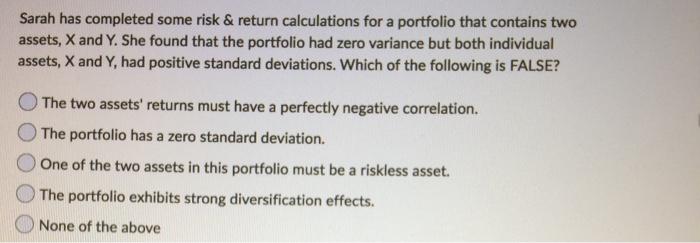

A project requires an initial investment of $70,000. The project is expected to produce $12,000 profit in the first five years and $9,000 profit in the following five years (i.e., years 6-10). What are the net present value (NPV) and the profitability index (Pl) of this project assuming a discount rate of 7.7%? NPV - $3,290 and PI = 1.0470 NPV = $4,514 and PI = 1.0645 NPV = $3,290 and PI = 1.0832 NPV = $4,514 and PI = 1.0951 None of the above. NPV and IRR can provide contradictory decisions for mutually exclusive projects when the risk of the projects may differ. the scale of the projects may differ. the discount rates on the projects may differ. All of the above. None of the above The Camel Company is considering two mutually exclusive projects with the following cash flows. Project A cash flow: Year 0 $-75; Year 1 $30; Year 2 $35; Year 3 $35. Project B cash flow: Year 0 $-60; Year 1 $25; Year 2 $30; Year 3 $25; What is the crossover rate (incremental IRR)? 13.94% 14.47% 15.44% 15.86% None of the above Sarah has completed some risk & return calculations for a portfolio that contains two assets, X and Y. She found that the portfolio had zero variance but both individual assets, X and Y, had positive standard deviations. Which of the following is FALSE? The two assets' returns must have a perfectly negative correlation. The portfolio has a zero standard deviation. One of the two assets in this portfolio must be a riskless asset. The portfolio exhibits strong diversification effects. None of the above

b.

c.

d.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started