Answered step by step

Verified Expert Solution

Question

1 Approved Answer

43. According to the ...theory, the futures prices is equal to expected spot price of the underlying asset a. contango b. expectations c. backwardation d.

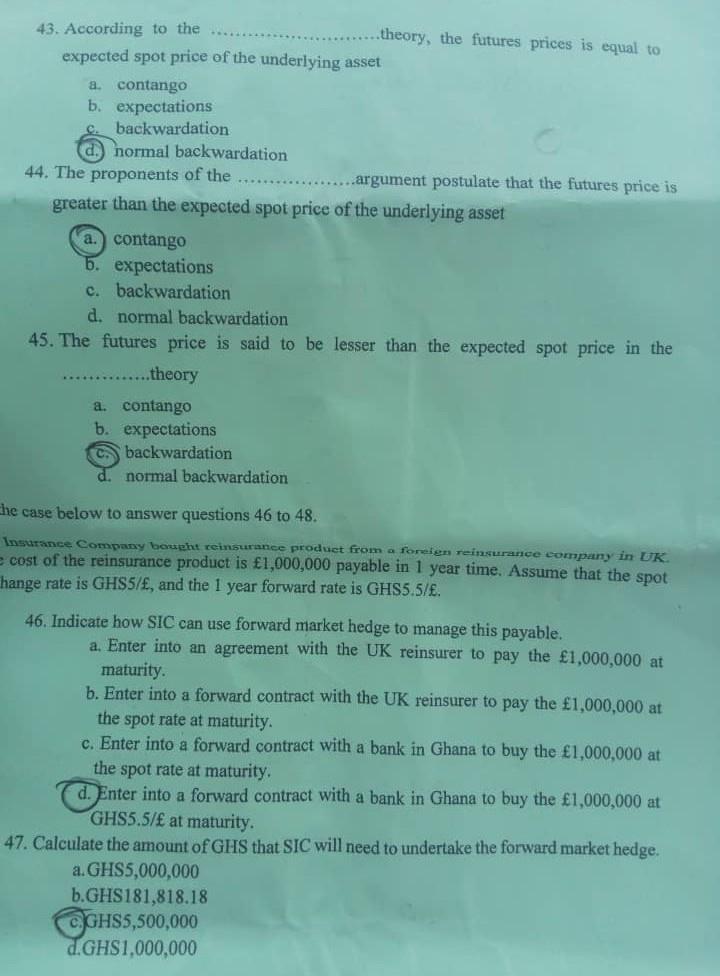

43. According to the ...theory, the futures prices is equal to expected spot price of the underlying asset a. contango b. expectations c. backwardation d. normal backwardation 44. The proponents of the ..argument postulate that the futures price is greater than the expected spot price of the underlying asset a. contango b. expectations c. backwardation d. normal backwardation 45. The futures price is said to be lesser than the expected spot price in the ...theory a. contango b. expectations C backwardation normal backwardation the case below to answer questions 46 to 48. Insurance Company bought reinsurance product from a foreign reinsurance company in UK. e cost of the reinsurance product is 1,000,000 payable in 1 year time. Assume that the spot hange rate is GHS5/, and the 1 year forward rate is GHS5.5/. 46. Indicate how SIC can use forward market hedge to manage this payable. a. Enter into an agreement with the UK reinsurer to pay the 1,000,000 at maturity. b. Enter into a forward contract with the UK reinsurer to pay the 1,000,000 at the spot rate at maturity. c. Enter into a forward contract with a bank in Ghana to buy the 1,000,000 at the spot rate at maturity. d. Enter into a forward contract with a bank in Ghana to buy the 1,000,000 at GHS5.5/ at maturity. 47. Calculate the amount of GHS that SIC will need to undertake the forward market hedge. a. GHS5,000,000 b.GHS181,818.18 GHS5,500,000 d.GHS1,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started