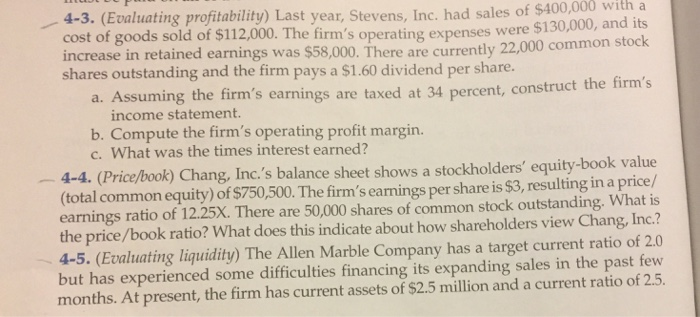

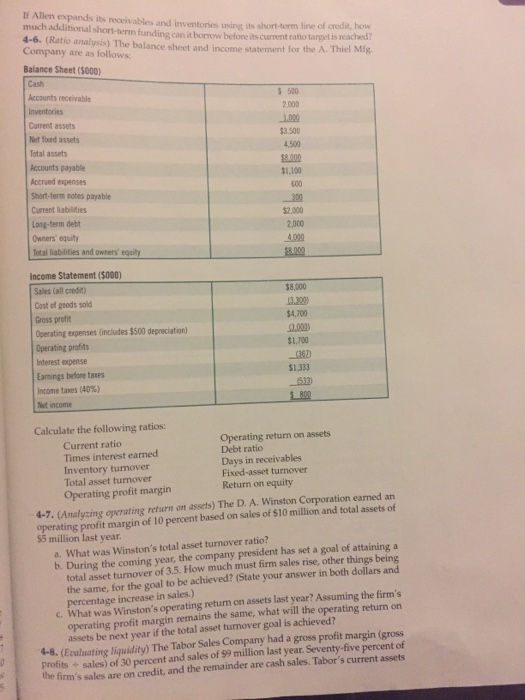

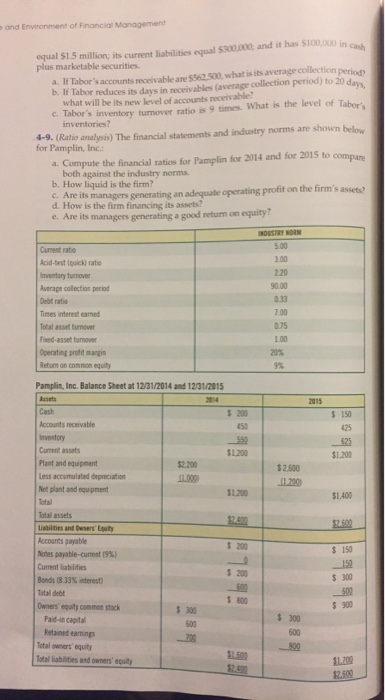

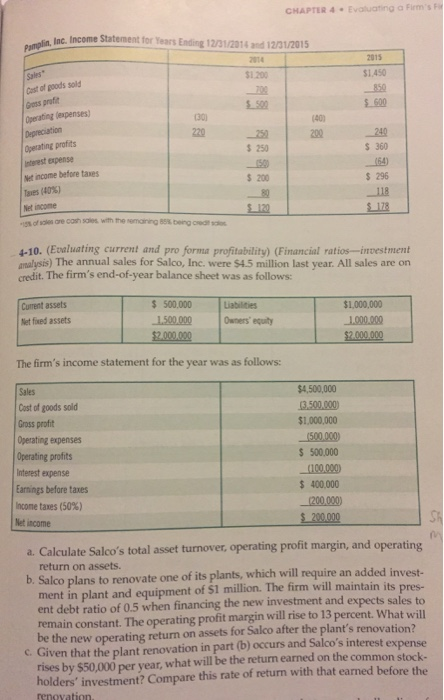

- 4-3. (Evaluating profitability) Last year, Stevens, Inc. had sales of $400,000 W cost of goods sold of $112,000. The firm's operating expenses were $130,000, and its increase in retained earnings was $58,000. There are currently 22,000 common stock shares outstanding and the firm pays a $1.60 dividend per share. a. Assuming the firm's earnings are taxed at 34 percent, construct the firm's income statement. b. Compute the firm's operating profit margin. c. What was the times interest earned? 4-4. (Price/book) Chang, Inc.'s balance sheet shows a stockholders' equity-book value (total common equity) of $750,500. The firm's earnings per share is $3, resulting in a price/ earnings ratio of 12.25X. There are 50,000 shares of common stock outstanding. What is the price/book ratio? What does this indicate about how shareholders view Chang, Inc.? 4-5. (Evaluating liquidity) The Allen Marble Company has a target current ratio of 2.0 but has experienced some difficulties financing its expanding sales in the past few months. At present, the firm has current assets of $2.5 million and a current ratio of 2.5. e u If Allen expands its receivabl much additional short-term fundin an 4-6. (Ratio analysis) The bala Company are as follows Balance Sheet (5000) short-term line of credit nt ratio tantis reached ent for the A Thiel Mig n s Cash S500 2.000 $3.500 Accounts receivable Inventories Current assets Net foud assets Total assets Accounts payable Accrued expenses Short-term notes payable Current liabilities Long-term dett Owners' equity Total liabilities and owners' equity $8.000 $1,100 300 $2.000 2.000 92.000 Income Statement (5000) Sales (all credit) Cost of goods sold Gross profit Operating expenses includes $500 depreciation) Operating profits Interest expense Earnings before tres Income taxes (40%) Net income $8.000 3.300) 54.100 0.000) $1,700 060 $1,333 1533) 3809 Calculate the following ratios: Current ratio Operating return on assets Times interest earned Debt ratio Inventory tumover Days in receivables Total asset turnover Fixed-asset turnover Operating profit margin Return on equity 4-7. Analyzing rating return of assets) The D. A. Winston Corporation eamed an operating profit margin of 10 percent based on sales of $10 million and total assets of $5 million last year. a. What was Winston's total asset turnover ratio? b. During the coming year, the company president has set a goal of attaining a total asset turnover of 3.5. How much must firm sales rise, other things being the same, for the goal to be achieved? (State your answer in both dollars and percentage increase in sales.) What was Winston's operating return on assets last year? Assuming the firm's operating profit margin remains the same, what will the operating return on assets be next year if the total asset turnover goal is achieved? 4-8. (Emulating liquidity) The Tabor Sales Company had a gross profit margin (gross profits sales of 30 percent and sales of $9 million last year. Seventy-five percent of the firm's sales are on credit, and the remainder are cash sales. Tabor's current assets and More plus marketable securities labor's account per cevable are 5 2500. what is the If labor reduces its days in civables (average collection pond 20 days what will be its new level of accounts receivable Tabor's inventory turnover ratio 9 times. What is the level of Tabor inventories? 4-9. (Rate analysis) The financial statements and industry norms are shown below for Pamplin, Inc. Compute the financial ratios for Pamplin for 2014 and for 2015 to compar both against the industry norms b. How liquid is the firm? c. Are its managers generating an adequate operating profit on the firm's assets) d. How is the firm financing its assets e. Are its managers generating a good return on equity? Average collection period Times west came Total se tumowe Fredasse turnover Operating Return on common equity Pamplin, Ing. Balance Sheet at 12/31/2014 and 1231/2015 $ 150 Royale $1.200 Pastanut Les accumulated depreciation et plant and equipment $1,400 $ 150 150 Accounts payable Notes payable-current 19%) Current liabilities Bonds 0.3% interest Total de Omers' y common stock Paid in capital Total owners' uity CHAPTER 4. Evaluating a Firm's Inc. Income Statement for Years Ending 12/31/2016 Pamplin, Inc. Inco 12312015 2015 Sales" S1200 $1.450 $ 600 Cost of goods solu Dass profit Operating expenses) Depreciation Operating profits estepense 240 S 360 wat income before tres 184 $ 296 $ 200 118 $ 178 Nincome $_120 ore cosh with the remaining being 1-10. (Evaluating current and pro forma profitability) (Financial ratios-investment analysis) The annual sales for Salco, Inc. were $4.5 million last year. All sales are on credit. The firm's end-of-year balance sheet was as follows: Current assets Net fixed assets $ 500.000 1.500.000 $2.000.000 Liabilities Owners' equity $1,000,000 1.000.000 $2.000.000 The firm's income statement for the year was as follows: Sales Cost of goods sold Gross profit Operating expenses Operating profits Interest expense Earnings before taxes Income taxes (50%) Net income $4,500,000 3.500.000 $1,000,000 (500.000 $ 500.000 (100.000 $ 400.000 1200.000) $ 200.000 a. Calculate Salco's total asset turnover, operating profit margin, and operating return on assets. b. Salco plans to renovate one of its plants, which will require an added invest- ment in plant and equipment of $1 million. The firm will maintain its pres- ent debt ratio of 0.5 when financing the new investment and expects sales to remain constant. The operating profit margin will rise to 13 percent. What will be the new operating return on assets for Salco after the plant's renovation? c. Given that the plant renovation in part (b) occurs and Salco's interest expense rises by $50,000 per year, what will be the return earned on the common stock- holders' investment? Compare this rate of return with that earned before the renovation - 4-3. (Evaluating profitability) Last year, Stevens, Inc. had sales of $400,000 W cost of goods sold of $112,000. The firm's operating expenses were $130,000, and its increase in retained earnings was $58,000. There are currently 22,000 common stock shares outstanding and the firm pays a $1.60 dividend per share. a. Assuming the firm's earnings are taxed at 34 percent, construct the firm's income statement. b. Compute the firm's operating profit margin. c. What was the times interest earned? 4-4. (Price/book) Chang, Inc.'s balance sheet shows a stockholders' equity-book value (total common equity) of $750,500. The firm's earnings per share is $3, resulting in a price/ earnings ratio of 12.25X. There are 50,000 shares of common stock outstanding. What is the price/book ratio? What does this indicate about how shareholders view Chang, Inc.? 4-5. (Evaluating liquidity) The Allen Marble Company has a target current ratio of 2.0 but has experienced some difficulties financing its expanding sales in the past few months. At present, the firm has current assets of $2.5 million and a current ratio of 2.5. e u If Allen expands its receivabl much additional short-term fundin an 4-6. (Ratio analysis) The bala Company are as follows Balance Sheet (5000) short-term line of credit nt ratio tantis reached ent for the A Thiel Mig n s Cash S500 2.000 $3.500 Accounts receivable Inventories Current assets Net foud assets Total assets Accounts payable Accrued expenses Short-term notes payable Current liabilities Long-term dett Owners' equity Total liabilities and owners' equity $8.000 $1,100 300 $2.000 2.000 92.000 Income Statement (5000) Sales (all credit) Cost of goods sold Gross profit Operating expenses includes $500 depreciation) Operating profits Interest expense Earnings before tres Income taxes (40%) Net income $8.000 3.300) 54.100 0.000) $1,700 060 $1,333 1533) 3809 Calculate the following ratios: Current ratio Operating return on assets Times interest earned Debt ratio Inventory tumover Days in receivables Total asset turnover Fixed-asset turnover Operating profit margin Return on equity 4-7. Analyzing rating return of assets) The D. A. Winston Corporation eamed an operating profit margin of 10 percent based on sales of $10 million and total assets of $5 million last year. a. What was Winston's total asset turnover ratio? b. During the coming year, the company president has set a goal of attaining a total asset turnover of 3.5. How much must firm sales rise, other things being the same, for the goal to be achieved? (State your answer in both dollars and percentage increase in sales.) What was Winston's operating return on assets last year? Assuming the firm's operating profit margin remains the same, what will the operating return on assets be next year if the total asset turnover goal is achieved? 4-8. (Emulating liquidity) The Tabor Sales Company had a gross profit margin (gross profits sales of 30 percent and sales of $9 million last year. Seventy-five percent of the firm's sales are on credit, and the remainder are cash sales. Tabor's current assets and More plus marketable securities labor's account per cevable are 5 2500. what is the If labor reduces its days in civables (average collection pond 20 days what will be its new level of accounts receivable Tabor's inventory turnover ratio 9 times. What is the level of Tabor inventories? 4-9. (Rate analysis) The financial statements and industry norms are shown below for Pamplin, Inc. Compute the financial ratios for Pamplin for 2014 and for 2015 to compar both against the industry norms b. How liquid is the firm? c. Are its managers generating an adequate operating profit on the firm's assets) d. How is the firm financing its assets e. Are its managers generating a good return on equity? Average collection period Times west came Total se tumowe Fredasse turnover Operating Return on common equity Pamplin, Ing. Balance Sheet at 12/31/2014 and 1231/2015 $ 150 Royale $1.200 Pastanut Les accumulated depreciation et plant and equipment $1,400 $ 150 150 Accounts payable Notes payable-current 19%) Current liabilities Bonds 0.3% interest Total de Omers' y common stock Paid in capital Total owners' uity CHAPTER 4. Evaluating a Firm's Inc. Income Statement for Years Ending 12/31/2016 Pamplin, Inc. Inco 12312015 2015 Sales" S1200 $1.450 $ 600 Cost of goods solu Dass profit Operating expenses) Depreciation Operating profits estepense 240 S 360 wat income before tres 184 $ 296 $ 200 118 $ 178 Nincome $_120 ore cosh with the remaining being 1-10. (Evaluating current and pro forma profitability) (Financial ratios-investment analysis) The annual sales for Salco, Inc. were $4.5 million last year. All sales are on credit. The firm's end-of-year balance sheet was as follows: Current assets Net fixed assets $ 500.000 1.500.000 $2.000.000 Liabilities Owners' equity $1,000,000 1.000.000 $2.000.000 The firm's income statement for the year was as follows: Sales Cost of goods sold Gross profit Operating expenses Operating profits Interest expense Earnings before taxes Income taxes (50%) Net income $4,500,000 3.500.000 $1,000,000 (500.000 $ 500.000 (100.000 $ 400.000 1200.000) $ 200.000 a. Calculate Salco's total asset turnover, operating profit margin, and operating return on assets. b. Salco plans to renovate one of its plants, which will require an added invest- ment in plant and equipment of $1 million. The firm will maintain its pres- ent debt ratio of 0.5 when financing the new investment and expects sales to remain constant. The operating profit margin will rise to 13 percent. What will be the new operating return on assets for Salco after the plant's renovation? c. Given that the plant renovation in part (b) occurs and Salco's interest expense rises by $50,000 per year, what will be the return earned on the common stock- holders' investment? Compare this rate of return with that earned before the renovation