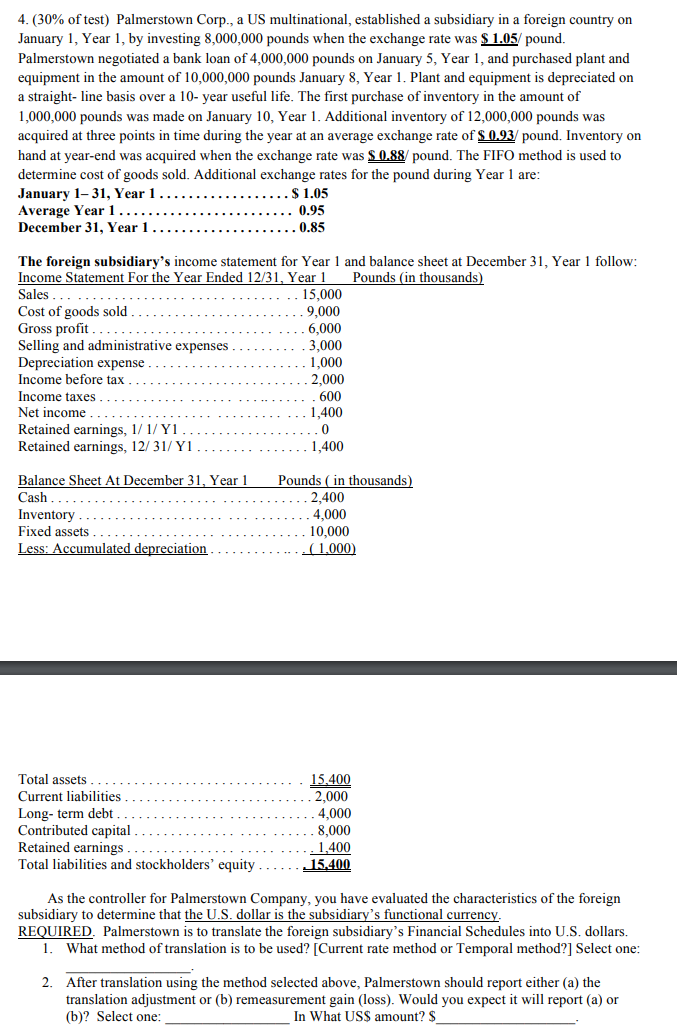

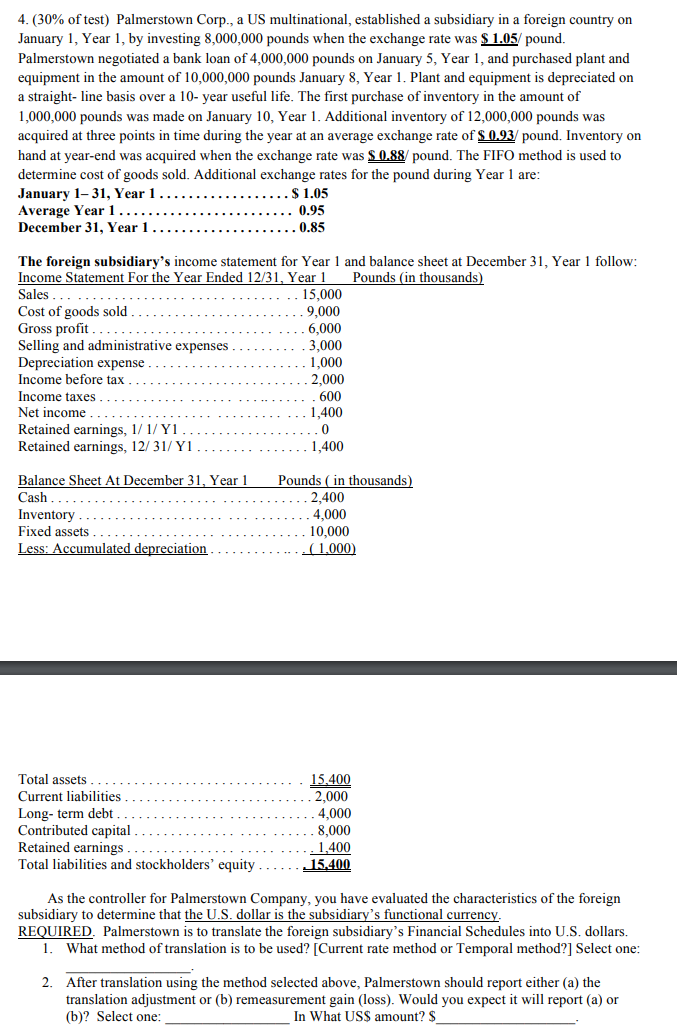

4.(30% of test) Palmerstown Corp., a US multinational, established a subsidiary in a foreign country on January 1, Year 1, by investing 8,000,000 pounds when the exchange rate was $ 1.05/ pound. Palmerstown negotiated a bank loan of 4,000,000 pounds on January 5, Year 1, and purchased plant and equipment in the amount of 10,000,000 pounds January 8, Year 1. Plant and equipment is depreciated on a straight-line basis over a 10-year useful life. The first purchase of inventory in the amount of 1,000,000 pounds was made on January 10, Year 1. Additional inventory of 12,000,000 pounds was acquired at three points in time during the year at an average exchange rate of $ 0.93 pound. Inventory on hand at year-end was acquired when the exchange rate was $ 0.88 pound. The FIFO method is used to determine cost of goods sold. Additional exchange rates for the pound during Year 1 are: January 1-31, Year 1. . $ 1.05 Average Year 1.... 0.95 December 31, Year 1 0.85 6,000 The foreign subsidiary's income statement for Year 1 and balance sheet at December 31, Year 1 follow: Income Statement For the Year Ended 12/31, Year 1 Pounds (in thousands) Sales 15,000 Cost of goods sold 9,000 Gross profit Selling and administrative expenses 3.000 Depreciation expense 1,000 Income before tax 2,000 Income taxes 600 1,400 Retained earnings, 1/1/Y1 0 Retained earnings, 12/31/Y1 1,400 Net income Balance Sheet At December 31, Year 1 Cash Inventory Fixed assets Less: Accumulated depreciation Pounds in thousands) 2,400 4.000 10.000 . (1.000) Total assets 15.400 Current liabilities 2,000 Long-term debt 4,000 Contributed capital 8,000 Retained earnings 1,400 Total liabilities and stockholders' equity..... 15.400 As the controller for Palmerstown Company, you have evaluated the characteristics of the foreign subsidiary to determine that the U.S. dollar is the subsidiary's functional currency. REQUIRED. Palmerstown is to translate the foreign subsidiary's Financial Schedules into U.S. dollars. 1. What method of translation is to be used? [Current rate method or Temporal method?] Select one: 2. After translation using the method selected above, Palmerstown should report either (a) the translation adjustment or (b) remeasurement gain (loss). Would you expect it will report (a) or (b)? Select one: In What US$ amount? $ 4.(30% of test) Palmerstown Corp., a US multinational, established a subsidiary in a foreign country on January 1, Year 1, by investing 8,000,000 pounds when the exchange rate was $ 1.05/ pound. Palmerstown negotiated a bank loan of 4,000,000 pounds on January 5, Year 1, and purchased plant and equipment in the amount of 10,000,000 pounds January 8, Year 1. Plant and equipment is depreciated on a straight-line basis over a 10-year useful life. The first purchase of inventory in the amount of 1,000,000 pounds was made on January 10, Year 1. Additional inventory of 12,000,000 pounds was acquired at three points in time during the year at an average exchange rate of $ 0.93 pound. Inventory on hand at year-end was acquired when the exchange rate was $ 0.88 pound. The FIFO method is used to determine cost of goods sold. Additional exchange rates for the pound during Year 1 are: January 1-31, Year 1. . $ 1.05 Average Year 1.... 0.95 December 31, Year 1 0.85 6,000 The foreign subsidiary's income statement for Year 1 and balance sheet at December 31, Year 1 follow: Income Statement For the Year Ended 12/31, Year 1 Pounds (in thousands) Sales 15,000 Cost of goods sold 9,000 Gross profit Selling and administrative expenses 3.000 Depreciation expense 1,000 Income before tax 2,000 Income taxes 600 1,400 Retained earnings, 1/1/Y1 0 Retained earnings, 12/31/Y1 1,400 Net income Balance Sheet At December 31, Year 1 Cash Inventory Fixed assets Less: Accumulated depreciation Pounds in thousands) 2,400 4.000 10.000 . (1.000) Total assets 15.400 Current liabilities 2,000 Long-term debt 4,000 Contributed capital 8,000 Retained earnings 1,400 Total liabilities and stockholders' equity..... 15.400 As the controller for Palmerstown Company, you have evaluated the characteristics of the foreign subsidiary to determine that the U.S. dollar is the subsidiary's functional currency. REQUIRED. Palmerstown is to translate the foreign subsidiary's Financial Schedules into U.S. dollars. 1. What method of translation is to be used? [Current rate method or Temporal method?] Select one: 2. After translation using the method selected above, Palmerstown should report either (a) the translation adjustment or (b) remeasurement gain (loss). Would you expect it will report (a) or (b)? Select one: In What US$ amount? $