Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4:31 AM Wed Dec 20 10% Recycling Problems 7 7-R Recycling Problem: Preparing financial statements with a net loss LO1, 2, 3 Forms are

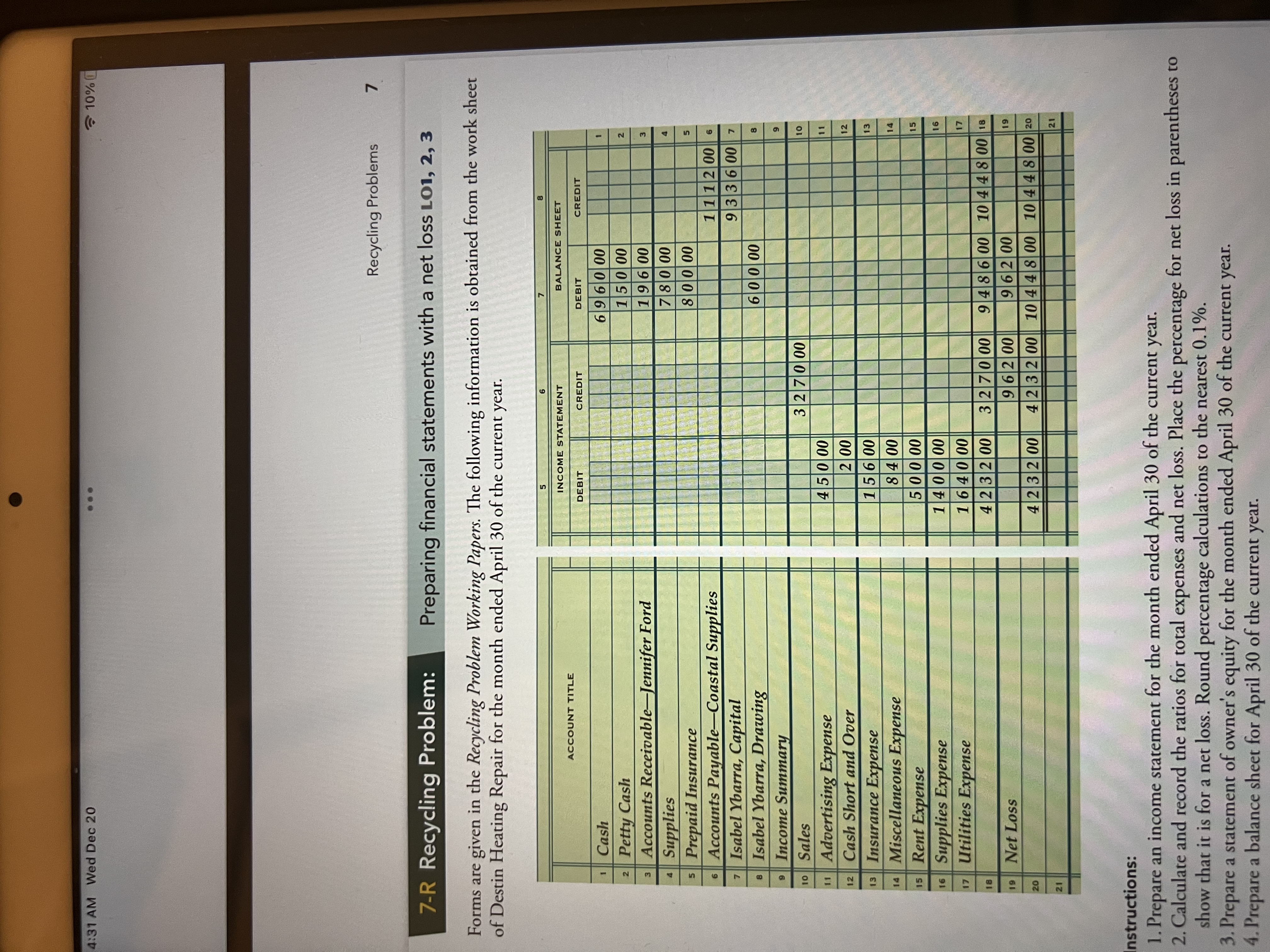

4:31 AM Wed Dec 20 10% Recycling Problems 7 7-R Recycling Problem: Preparing financial statements with a net loss LO1, 2, 3 Forms are given in the Recycling Problem Working Papers. The following information is obtained from the work sheet of Destin Heating Repair for the month ended April 30 of the current year. 1 Cash ACCOUNT TITLE 2 Petty Cash 3 Accounts Receivable-Jennifer Ford 4 Supplies 5 Prepaid Insurance 6 Accounts Payable-Coastal Supplies 7 Isabel Ybarra, Capital 8 Isabel Ybarra, Drawing 9 Income Summary 10 10 Sales 11 Advertising Expense 12 Cash Short and Over 13 Insurance Expense 14 Miscellaneous Expense 15 Rent Expense 16 Supplies Expense 17 Utilities Expense 18 19 Net Loss 20 20 21 5 6 7 8 INCOME STATEMENT BALANCE SHEET DEBIT CREDIT DEBIT CREDIT 696000 1 15000 2 19600 3 78000 4 80000 5 111200|| 6 933600|| 7 60000 B 327000 9 10 45000 200 15600 8400 50000 140000 164000 423200 327000 423200 96200 423200 11 12 13 14 15 16 17 948600 10448 00 18 96200 19 10448 00 10 448 00 20 21 Instructions: 1. Prepare an income statement for the month ended April 30 of the current year. 2. Calculate and record the ratios for total expenses and net loss. Place the percentage for net loss in parentheses to show that it is for a net loss. Round percentage calculations to the nearest 0.1%. 3. Prepare a statement of owner's equity for the month ended April 30 of the current year. 4. Prepare a balance sheet for April 30 of the current year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the income statement we need to calculate the total revenue and total expenses Total Reve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started