Question

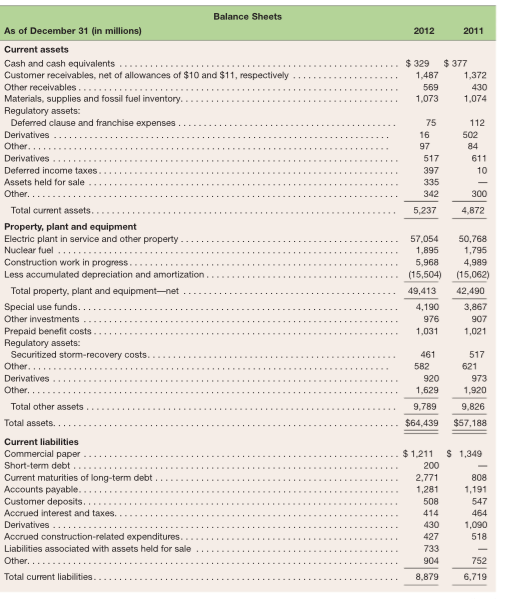

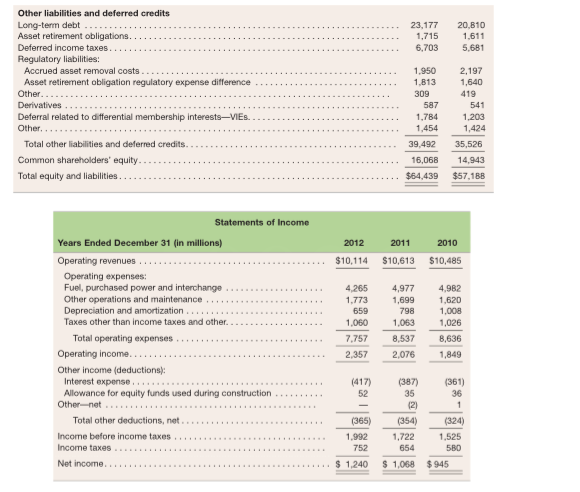

4-31 Assess Credit Risk (LO2, 3) Balance sheets and income statements for NextEra Energy, Inc. follow. Refer to these financial state-ments to answer the requirements

4-31

Assess Credit Risk (LO2, 3)

Balance sheets and income statements for NextEra Energy, Inc. follow. Refer to these financial state-ments to answer the requirements

Required

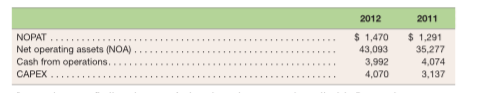

a. Use the financial statements and the information below to compute the following profitability and coverage, liquidity and solvency ratios for 2012 and 2011: RNOA, ROE, times interest earned, free cash flow to debt, current ratio, quick ratio, liabilities-to-equity ratio, and total debt-to-equity ratio. (For simplicity here, use year-end balances for the denominator of RNOA and ROE.) Comment on any observed trends

b. Summarize your findings in a conclusion about the companys credit risk. Do you have any concerns about the companys ability to meet its debt obligations?

*** Show ALL Work Please To Be Voted Best Answer ***

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started