Answered step by step

Verified Expert Solution

Question

1 Approved Answer

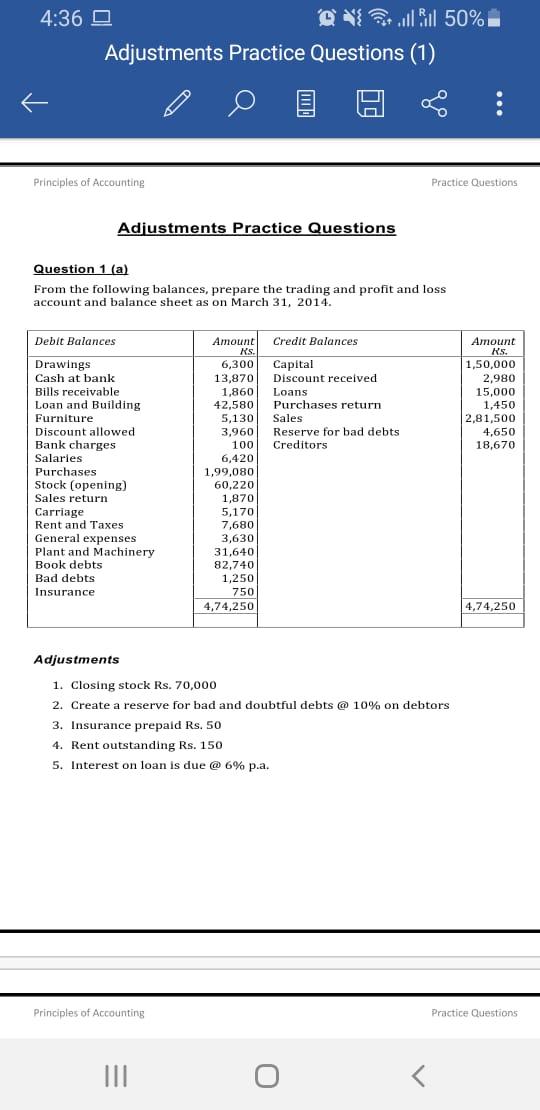

4:36 0 till Bil 50% Adjustments Practice Questions (1) : Principles of Accounting Practice Questions Adjustments Practice Questions Question 1 (a) From the following balances,

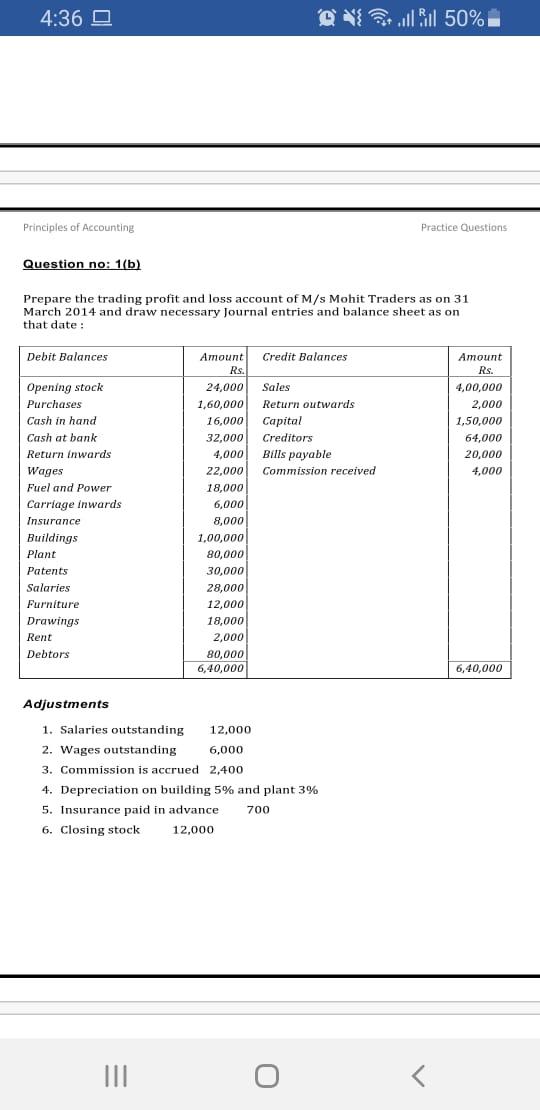

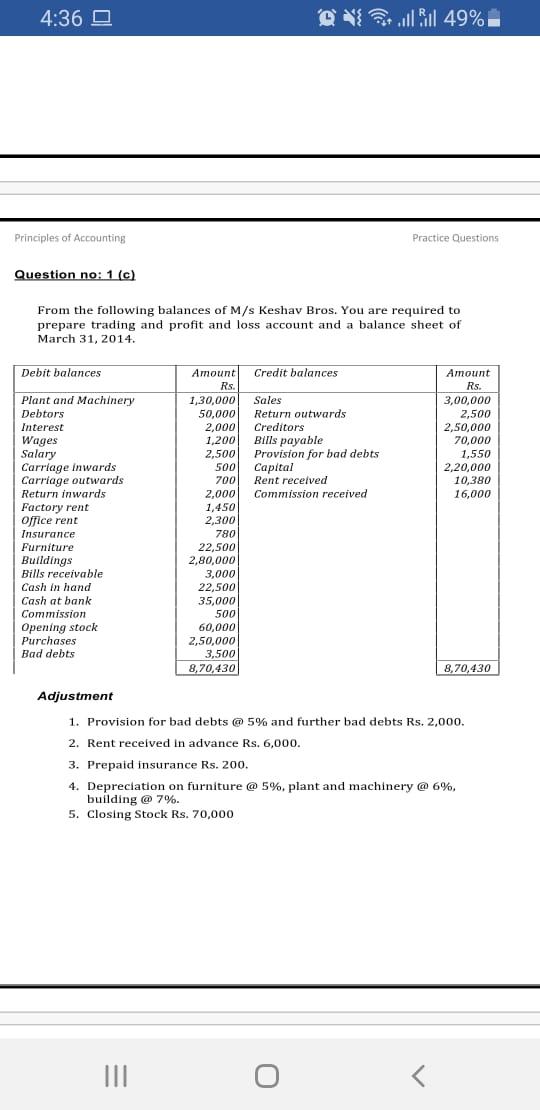

4:36 0 till Bil 50% Adjustments Practice Questions (1) : Principles of Accounting Practice Questions Adjustments Practice Questions Question 1 (a) From the following balances, prepare the trading and profit and loss account and balance sheet as on March 31, 2014. Debit Balances Credit Balances Capital Discount received Loans Purchases return Sales Reserve for bad debts Creditors Amount R's. 1,50,000 2,980 15,000 1,450 2,81,500 4,650 18,670 Drawings Cash at bank Bills receivable Loan and Building Furniture Discount allowed Bank charges Salaries Purchases Stock (opening) Sales return Carriage Rent and Taxes General expenses Plant and Machinery Book debts Bad debts Insurance Amount Rs. 6,300 13,870 1,860 42,580 5,130 3,960 100 6,420 1,99,080 60,220 1,870 5,170 7,680 3,630 31,640 82,740 1,250 750 4,74,250 4,74,250 Adjustments 1. Closing stock Rs. 70,000 2. Create a reserve for bad and doubtful debts @ 10% on debtors a @ 3. Insurance prepaid Rs. 50 4. Rent outstanding Rs. 150 5. Interest on loan is due @ 6% p.a. Principles of Accounting Practice Questions 4:36 0 till Bill 50% Principles of Accounting Practice Questions Question no: 1(b) Prepare the trading profit and loss account of M/s Mohit Traders as on 31 March 2014 and draw necessary Journal entries and balance sheet as on that date : Debit Balances Credit Balances Sales Return outwards Capital Creditor's Bills payable Commission received Amount Rs. 4,00,000 2,000 1,50,000 64,000 20,000 4,000 Opening stock Purchases Cash in hand Cash at bank Return inwards Wages Fuel and Power Carriage inwards Insurance Buildings Plant Patents Salaries Furniture Drawings Rent Debtors Amount Rs. 24,000 1,60,000 16,000 32,000 4,000 22,000 18,000 6,000 8,000 1,00,000 80,000 30,000 28,000 12,000 18,000 2,000 80,000 6,40,000 6,40,000 Adjustments 1. Salaries outstanding 12,000 2. Wages outstanding 6,000 3. Commission is accrued 2,400 4. Depreciation on building 5% and plant 3% 5. Insurance paid in advance 700 6. Closing stock 12.000 4:36 0 C Pull Ril 49% Principles of Accounting Practice Questions Question no: 1 (C) From the following balances of M/s Keshav Bros. You are required to prepare trading and profit and loss account and a balance sheet of March 31, 2014. Debit balances Credit balances Sales Return outwards Creditors Bills payable Provision for bad debts Capital Rent received Commission received Amount Rs. 3,00,000 2,500 2,50,000 70,000 1,550 2,20,000 10,380 16,000 Plant and Machinery Debtor's Interest Wages Salary Carriage inwards Carriage outwards Return inwards Factory rent office rent Insurance Furniture Buildings Bills receivable Cash in hand Cash at bank Commission Opening stock Purchases Bad debts Amount Rs. 1,30,000 50,000 2,000 1,200 2,500 500 700 2,000 1,450 2,300 780 22,500 2,80,000 3,000 22,500 35,000 500 60,000 2,50,000 3,500 8,70,430 8,70,430 Adjustment 1. Provision for bad debts @ 5% and further bad debts Rs. 2,000. 2. Rent received in advance Rs. 6,000. 3. Prepaid insurance Rs. 200. 4. Depreciation on furniture @ 5%, plant and machinery @ 6%. building @ 7%. 5. Closing Stock Rs. 70,000 III o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started