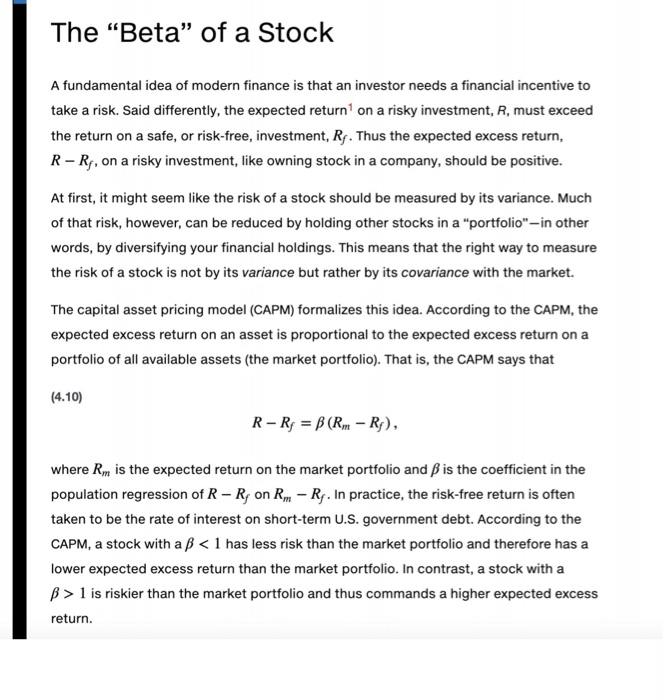

4.4 Read the box "The 'Beta' of a Stock" in Section 4.20 a. Suppose the value of is greater than 1 for a particular stock. Show that the variance of (R R;) for this stock is greater than the variance of (Rm R.). b. Suppose the value of is less than 1 for a particular stock. Is it possible that the variance of (R - Ry) for this stock is greater than the variance of (Rm R.)? (Hint: Don't forget the regression error.) c. In a given year, the rate of return on 3-month Treasury bills is 2.0% and the rate of return on a large diversified portfolio of stocks (the S&P 500) is 5.3%. For each company listed in the table in the box, use the estimated value of B to estimate the stock's expected rate of return. The "Beta" of a Stock A fundamental idea of modern finance is that an investor needs a financial incentive to take a risk. Said differently, the expected return on a risky investment, R, must exceed the return on a safe, or risk-free, investment, Rf. Thus the expected excess return, R-RF, on a risky investment, like owning stock in a company, should be positive. At first, it might seem like the risk of a stock should be measured by its variance. Much of that risk, however, can be reduced by holding other stocks in a "portfolio"-in other words, by diversifying your financial holdings. This means that the right way to measure the risk of a stock is not by its variance but rather by its covariance with the market. The capital asset pricing model (CAPM) formalizes this idea. According to the CAPM, the expected excess return on an asset is proportional to the expected excess return on a portfolio of all available assets (the market portfolio). That is, the CAPM says that (4.10) R-R; = B (Rm - R), where Rm is the expected return on the market portfolio and B is the coefficient in the population regression of R Rp on Rm Rs. In practice, the risk-free return is often taken to be the rate of interest on short-term U.S. government debt. According to the CAPM, a stock with a B 1 is riskier than the market portfolio and thus commands a higher expected excess return