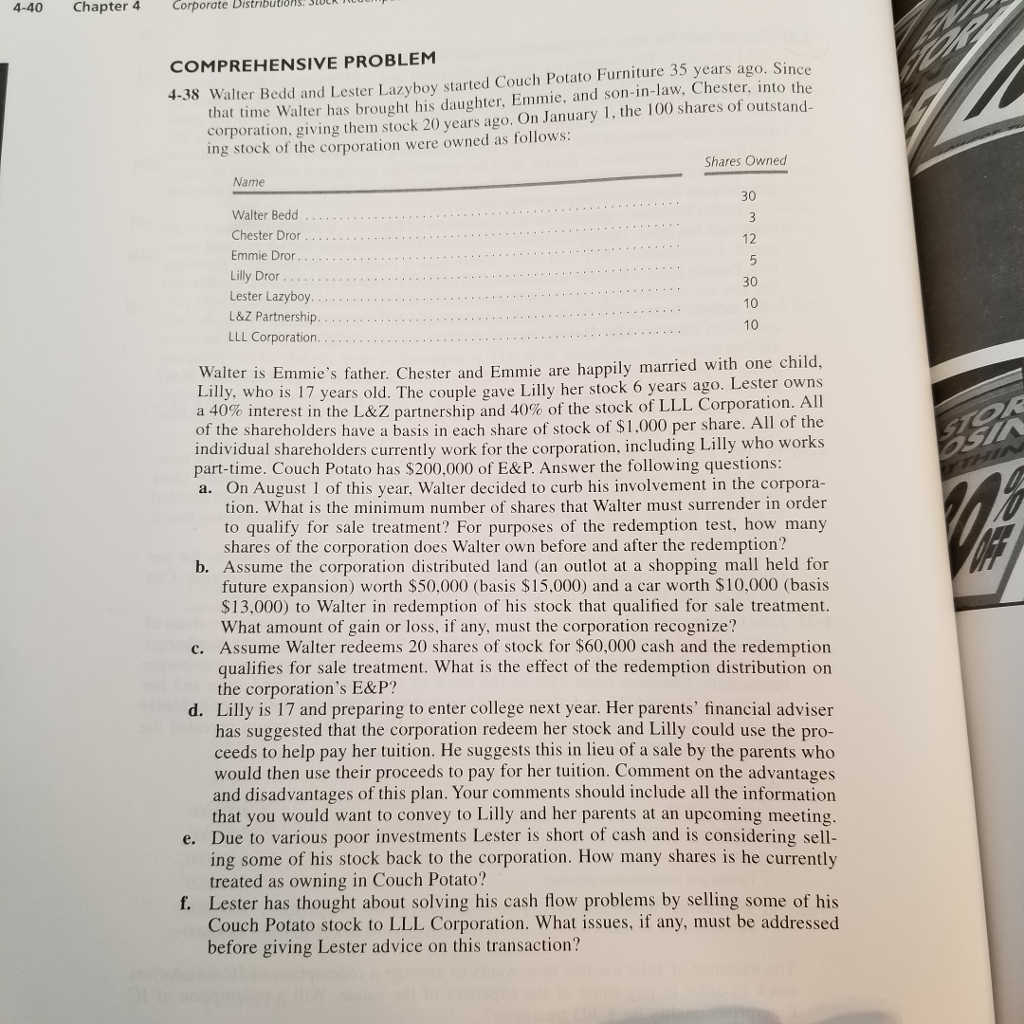

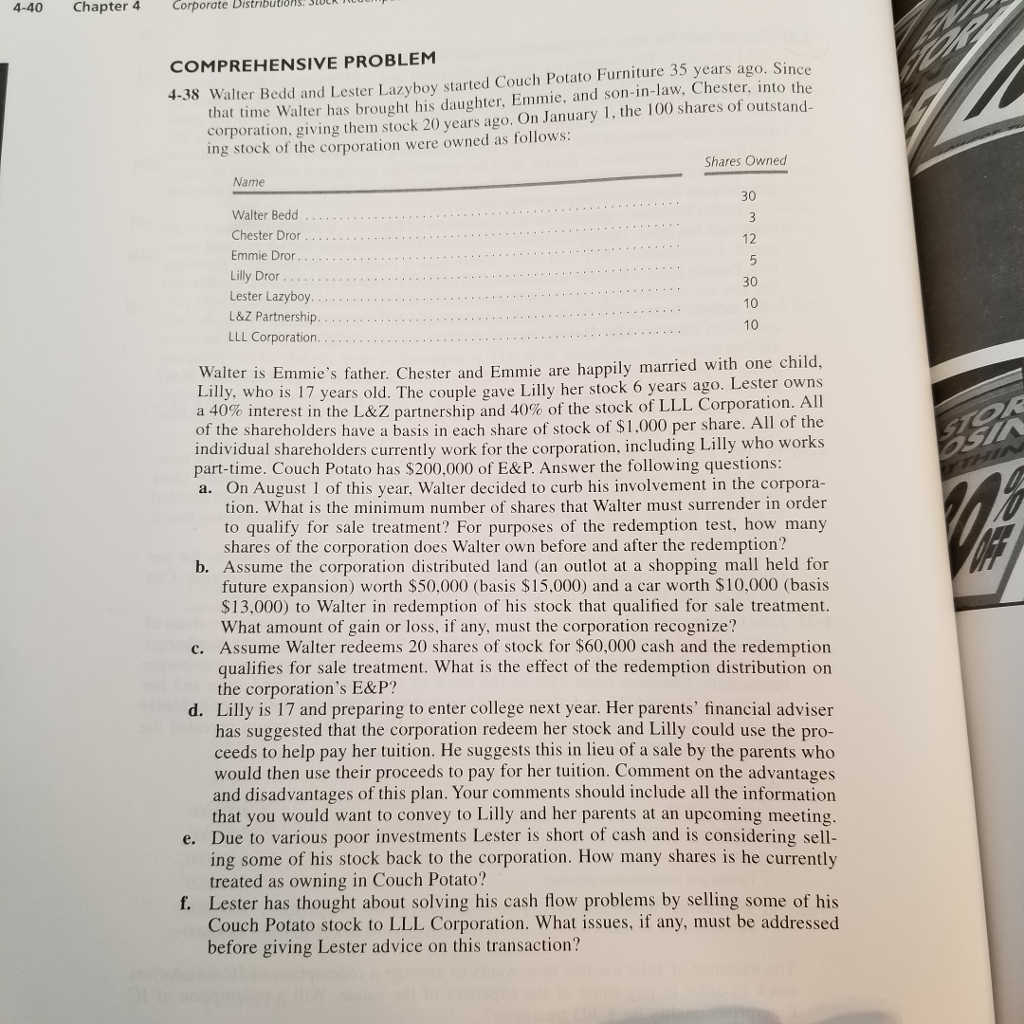

4-40 Chapter 4 Corporate BistribubonS: Sluk COMPREHENSIVE PROBLEM 4-38 Walter Bedd and Lester Lazyboy started Couch Potato Furniture 35 years ago. Since corporation, giving them stock 20 years ago. On January 1, the 100 shares of outstand ing stock of the corporation were owned as follows: that time Walter has brought his daughter, Emmie, and son-in-law, Chester, into the Shares Owned Name 30 Walter Bedd Chester Dror Emmie Dror Lilly Dror Lester Lazyboy L&Z Partnership LLL Corporation 30 10 pily married with one child Lilly, who is 17 years old. The couple gave Lilly her stock 6 years ago. Lester own a 40% interest in the LAZ partnership and 40% of the stock of LLL Corporation of the shareholders have a basis in each share of stock of $1,000 per share. All of the individual shareholders currently work for the corporation, including Lilly who works part-time. Couch Potato has $200,000 of E&P. Answer the following questions: a. On August 1 of this year, Walter decided to curb his involvement in the corpora- tion. What is the minimum number of shares that Walter must surrender in order to qualify for sale treatment? For purposes of the redemption test, how many shares of the corporation does Walter own before and after the redemption? b. Assume the corporation distributed land (an outlot at a shopping mall held for future expansion) worth $50,000 (basis $15,000) and a car worth $10,000 (basis $13,000) to Walter in redemption of his stock that qualified for sale treatment What amount of gain or loss, if any, must the corporation recognize? Assume Walter redeems 20 shares of stock for $60,000 cash and the redemption qualifies for sale treatment. What is the effect of the redemption distribution on c. the corporation's E&P? d. Lilly is 17 and preparing to enter college next year. Her parents' financial adviser has suggested that the corporation redeem her stock and Lilly could use the pro ceeds to help pay her tuition. He suggests this in lieu of a sale by the parents who would then use their proceeds to pay for her tuition. Comment on the advantages and disadvantages of this plan. Your comments should include all the information that you would want to convey to Lilly and her parents at an upcoming meeting e. Due to various poor investments Lester is short of cash and is considering sel ing some of his stock back to the corporation. How many shares is he currently treated as owning in Couch Potato? f. Lester has thought about solving his cash flow problems by selling some of his Couch Potato stock to LLL Corporation. What issues, if any, must be addressed before giving Lester advice on this transaction? 4-40 Chapter 4 Corporate BistribubonS: Sluk COMPREHENSIVE PROBLEM 4-38 Walter Bedd and Lester Lazyboy started Couch Potato Furniture 35 years ago. Since corporation, giving them stock 20 years ago. On January 1, the 100 shares of outstand ing stock of the corporation were owned as follows: that time Walter has brought his daughter, Emmie, and son-in-law, Chester, into the Shares Owned Name 30 Walter Bedd Chester Dror Emmie Dror Lilly Dror Lester Lazyboy L&Z Partnership LLL Corporation 30 10 pily married with one child Lilly, who is 17 years old. The couple gave Lilly her stock 6 years ago. Lester own a 40% interest in the LAZ partnership and 40% of the stock of LLL Corporation of the shareholders have a basis in each share of stock of $1,000 per share. All of the individual shareholders currently work for the corporation, including Lilly who works part-time. Couch Potato has $200,000 of E&P. Answer the following questions: a. On August 1 of this year, Walter decided to curb his involvement in the corpora- tion. What is the minimum number of shares that Walter must surrender in order to qualify for sale treatment? For purposes of the redemption test, how many shares of the corporation does Walter own before and after the redemption? b. Assume the corporation distributed land (an outlot at a shopping mall held for future expansion) worth $50,000 (basis $15,000) and a car worth $10,000 (basis $13,000) to Walter in redemption of his stock that qualified for sale treatment What amount of gain or loss, if any, must the corporation recognize? Assume Walter redeems 20 shares of stock for $60,000 cash and the redemption qualifies for sale treatment. What is the effect of the redemption distribution on c. the corporation's E&P? d. Lilly is 17 and preparing to enter college next year. Her parents' financial adviser has suggested that the corporation redeem her stock and Lilly could use the pro ceeds to help pay her tuition. He suggests this in lieu of a sale by the parents who would then use their proceeds to pay for her tuition. Comment on the advantages and disadvantages of this plan. Your comments should include all the information that you would want to convey to Lilly and her parents at an upcoming meeting e. Due to various poor investments Lester is short of cash and is considering sel ing some of his stock back to the corporation. How many shares is he currently treated as owning in Couch Potato? f. Lester has thought about solving his cash flow problems by selling some of his Couch Potato stock to LLL Corporation. What issues, if any, must be addressed before giving Lester advice on this transaction