445 econ the question is complete

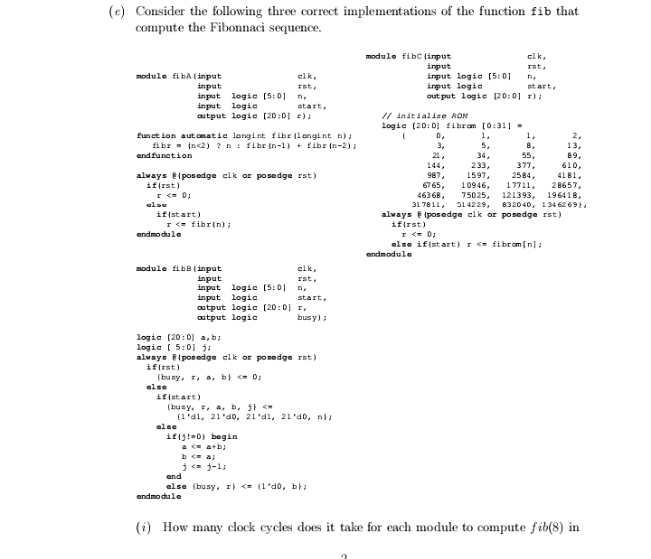

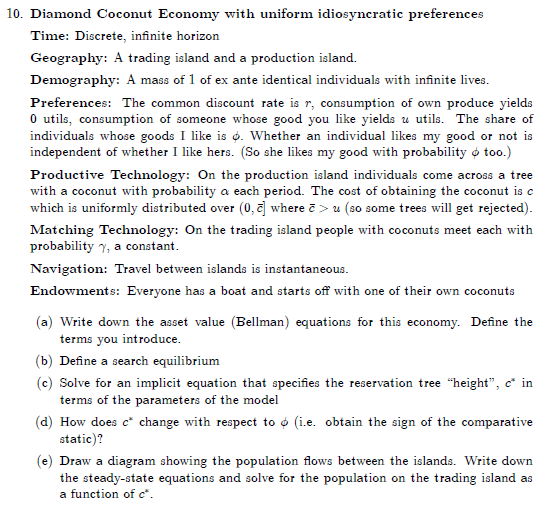

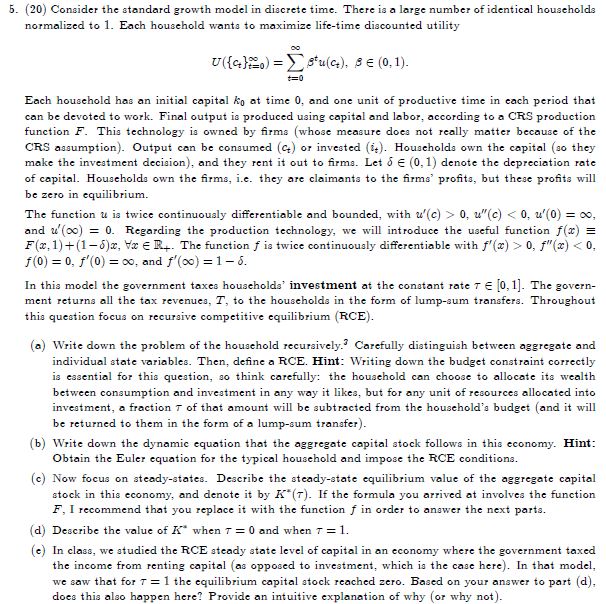

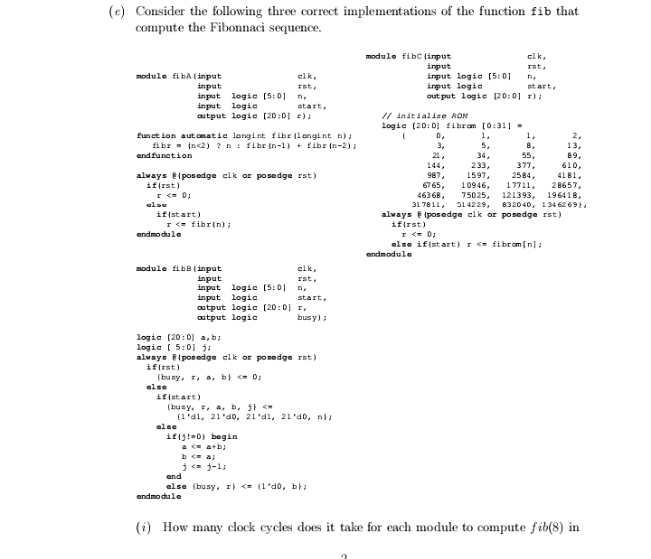

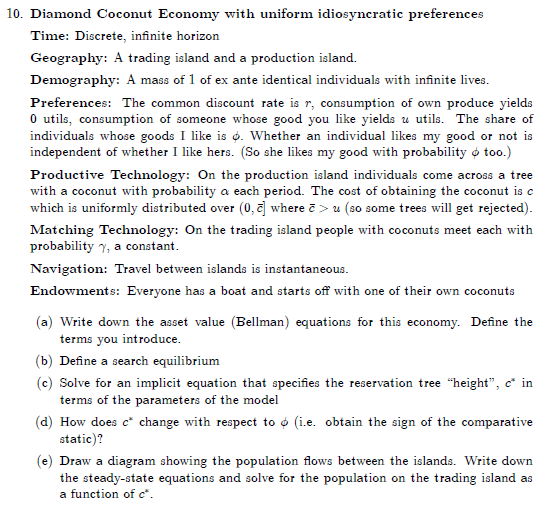

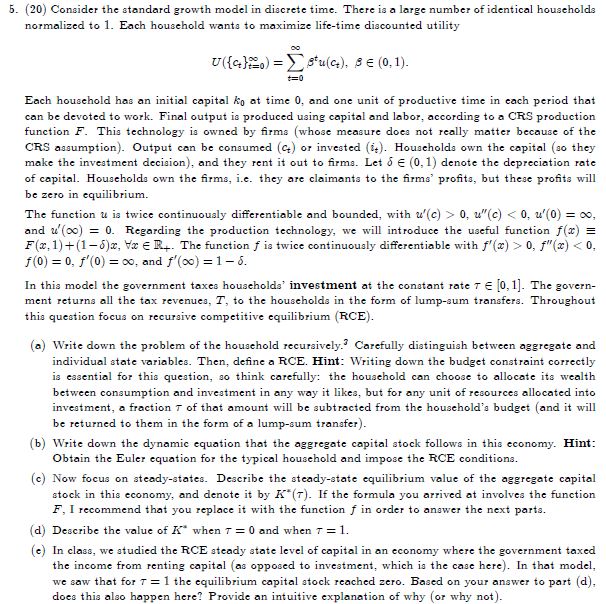

(e) Consider the following three correct implementations of the function fib that compute the Fibonnaci sequence. module fibC linput cik, input module fibA input alk. input logia [5:0] input input logic start . input logic [5:0] n. output logic (20:0] r] ; input logic output logic [20:0] :) 1 // initialize RON logic [20:0] fibrom [0:31] = function automatic longing flbe (longint a) , 1 , Abr . (n0. Output is produced by an infinite-lived tree: each period, the tree produces d units of non-storable output. The growth rate of dividends follows a stationary process, with G: = d/de-1 following a two-state Markov chain. In particular, G, can take on two values: 1, and y > 1. The conditional probabilities are f (7, y) = Pr (G++1 = 7/ G+ = Y) = *, f (1, y) = Pr (G+41 = 1/ G = 7) =1-*, f (y, 1) = Pr (G++1 = 7/ G = 1) =0, f (1, 1) = Pr (G++1 = 1/ G =1) =1. In short, high growth may be followed by zero growth, but zero growth is permanent. Let p. = p(d, G.) be the price at time t of a title to all future dividends from a tree. Let R7 = R- (d, G.) = R- (G:) be the time-t price of a risk-free discount bond that pays one unit of consumption at time t + 1 under any future state. Finally, let a denote the consumer's financial resources, which she allocates between stocks, bonds, and consumption. (a) Write down the consumer's problem in recursive form and find the first order conditions. (b) Define a recursive equilibrium for this economy. (c) Now consider the equilibrium price of a stock. i. Find pi(d) = p(d, 1) = Aid. Your answer should not include any summations. (Hint: The fact that the bad state is permanent makes pi very easy to find.) ii. Using your answer to part 1, guess and verify that p,(d) = p (d, y) = And. (d) Find the price of the risk-free bond, R. = R- (G:) as functions of y and . Find closed-from solutions for Ril = R" (y) and RT) = R-1 (1) (e) Consider how economic growth, as indexed by y, affects asset prices. i. Does higher expected growth raise bond prices? Put differently, does a higher value of y raise R-17 Briefly discuss.1i}. Diamond lDoconut Economy with uniform idiosyncratic preferences Time: Discrete, innite horizon Geography: A trading island and a production island. Demography: A mass of l ofex ante identical individuals with innite lives. Preferences: The oom.mon discount rate is 1', consumption of own produce yields ill utils.. consLunptioo of someone whose good you like yields 11 utils. The share of individuals whose goods I like is all. 1Whether an individual likes my good or not is independent of whether I like hers. {So she likes my good with probability :1: too.} Productive Tachnology: On the production island individuals come across a tree with a coconut with probability a: each period. The cost of obtaining the coconut is c which is uniformly distributed over [41.5] where E :> u {so some trees will get rejected}. hiatching Technology: On the trading island people with coconuts meet each with probability \"1'1 a constant. Navigation: Travel between islands is instantaneous. Endowments: Everyone has a boat and starts off with one of their own oooonuts {a} 1Write down the asset value [Bellman]I equations for this eoonomy. Dene the terms you int roduce. {b} Dene a search equilibrium c Solve for an i licit nation that s ecies the reservation tree \"he' ht":I c" in \"1P 3'1 P 15 :- terms of the parameters of the model {:1} How does c' change with respect to st [i.e. obtain the sign of the comparative staticjr.Ir {e} Draw a diagram showing the population ows between the islands. Write down the steadystate equations and solve for the population on the trading island as a function of c'. ii. [213} Consider the standard growth model in discrete time. There is a large number ofidentical households normalized to 1. Each household wants to maximise life-time discounted utility \"({olu} = E futon}: .3 E (IL 11l- Each household has an initial capital kg. at time D, and one unit ofproductive tim.e in each period that can be devoted to work. Final output is produced using capital and labor, according to a CH3 production function F. This technology is owned by rms [whose measure does not really matter because of the CH3 assumption}. Output can be consumed [121} or invested {It}. Households own the capital [so the}.r make the investment decision}, and they rent it out to rms. Let 5 E {l}, 1} denote the depreciation rate of capital. Households own the rms, i.e. they are claimants to the rms' prots, but these prots will be zero in equilibriimi. The function I; is twice continuouslyr dierentiable and bounded, with 1116] :5- ll', HHIICII r: ll, \"10} 2 co, and 11130] 2 ll. Regarding the production. technology, we will introduce the useful function flit} E FEE, l] + [l (5):, 19': E l1... The function f is twice continuously diEerentiable with jibe] :5- tl, f"{c] t: ll, fill] = (1, frilll} = 30, and fTDO} = l :5. In this model the government taxes households? mvastmont at the constant rate T E [Il,l.]. The govern ment returns all the tax revenues, T, to the households in the form of lumpsum transfers. Throughout this question focus on recursive competitive equilibrium {RUE}. a rite wnt e ro ecmo t e ouse o recurs1v y. r y Istinguls etwecn aggregate \"F'do hpbl fhh hld 'el'Gaecfulld" 'hb and individual state Tvariables. Then, dene a ROE. Hint: 1|Writing down the budget constraint correctly is essential for this question, so thin]: carefully: the household can choose to allocate its wealth between consumption and investment in any way it likes, but for any unit of resources allocated into investment, a fraction '1' of that amount will be subtracted from the household's budget [and it will be returned to them in the form of a lump-sum transfer}. {b} l-Vrite down the dynamic equation that the aggregate capital stock follows in this economy. Hint Obtain the Euler equation for the typical household and impose the RUE conditions. [cl Now focus on steadystates. Describe the steady-state equilibrium value of the aggregate capital stoclc in this economy, and denote it by HIET']. If the formula you arrived at involves the function F, I recommend that you replace it with the function f in order to answer the neoct parts. {d} Describe the value of K" when T = [l' and when T = l.. {e} In class, we studied the RCE steady state level of capital in an economy where the government taxed the income from renting capital {as opposed to investment, which is the case here}. In that model, we saw that for T = l the equilibrium capital stock reached zero. Based on your answer to part [d], does this also happen here? Provide an intuitive explanation of why [or why not]. t'l'. {I'll} Consider the discrete time monetary-search model we saw in class. As in the baseline model, in the day time trade takes place in a decentralized market characterized by anonymity and bilateral meetings [call it the DM}, and at night trade takes place in a l-Valrasian or centralised market {call it the CM}. There are two types ofagents, buyers and sellers, and the measure of both is normalized to the 'unit. The per period utility is 11W} + UIIXJ H, for buyers, and q+ DIX} H, for sellers; q is consumption: of the DM good, I is consumption of the CM good [the numeraire], and H is hours worked in the Cl'rI. In the Cl'rI, one hour of work delivers one unit of the numeraire. The functions u, U satisfy standard properties. 1|I-'Ii'hat is important here is that there exists .1\" 2:- ll such that U' EX\") 2 l. Goods are non storable, but there exits a storable and recognizable object, called at money, that can serve as a means ofpayment. The supply of money, controlled by the monetary authority, follows the process .m+1 = {l +y}llr._ and new money is introduced via lump-sum transfers to buyers in the Chi. So far, this is just a description of the model we saw in class. \"'hat is dierent here is that only a fraction 1T of buyers turn out to have a desire to consume the DM good in the current period; let us refer to these buyers as Ctypes {for consumption} and to the remaining 1 fr buyers as Ntypes {for noconsumption]. The shock that determines each buyer's type in every period is find. A. buyer learns her type after all Chi: trade has conclude but before the DM opens. To make things interesting we will assume that between the CPI-I and the DIE-I there is a third market, where Ctypes and Ntypes can meet and trade r"liv|:i_uidity", i.e., money. Let us refer to this market as the loan market {Lb-Ell" The leI is a bilateral market for loans, where Ntypes, who may carry some money that they do not need, meet Ctypes, who may need additional liquidity. A CRS matching function f{:'l'._ l 51'} brings the two types together. Importantly, the LM is not anonymous, so that agents can make credible [and enforceable} promises. Hence, when an Ntype and a Ctype meet, they mutually benet from a contract specifying that the I'lltype will give l units ofmoney to the Ctype right away, and the Ctype will repay d [for debt} units of the numeraire good in the forthcoming CM. After the LM trades have concluded [for the agents who matched with someone}, Ctypcs proceed to the DM, where they use money to purchase goods from sellers. Assume that oil (7le buyers match with a seller. Notice that I have not said anything about the splitting of the various surpluses {i.e., bargaining], because this information will not be necessary for what I am asking here. Let LIKE.) be the CM value function ofa buyer, and VII.) the Dle value function ofa Ctype buyer [since only these buyers visit the Dbl]. Also, let fl'{.} be the Ll'rI value function of a typei buyer, i E {3,4V}. Your task in this question is to describe these value functions. I am not asking you to analyze them. I recommend that you draw a graph summarising the timing of the model. {a} Describe the function W[.}, and show that it is linear in all its argumentsfstate variables [what these arguments are, however, is for you to determine}. {b} Let [q._p} be the quantity ofgood and the units of money exchanged in a typical DIE-I meeting. Let {Lil} be the size of the loan [in dollars] and the promised repayment {in terms of the numeraire} specied in a typical LIL-I meeting. \"'hat variables do the terms 5', p,l._ d depend on? Hint: Provide quick answers of the form "(I is a function of the money holdings of the {LCtype} buyer"