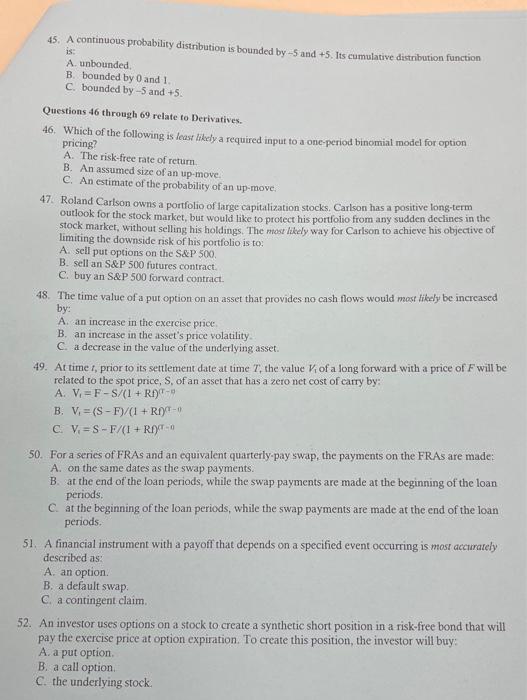

45. A continuous probability distribution is bounded by -5 and +5 . Its cumulative distribution function is: A. unbounded, B. bounded by 0 and 1 . C. bounded by -5 and +5 . Questions 46 through 69 relate to Derivatives. 46. Which of the following is least b kecty a required input to a one-period binomial model for option pricing? A. The risk-free rate of returm. B. An assumed size of an up-move. C. An estimate of the probability of an up-move. 47. Roland Carlson owns a portfolio of large capitalization stocks. Carlson has a positive long-term outlook for the stock market, bur would like to protect his portfolio from any sudden declines in the stock market, without selling his holdings. The mot likely way for Carlson to achieve his objective of limiting the downside risk of his portfolio is to: A. sell put options on the SdP 300 . B. sell an S\&P 500 futures contract. C. buy an S\&P 500 forward contract. 48. The time value of a put option on an asset that provides no cash flows would most tikely be increased by: A. an increase in the exercise price. B. an increase in the asset's price volatility. C. a decrease in the value of the underlying asset. 49. At time t, prior to its settlement date at time T, the value V1 of a long forward with a price of F will be related to the spot price, S, of an asset that has a zero net cost of carry by: A. V1=FS/(1+Rf)TD B. V1=(SF)/(1+Rf)(r0 C. V1=SF/(1+R)a0 50. For a series of FRAs and an equivalent quarterly pay swap, the payments on the FRAs are made: A. on the same dates as the swap payments. B. at the end of the loan periods, while the swap payments are made at the beginning of the loan periods. C. at the beginning of the loan periods, while the swap payments are made at the end of the loan periods. 51. A financial instrument with a payoff that depends on a specified event occurring is most accturatey described as: A. an option. B. a default swap. C. a contingent claim. 52. An investor uses options on a stock to create a synthetic short position in a risk-free bond that will pay the exercise price at option expiration. To create this position, the investor will buy: A. a put option. B. a call option. C. the underlying stock