Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[45] During its current fiscal year, ING Co. issued bonds with a face amount of $1 million for 104. One detachable stock warrant was attached

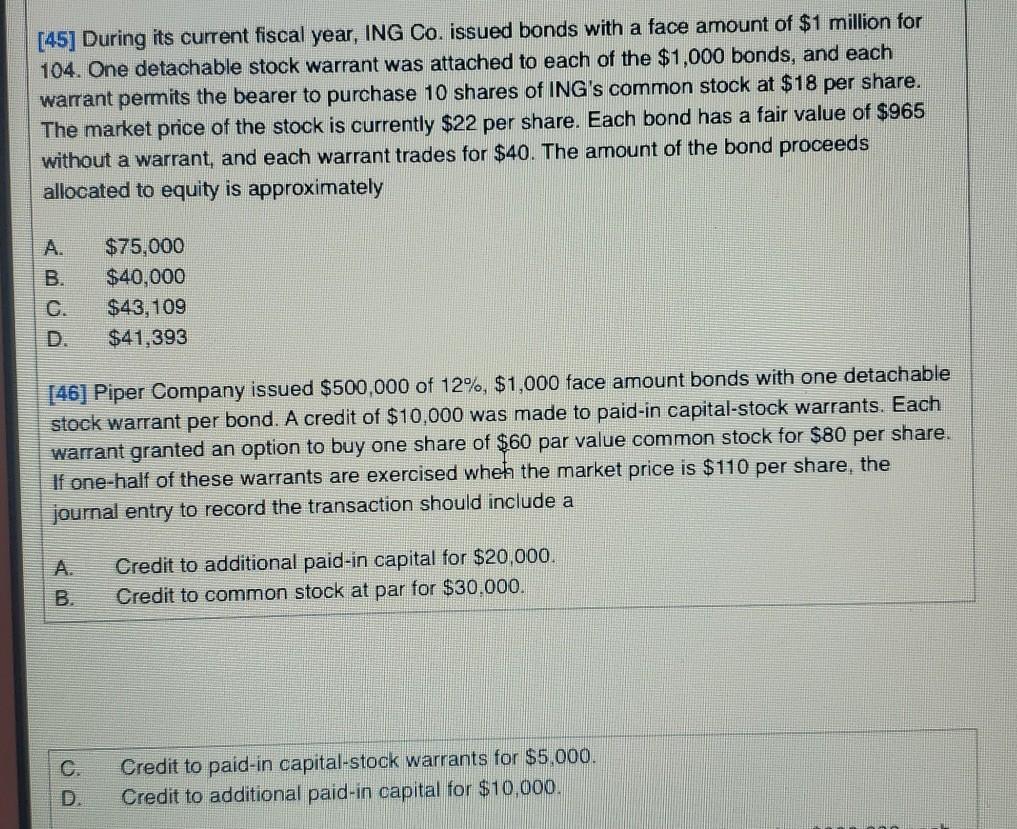

[45] During its current fiscal year, ING Co. issued bonds with a face amount of $1 million for 104. One detachable stock warrant was attached to each of the $1,000 bonds, and each warrant permits the bearer to purchase 10 shares of ING's common stock at $18 per share. The market price of the stock is currently $22 per share. Each bond has a fair value of $965 without a warrant, and each warrant trades for $40. The amount of the bond proceeds allocated to equity is approximately B. $75,000 $40,000 $43,109 $41,393 G. D. [46] Piper Company issued $500,000 of 12%, $1,000 face amount bonds with one detachable stock warrant per bond. A credit of $10,000 was made to paid-in capital-stock warrants. Each warrant granted an option to buy one share of $60 par value common stock for $80 per share. If one-half of these warrants are exercised wheh the market price is $110 per share, the journal entry to record the transaction should include a Credit to additional paid-in capital for $20,000. Credit to common stock at par for $30.000. B. C. Credit to paid-in capital-stock warrants for $5,000. Credit to additional paid-in capital for $10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started