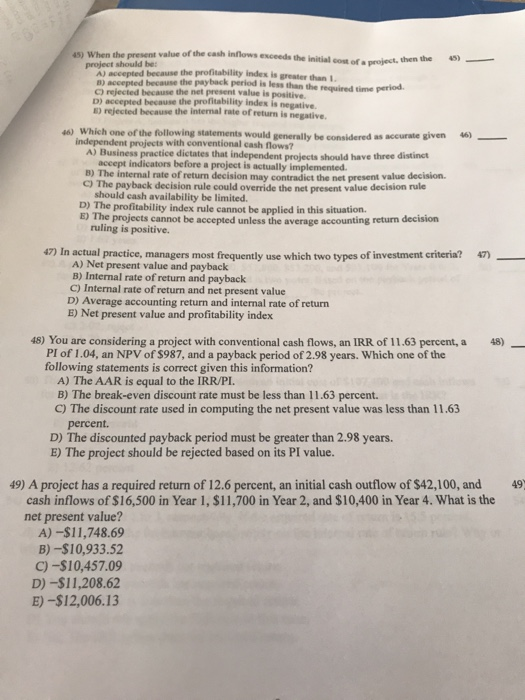

45) When the present value of the cash inflows project should ise the profitability index is greater than esceeds the initial cost of a project, thern A) accepted because because the payback period is less than the required time period C) rejected because the net present value is D) accepted because the profitability index is negative E) rejected because the internal rate of return positive. is negative. 46) Which one of the following statements would generally be considered as accurate given 4) independent projects with conventional cash flows? A) Business practice dictates that independent projects should have three distinct accept indicators before a project is actually implemented. B) The internal rate of return decision may contradict the net present value decision. C) The payback decision rule could override the net present value decision rule should cash availability be limited. D) The profitability index rule cannot be applied in this situation. E The projects cannot be accepted unless the average accounting return decision ruling is positive 47) In actual practice, managers most frequently use which two types of investment criteria? 47) A) Net present value and payback B) Internal rate of return and payback C) Internal rate of return and net present value D) Average accounting return and internal rate of return E) Net present value and profitability index 48) You are considering a project with conventional cash flows, an IRR of 11.63 percent, a PI of 1.04, an NPV of $987, and a payback period of 2.98 years. Which one of the following statements is correct given this information? A) The AAR is equal to the IRR/PI. B) The break-even discount rate must be less than 11.63 percent. C) The discount rate used in computing the net present value was less than 11.63 percent. D) The discounted payback period must be greater than 2.98 years. E) The project should be rejected based on its PI value. 48) 49) A project has a required return of 12.6 percent, an initial cash outflow of $42,100, and cash inflows of $16,500 in Year 1, $11,700 in Year 2, and $10,400 in Year 4. What is the net present value? A)-$11,748.69 B)-$10,933.52 C)-$10,457.09 D)-$11,208.62 E)-$12,006.13 49)