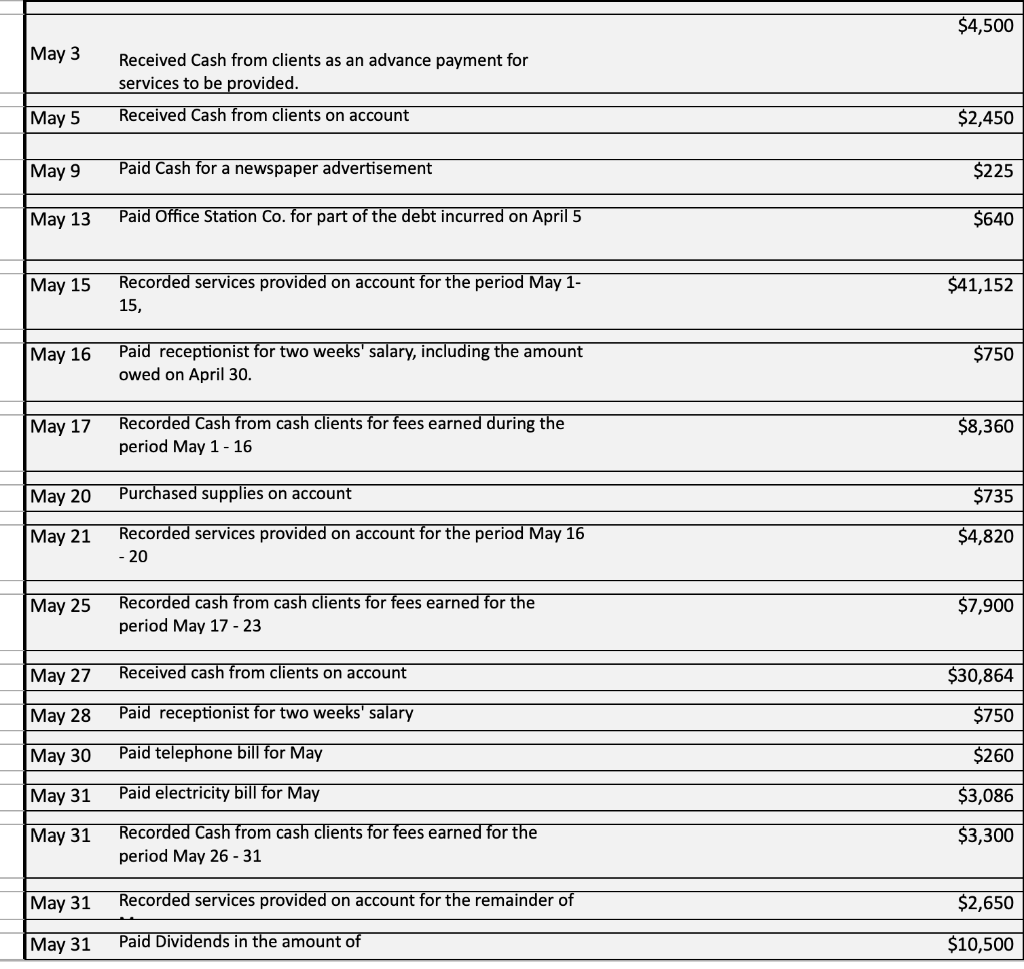

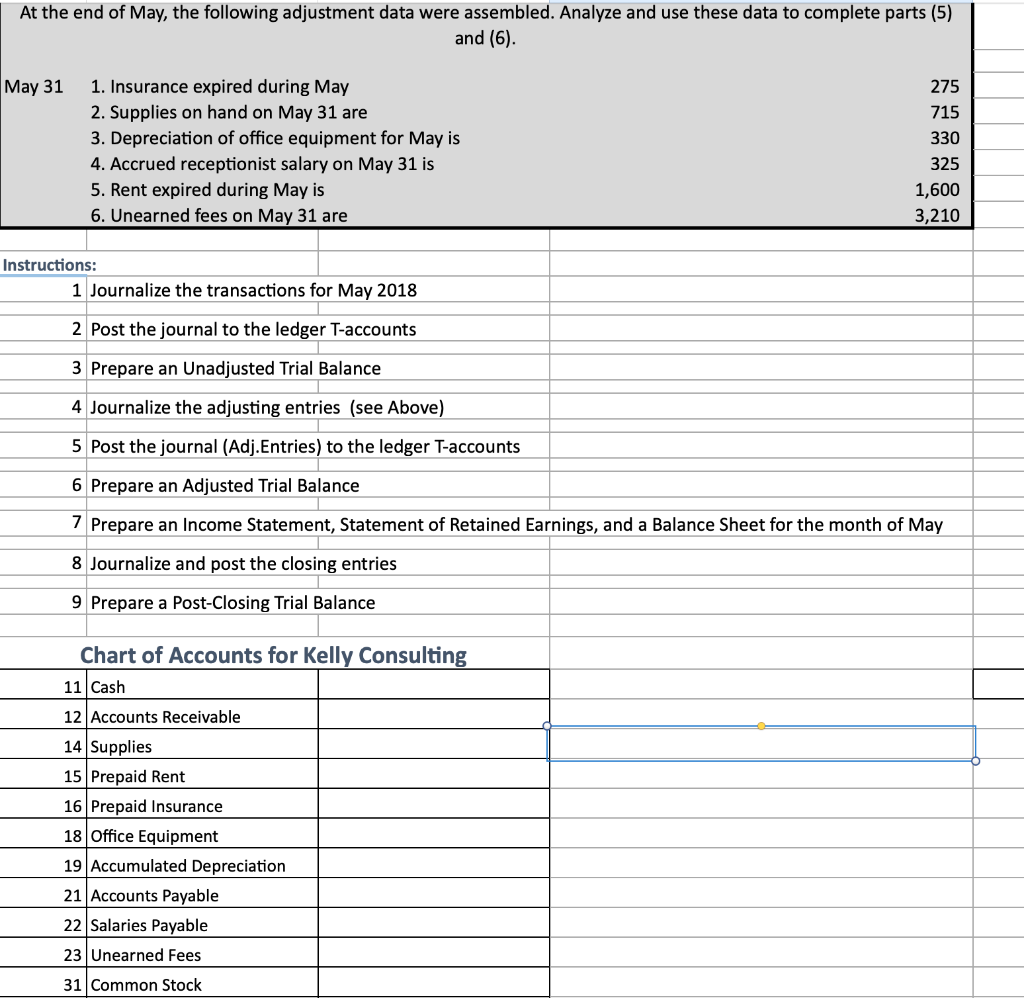

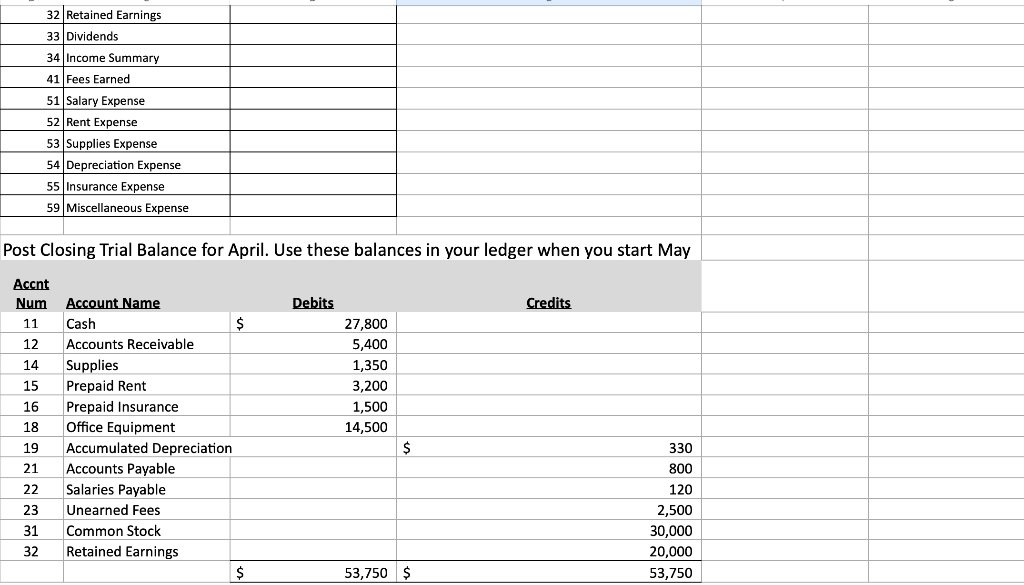

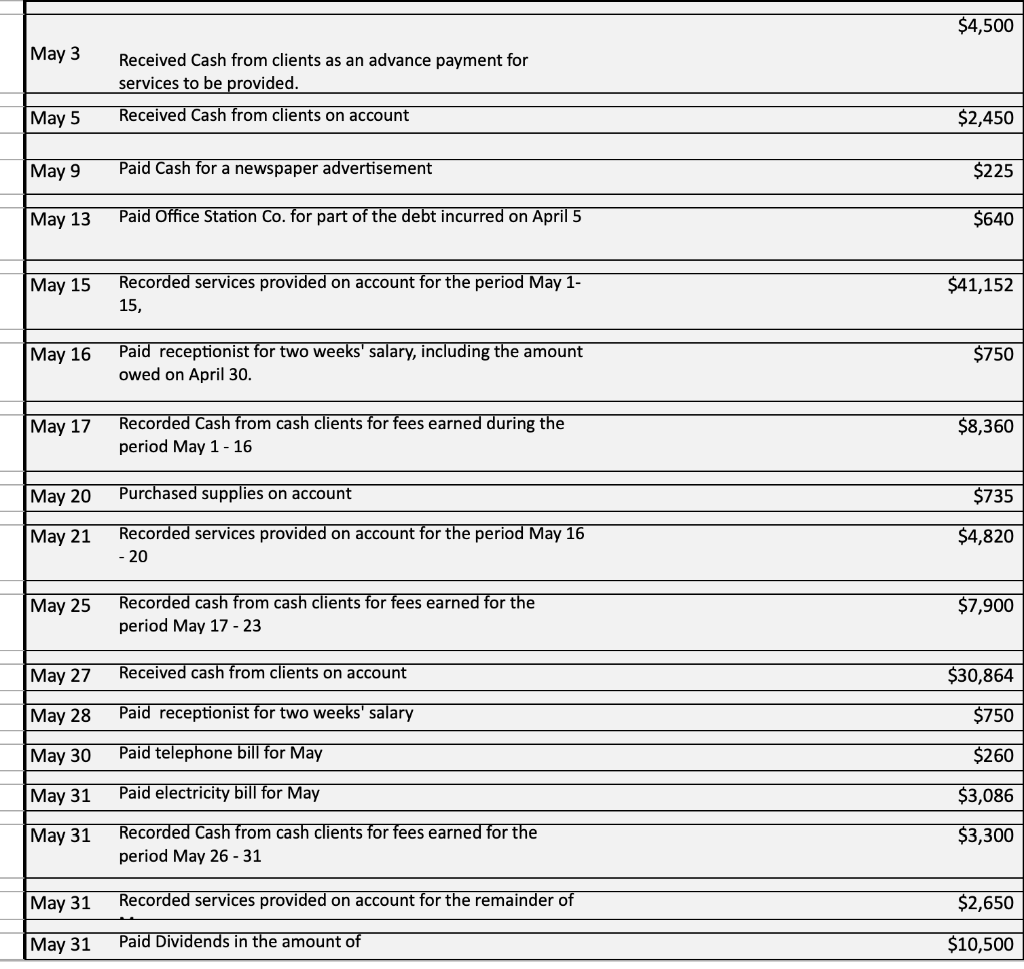

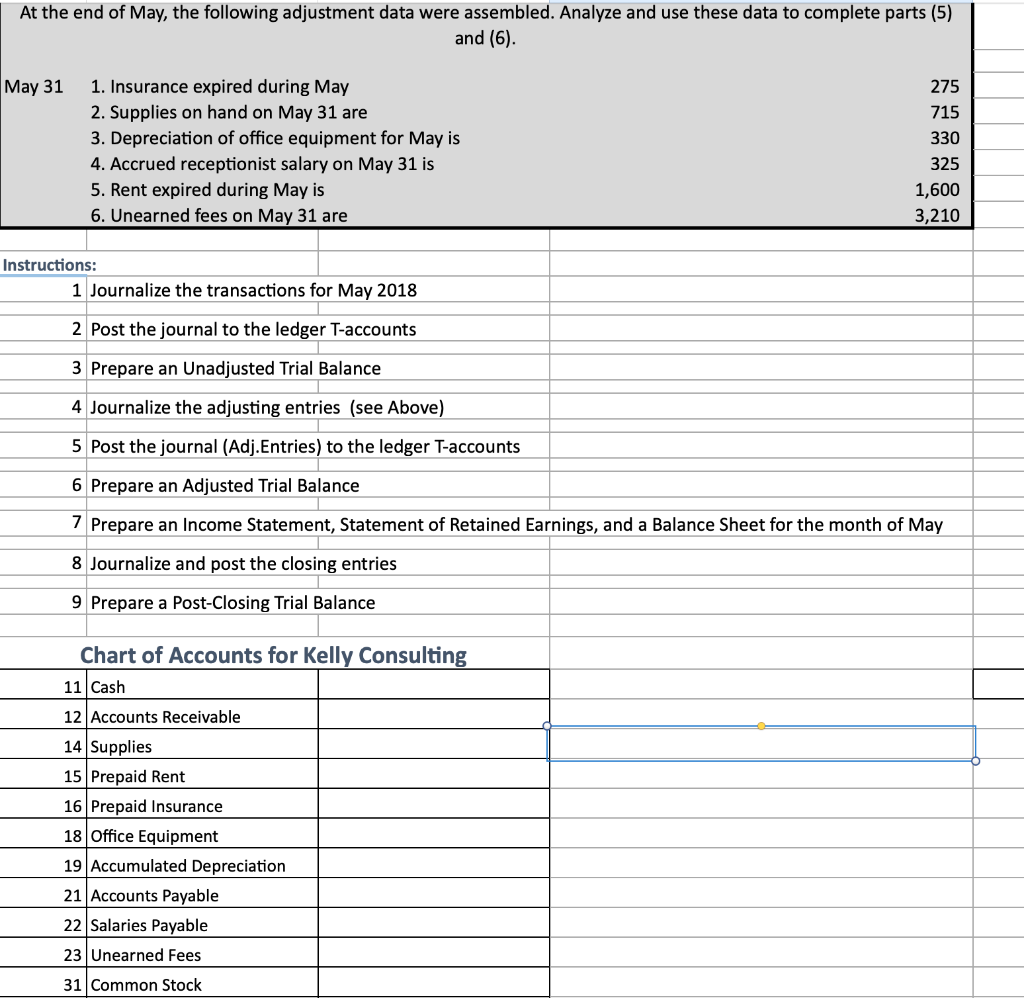

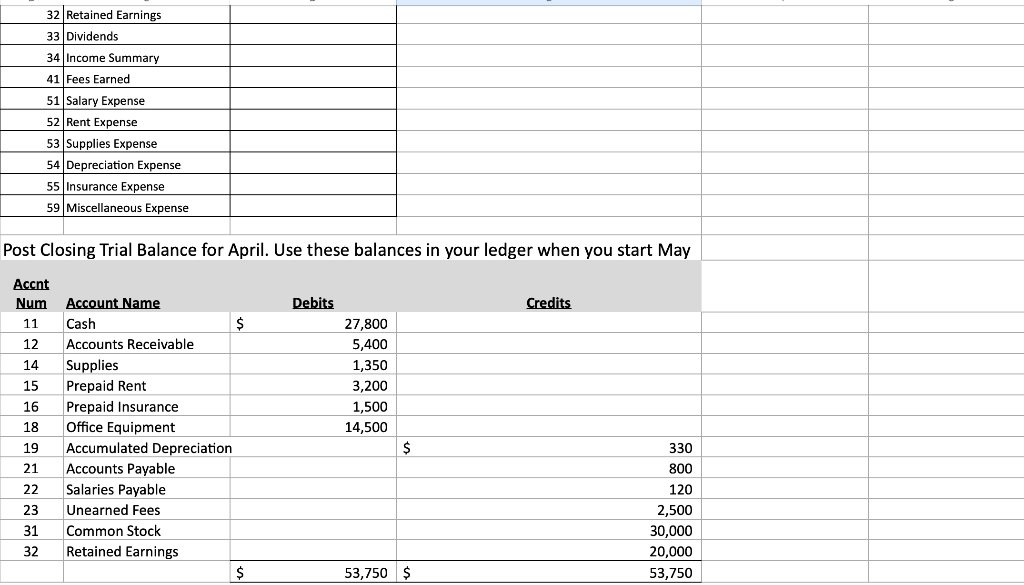

$4,500 May 3 Received Cash from clients as an advance payment for services to be provided. May 5 Received Cash from clients on account $2,450 May 9 Paid Cash for a newspaper advertisement $225 May 13 Paid Office Station Co. for part of the debt incurred on April 5 $640 May 15 Recorded services provided on account for the period May 1- 15, $41,152 May 16 Paid receptionist for two weeks' salary, including the amount owed on April 30. $750 May 17 Recorded Cash from cash clients for fees earned during the period May 1 - 16 $8,360 May 20 Purchased supplies on account $735 May 21 Recorded services provided on account for the period May 16 - 20 $4,820 May 25 $7,900 Recorded cash from cash clients for fees earned for the period May 17 - 23 May 27 Received cash from clients on account $30,864 May 28 Paid receptionist for two weeks' salary $750 May 30 Paid telephone bill for May $260 May 31 Paid electricity bill for May $3,086 May 31 Recorded Cash from cash clients for fees earned for the period May 26 - 31 $3,300 May 31 Recorded services provided on account for the remainder of $2,650 May 31 Paid Dividends in the amount of $10,500 At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). May 31 1. Insurance expired during May 2. Supplies on hand on May 31 are 3. Depreciation of office equipment for May is 4. Accrued receptionist salary on May 31 is 5. Rent expired during May is 6. Unearned fees on May 31 are 275 715 330 325 1,600 3,210 Instructions: 1 Journalize the transactions for May 2018 2 Post the journal to the ledger T-accounts 3 Prepare an Unadjusted Trial Balance 4 Journalize the adjusting entries (see Above) 5 Post the journal (Adj.Entries) to the ledger T-accounts 6 Prepare an Adjusted Trial Balance 7 Prepare an Income Statement, Statement of Retained Earnings, and a Balance Sheet for the month of May 8 Journalize and post the closing entries 9 Prepare a Post-Closing Trial Balance Chart of Accounts for Kelly Consulting 11 Cash 12 Accounts Receivable 14 Supplies 15 Prepaid Rent 16 Prepaid Insurance 18 Office Equipment 19 Accumulated Depreciation 21 Accounts Payable 22 Salaries Payable 23 Unearned Fees 31 Common Stock 32 Retained Earnings 33 Dividends 34 Income Summary 41 Fees Earned 51 Salary Expense 52 Rent Expense 53 Supplies Expense 54 Depreciation Expense 55 Insurance Expense 59 Miscellaneous Expense Post Closing Trial Balance for April. Use these balances in your ledger when you start May Debits Credits Accnt Num 11 12 14 15 16 27,800 5,400 1,350 3,200 1,500 14,500 Account Name Cash $ Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Fees Common Stock Retained Earnings $ 18 19 21 22 23 31 $ 330 800 120 2,500 30,000 20,000 32 53,750 $ 53,750