Question

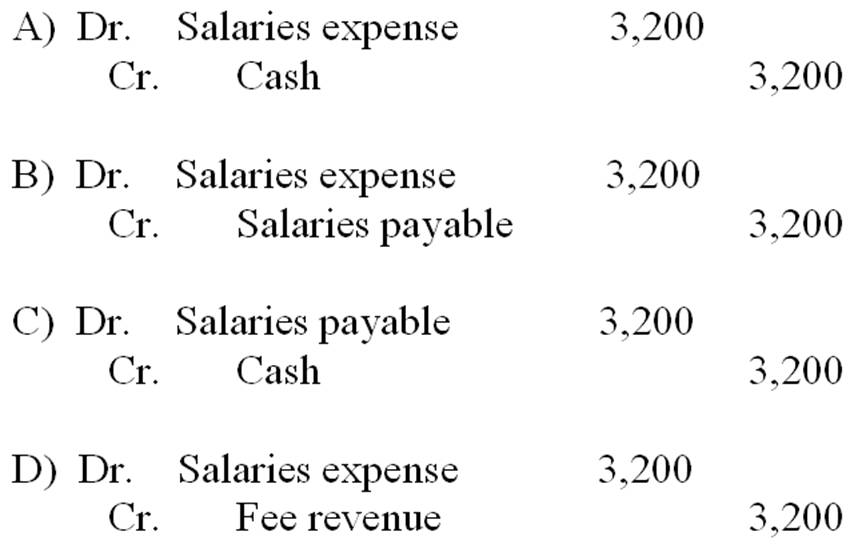

46. To accrue $3,200 of employee salaries for the last week of February, the employer's journal entry is: Select one: a. Option A b. Option

46. To accrue $3,200 of employee salaries for the last week of February, the employer's journal entry is:

Select one:

a. Option A

b. Option B

c. Option C

d. Option D

20. The balance sheet of an entity:

Select one:

a. reports plant and equipment at its opportunity cost.

b. shows amounts that are not adjusted for changes in the purchasing power of the dollar.

c. shows the fair value of the assets at the date of the balance sheet.

d. reflects the impact of inflation on the replacement cost of the assets.

10. At the beginning of the year, paid-in capital was $82 and retained earnings was $47. During the year, the stockholders invested $24 and dividends of $6 were declared and paid. Retained earnings at the end of the year were $52. Net income for the year was:

Select one:

a. $15

b. $10

c. $11

d. $20

11. At the end of the year, retained earnings totaled $1,700. During the year, net income was $250, and dividends of $120 were declared and paid. Retained earnings at the beginning of the year totaled:

Select one:

a. $2,070

b. $1,330

c. $1,570

d. $1,230

17. Retained Earnings represents:

Select one:

a. cash that is available for dividends.

b. the amount invested in the entity by the stockholders.

c. par value of common stock outstanding.

d. cumulative net income that has not been distributed to stockholders as dividends.

33. A newspaper ad submitted and published this week, with the agreement to get paid for it next week would, in the newspaper's records:

Select one:

a. increase assets and increase expenses.

b. increase assets and increase revenues.

c. have no effect on total assets.

d. increase assets and decrease liabilities.

36. In an advertiser's records, a newspaper ad submitted and published this week with the agreement to pay for it next week would:

Select one:

a. decrease assets and decrease expenses.

b. increase assets and decrease liabilities.

c. increase liabilities and increase expenses.

d. decrease assets and increase revenue.

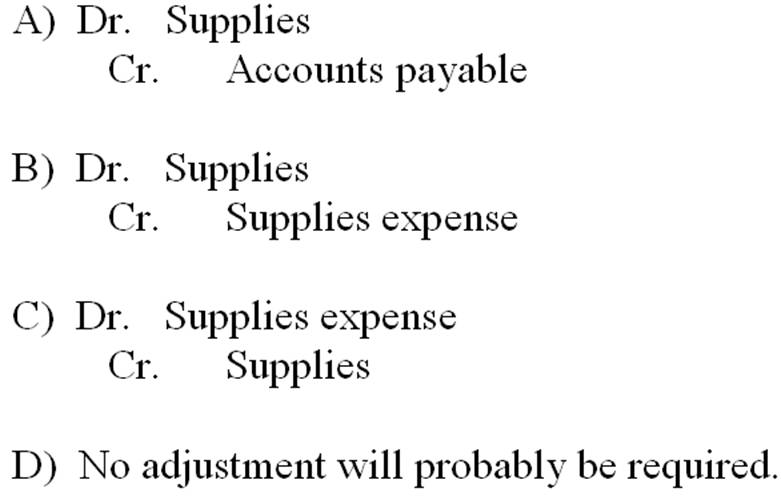

48. When a firm purchases supplies for use in its business, and the cost of the supplies purchased is recorded as an asset, the following adjustment to recognize the cost of supplies used will probably be required:

Select one:

a. Option D

b. Option B

c. Option A

d. Option C

50. Wisdom Co. has a note payable to its bank. An adjustment is likely to be required on Wisdom's books at the end of every month that the loan is outstanding to record the:

Select one:

a. accrued interest expense for the month.

b. amount of total interest to be paid when the note is paid off.

c. amount of interest paid during the month.

d. amount of principal payable at the maturity date of the note

A) Dr. Salaries expense r. Cash B) Dr. Salaries expense Cr. Salaries payable C) Dr. Salaries payable Cash D) Dr. Salaries expense Cr. Fee revenue 3,200 3,200 3,200 3,200 3,200 3,200 3,200 3,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started