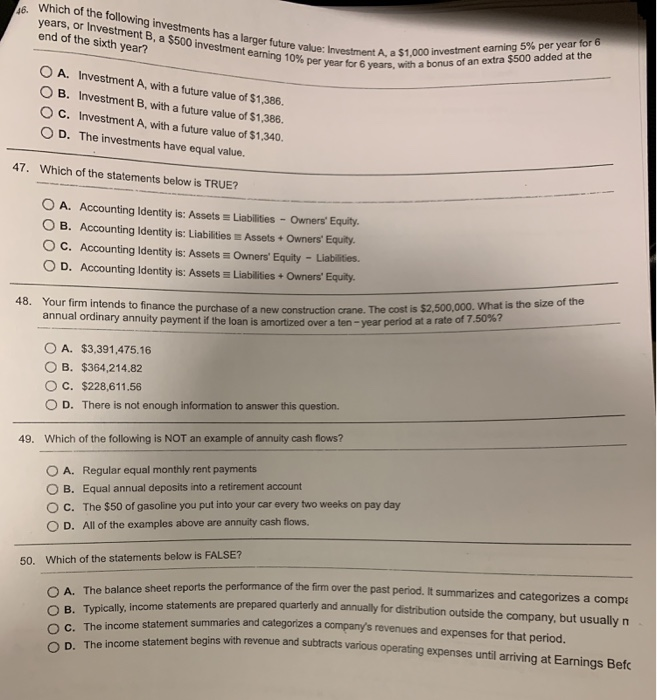

46. Which Which of the following investments has a larger future value: Investm years, or Investment B, a $500 investment earning 10% per year end of the sixth year? vestment A, a $1,000 investment earning 5% per year for 6 er year for 6 years, with a bonus of an extra $500 added at the O A. Investment A, with a future value of $1,386. O B. Investment B, with a future value of $1,386. O C. Investment A, with a future value of $1,340. OD. The investments have equal value. 47. Which of the statements below is TRUE? O O O O A. Accounting Identity is: Assets = Liabilities - Owners' Equity. B . Accounting Identity is: Liabilities Assets Owners' Equity c. Accounting Identity is: Assets Owners' Equity - Liabilities D. Accounting Identity is: Assets Liabilities Owners' Equity 48. Your firm intends to finance the purchase of a new construction crane. The cost is ance the purchase of a new construction. The most is $2.500.000. What is the size of the annual ordinary annuity payment if the loan is amortized over a ten-year period at a rate of O A. $3,391,475.16 OB. $364,214.82 O c. $228,611.56 OD. There is not enough information to answer this question. 49. Which of the following is NOT an example of annuity cash flows? O A. Regular equal monthly rent payments OB. Equal annual deposits into a retirement account OC. The $50 of gasoline you put into your car every two weeks on pay day OD. All of the examples above are annuity cash flows. 50. Which of the statements below is FALSE? A. The balance sheet reports the performance of the firm over the past period orts the performance of the firm over the past period. It summarizes and categorizes a compa me statements are prepared quarterly and annually for distribution outside the company, but usually n O B. Typically, income statements are prepared quarterly and a maries and categorizes a company's revenues and expenses for that period. C. The income statement summaries and categorizes a company's revenue ment begins with revenue and subtracts various operating expenses until arriving at Earnings Befc OD. The income statement begins with revenue and