Answered step by step

Verified Expert Solution

Question

1 Approved Answer

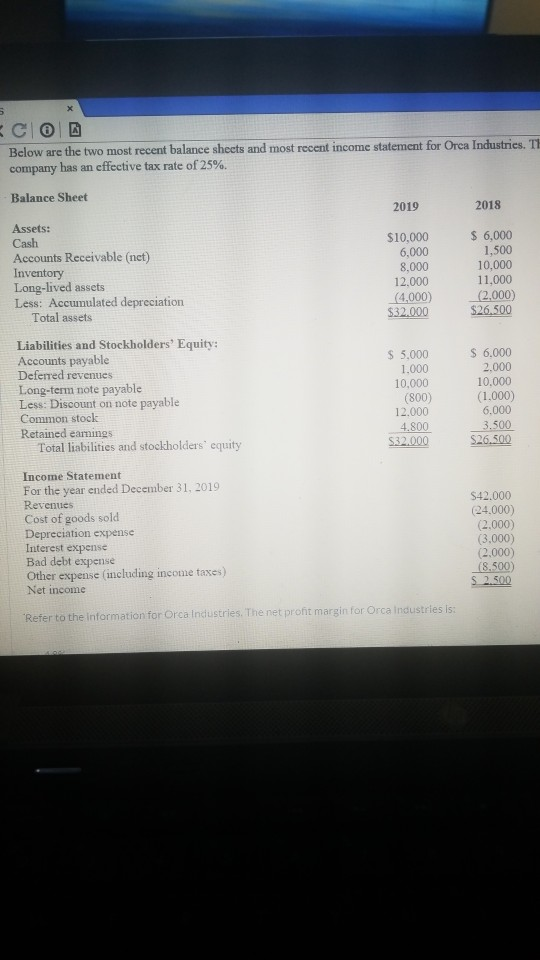

4.8% 7.1% 6.0% 8.3% CO Below are the two most recent balance sheets and most recent income statement for Orca Industries. Ti company has an

4.8% 7.1% 6.0% 8.3%

CO Below are the two most recent balance sheets and most recent income statement for Orca Industries. Ti company has an effective tax rate of 25%. Balance Sheet 2019 2018 Assets: Cash Accounts Receivable (net) Inventory Long-lived assets Less: Accumulated depreciation Total assets $10,000 6,000 8,000 12.000 (4,000) $32.000 $ 6,000 1,500 10,000 11,000 (2.000) $26.500 Liabilities and Stockholders' Equity: Accounts payable Deferred revenues Long-term note payable Less: Discount on note payable Common stock Retained earnings Total liabilities and stockholders' equity $ 5.000 1.000 10.000 (800) 12.000 4.800 S32.000 $ 6.000 2.000 10.000 (1,000) 6.000 3.500 $26.500 Income Statement For the year ended December 31, 2019 Revenues Cost of goods sold Depreciation expense Interest expense Bad debt expense Other expense (including income taxes) Net income S42.000 @4.000) (2.000) (3.000) (2.000) (8.500) $ 2.500 Refer to the information for Orca Industries. The net profit margin for Orca Industries isStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started