Answered step by step

Verified Expert Solution

Question

1 Approved Answer

48. Bonnie and Clyde Corporations have filed consolidated returns for several calendar years. Bonnie acquires land for $75,000 on January 1 of last year. On

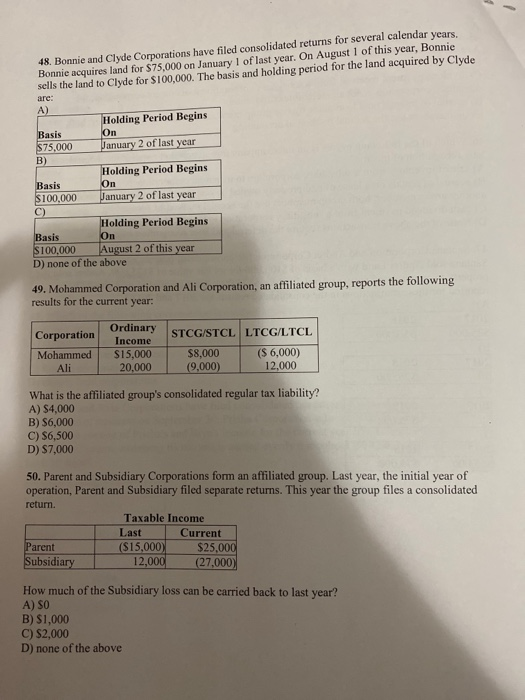

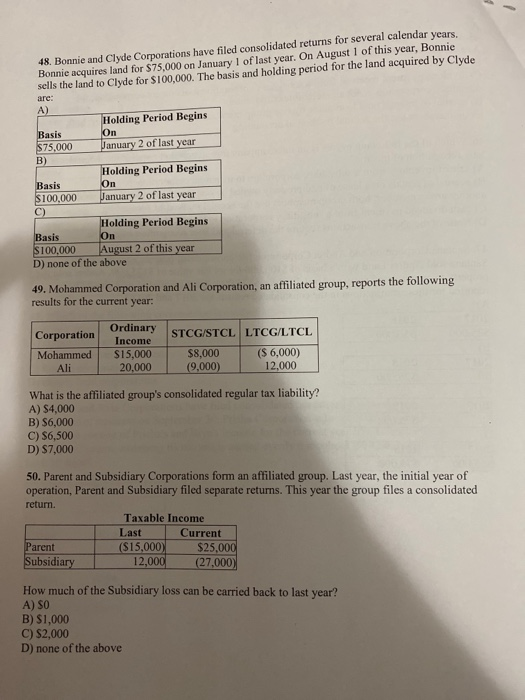

48. Bonnie and Clyde Corporations have filed consolidated returns for several calendar years. Bonnie acquires land for $75,000 on January 1 of last year. On August 1 of this year, Bonnie sells the land to Clyde for $100,000. The basis and holding period for the land acquired by Clyde are: A) Basis $75,000 Holding Period Begins On January 2 of last year B) Basis $100,000 Holding Period Begins On January 2 of last year C) On Holding Period Begins Basis $100,000 August 2 of this year D) none of the above 49. Mohammed Corporation and Ali Corporation, an affiliated group, reports the following results for the current year: Corporation Mohammed Ali Ordinary STCG/STCL LTCG/LTCL Income S15,000 $8,000 ($ 6,000) 20.000 (9,000) 12.000 What is the affiliated group's consolidated regular tax liability? A) $4,000 B) $6,000 C) S6,500 D) $7,000 50. Parent and Subsidiary Corporations form an affiliated group. Last year, the initial year of operation, Parent and Subsidiary filed separate returns. This year the group files a consolidated return. Taxable income Last Current Parent ($15,000) $25,000 Subsidiary 12,000 (27,000) How much of the Subsidiary loss can be carried back to last year? A) SO B) $1,000 C) $2,000 D) none of the above

48. Bonnie and Clyde Corporations have filed consolidated returns for several calendar years. Bonnie acquires land for $75,000 on January 1 of last year. On August 1 of this year, Bonnie sells the land to Clyde for $100,000. The basis and holding period for the land acquired by Clyde are: A) Basis $75,000 Holding Period Begins On January 2 of last year B) Basis $100,000 Holding Period Begins On January 2 of last year C) On Holding Period Begins Basis $100,000 August 2 of this year D) none of the above 49. Mohammed Corporation and Ali Corporation, an affiliated group, reports the following results for the current year: Corporation Mohammed Ali Ordinary STCG/STCL LTCG/LTCL Income S15,000 $8,000 ($ 6,000) 20.000 (9,000) 12.000 What is the affiliated group's consolidated regular tax liability? A) $4,000 B) $6,000 C) S6,500 D) $7,000 50. Parent and Subsidiary Corporations form an affiliated group. Last year, the initial year of operation, Parent and Subsidiary filed separate returns. This year the group files a consolidated return. Taxable income Last Current Parent ($15,000) $25,000 Subsidiary 12,000 (27,000) How much of the Subsidiary loss can be carried back to last year? A) SO B) $1,000 C) $2,000 D) none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started