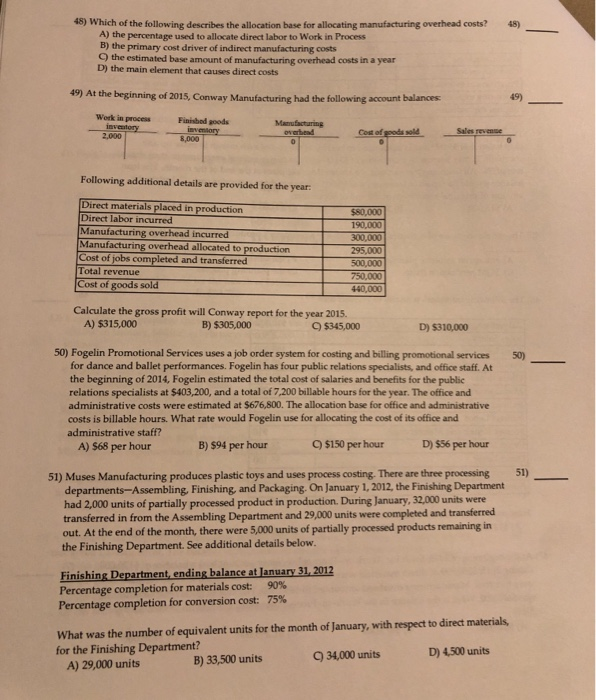

48) Which of the following describes the allocation base for allocating manufacturing overhead costs? 48) A) the percentage used to allocate direct labor to Work in Process B) the primary cost driver of indirect manufacturing costs ) the estimated base amount of manufacturing overhead costs in a year D) the main element that causes direct costs 49) At the beginning of 2015, Conway Manufacturing 49) had the following a account balances Work in process Fininbod goods Manufacturing Cos of goods sold Sales revense 2,000 Following additional details are provided for the year Direct materials placed in production Direct labor incurred Manufacturing $80,000 190,000 300,000 295,000 incurred Cost of jobs completed and transferred Total revenue Cost of goods sold 750,000 440,000 Calculate the gross profit will Conway report for the year 2015. A) $315,000 B) $305,000 $345,000 D) $310,000 50) Fogelin Promotional Services uses a job order system for costing and billing promotional services 50) for dance and ballet performances. Fogelin has four public relations specialists, and office staff. At the beginning of 2014, Fogelin estimated the total cost of salaries and benefits for the public relations specialists at $403,200, and a total of 7,200 billable hours for the year. The office and administrative costs were estimated at $676,800. The allocation base for office and administrative costs is billable hours. What rate would Fogelin use for allocating the cost of its office and administrative staff? C) $150 per hour D)S56 per hour B) $94 per hour A) S68 per hour 51) 51) Muses Manufacturing produces plastic toys and uses process costing. There are three processing departments-Assembling, Finishing, and Packaging. On January 1, 2012, the Finishing Department had 2,000 units of partially processed product in production. During January, 32,000 units were transferred in from the Assembling Department and 29,000 units were completed and transferred out. At the end of the month, there were 5,000 units of partially processed products remaining in the Finishing Department.See additional details below. Finishing Department ending balance at January 31, 2012 Percentage completion for materials cost 90% Percentage completion for conversion cost 75% What was the number of equivalent units for the month of January, with respect to direct materials for the Finishing Department? D) 4,500 units C) 34,000 units B) 33,500 units A) 29,000 units