Answered step by step

Verified Expert Solution

Question

1 Approved Answer

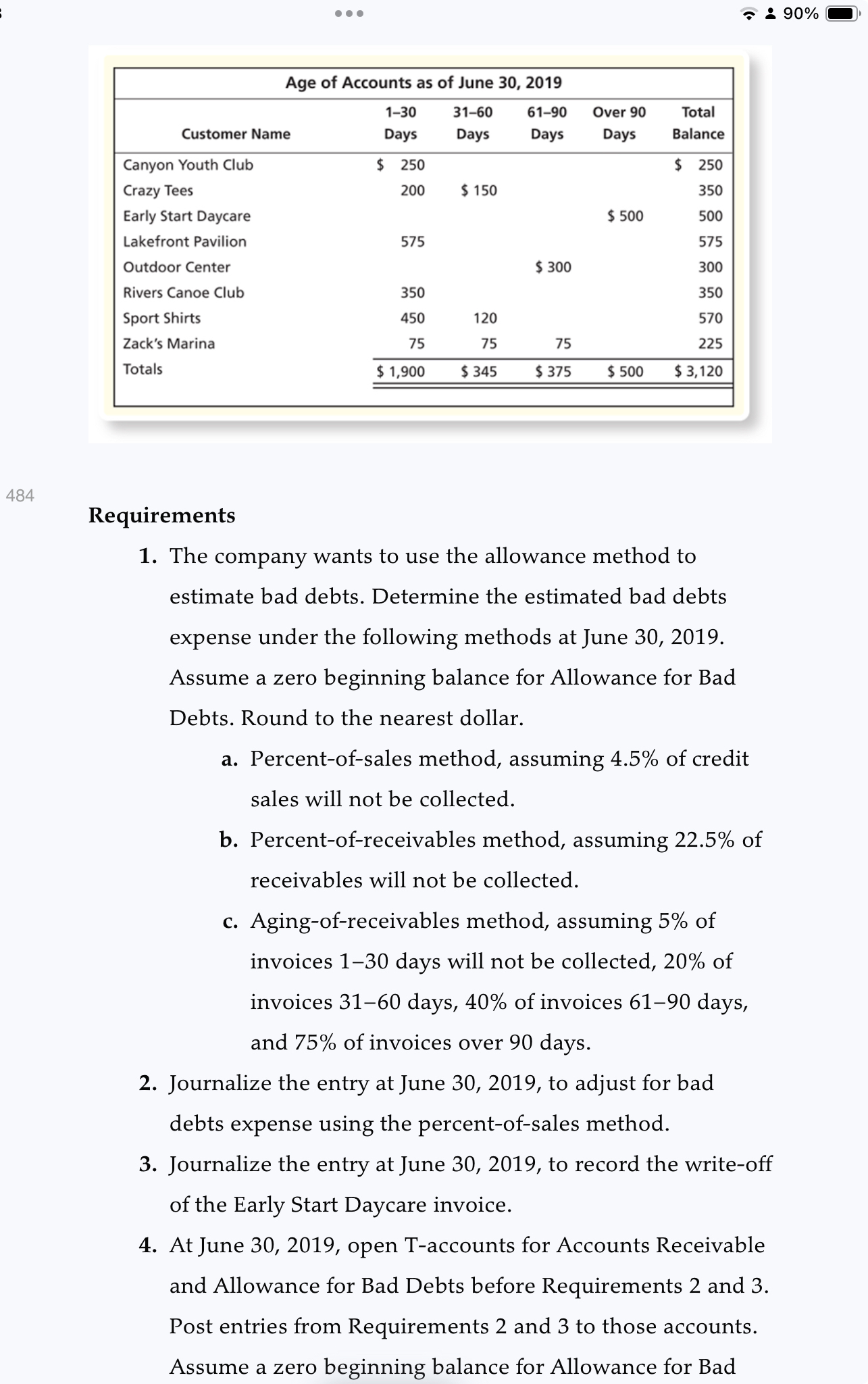

484 ... Age of Accounts as of June 30, 2019 1-30 31-60 61-90 Over 90 Customer Name Days Days Days Days Total Balance Canyon

484 ... Age of Accounts as of June 30, 2019 1-30 31-60 61-90 Over 90 Customer Name Days Days Days Days Total Balance Canyon Youth Club $ 250 $ 250 Crazy Tees 200 $ 150 350 Early Start Daycare $500 500 Lakefront Pavilion Outdoor Center 575 $ 300 575 300 Rivers Canoe Club 350 350 Sport Shirts 450 120 570 Zack's Marina 75 75 75 225 Totals $1,900 $ 345 $375 $ 500 $3,120 : 90% Requirements 1. The company wants to use the allowance method to estimate bad debts. Determine the estimated bad debts expense under the following methods at June 30, 2019. Assume a zero beginning balance for Allowance for Bad Debts. Round to the nearest dollar. a. Percent-of-sales method, assuming 4.5% of credit sales will not be collected. b. Percent-of-receivables method, assuming 22.5% of receivables will not be collected. c. Aging-of-receivables method, assuming 5% of invoices 1-30 days will not be collected, 20% of invoices 31-60 days, 40% of invoices 6190 days, and 75% of invoices over 90 days. 2. Journalize the entry at June 30, 2019, to adjust for bad debts expense using the percent-of-sales method. 3. Journalize the entry at June 30, 2019, to record the write-off of the Early Start Daycare invoice. 4. At June 30, 2019, open T-accounts for Accounts Receivable and Allowance for Bad Debts before Requirements 2 and 3. Post entries from Requirements 2 and 3 to those accounts. Assume a zero beginning balance for Allowance for Bad

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Estimated bad debts expense under different methods a Percentofsalesmethod Total credit sales are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started