Answered step by step

Verified Expert Solution

Question

1 Approved Answer

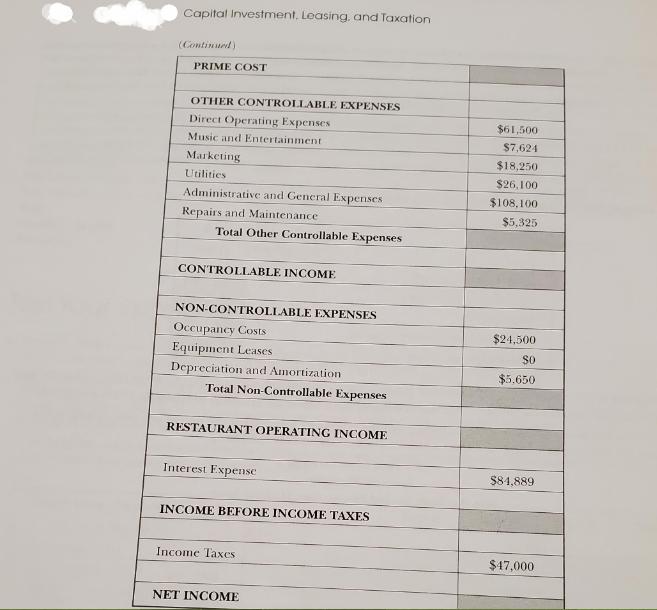

Capital Investment, Leasing, and Taxation (Continued) PRIME COST OTHER CONTROLLABLE EXPENSES Direct Operating Expenses $61,500 Music and Entertainment $7,624 Marketing $18,250 Utilities $26,100 Administrative

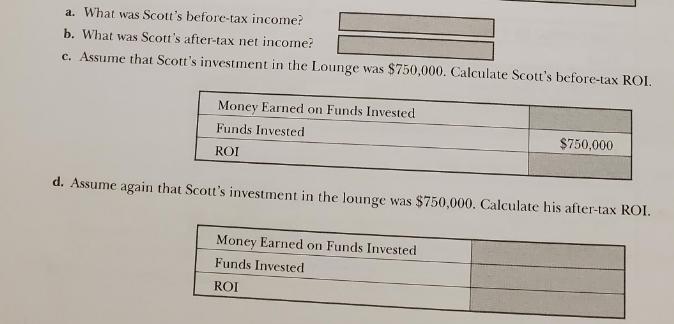

Capital Investment, Leasing, and Taxation (Continued) PRIME COST OTHER CONTROLLABLE EXPENSES Direct Operating Expenses $61,500 Music and Entertainment $7,624 Marketing $18,250 Utilities $26,100 Administrative and General Expenses $108,100 Repairs and Maintenance $5,325 Total Other Controllable Expenses CONTROLLABLE INCOME NON-CONTROLLABLE EXPENSES Occupancy Costs $24,500 Equipment Leases Depreciation and Amortization $5.650 Total Non-Controllable Expenses RESTAURANT OPERATING INCOME Interest Expense $81,889 INCOME BEFORE INCOME TAXES Income Taxes $17,000 NET INCOME a. What was Scott's before-tax income? b. What was Scott's after-tax net income? c. Assume that Scott's investment in the Lounge was $750,000. Calculate Scott's before-tax ROI. Money Earned on Funds Invested Funds Invested $750,000 ROI d. Assume again that Scott's investment in the lounge was $750,000. Calculate his after-tax ROI. Money Earned on Funds Invested Funds Invested ROI

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

In the question no information was provided about Sales Cost of Sales and Labour Let us a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started