Answered step by step

Verified Expert Solution

Question

1 Approved Answer

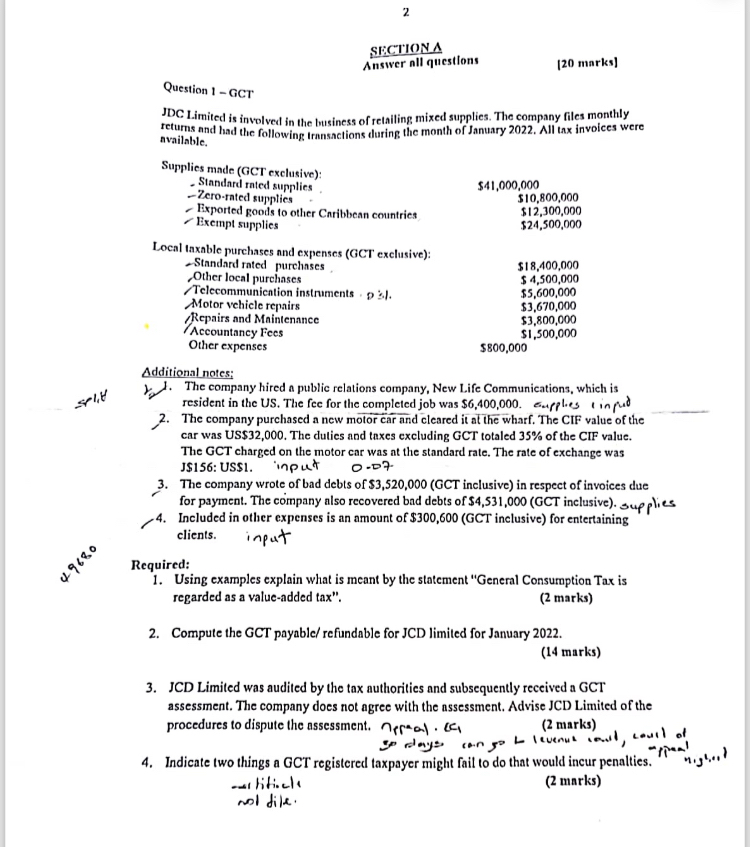

49680 selit 2 Question 1-GCT SECTION A Answer all questions [20 marks] JDC Limited is involved in the business of retailing mixed supplies. The

49680 selit 2 Question 1-GCT SECTION A Answer all questions [20 marks] JDC Limited is involved in the business of retailing mixed supplies. The company files monthly vas and had the following transactions during the month of January 2022. All tax invoices were available. Supplies made (GCT exclusive): Standard rated supplies Zero-rated supplies Exported goods to other Caribbean countries, Exempt supplies Local taxable purchases and expenses (GCT exclusive): Standard rated purchases, Other local purchases Telecommunication instruments pl. Motor vehicle repairs Repairs and Maintenance Accountancy Fees Other expenses $41,000,000 $10,800,000 $12,300,000 $24,500,000 $18,400,000 $4,500,000 $5,600,000 $3,670,000 $3,800,000 $1,500,000 $800,000 Additional notes: The company hired a public relations company, New Life Communications, which is resident in the US. The fee for the completed job was $6,400,000. Supplies inpud The company purchased a new motor car and cleared it at the wharf. The CIF value of the car was US$32,000. The duties and taxes excluding GCT totaled 35% of the CIF value. The GCT charged on the motor car was at the standard rate. The rate of exchange was J$156: US$1. nput 0-07 3. The company wrote of bad debts of $3,520,000 (GCT inclusive) in respect of invoices due for payment. The company also recovered bad debts of $4,531,000 (GCT inclusive). supplies 4. Included in other expenses is an amount of $300,600 (GCT inclusive) for entertaining clients. Required: input 1. Using examples explain what is meant by the statement "General Consumption Tax is regarded as a value-added tax". (2 marks) 2. Compute the GCT payable/ refundable for JCD limited for January 2022. (14 marks) 3. JCD Limited was audited by the tax authorities and subsequently received a GCT assessment. The company does not agree with the assessment. Advise JCD Limited of the procedures to dispute the assessment. al. (C So days (2 marks) can go to levenue court, court of 4. Indicate two things a GCT registered taxpayer might fail to do that would incur penalties. -tificate not dile. (2 marks) "spaal Higher

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started