Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4a this is rhe whole question there is nothing else to ot. Use the commission schedule from Company B shown in the Principal (Value of

4a

this is rhe whole question there is nothing else to ot.

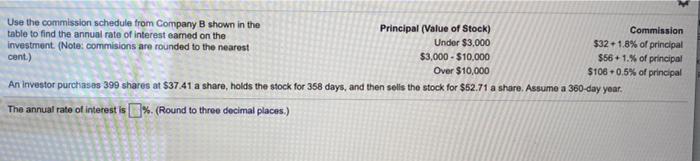

Use the commission schedule from Company B shown in the Principal (Value of Stock) Commission table to find the annual rate of interest eamed on the Under $3,000 $32-1.8% of principal investment. (Note: commisions are rounded to the nearest $3,000 - $10,000 $561.% of principal cent.) Over $10,000 $1060.5% of principal An Investor purchasas 399 shares at $37.41 a share, holds the stock for 358 days, and then sells the stock for $52.71 a share. Assume a 360-day year. The annuat rate of interest is [%. (Round to three decimal places.) Use the commission schedule from Company shown in the Principal (Value of Stock) Commission table to find the annual rate of interest eamed on the Under $3,000 $32.18% of principal Investment. (Note: commisions are rounded to the nearest $3,000 - $10,000 156. 1.5 of principal cent) Over $10,000 3105+0.5% of princip An investor purchases 399 shares of $37 41 a share, holds the stock for 358 days, and then sells the stock for $52.71 a share. Assume a 300-day your The annual rate of inborout is Cl (Round to three decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started