Answered step by step

Verified Expert Solution

Question

1 Approved Answer

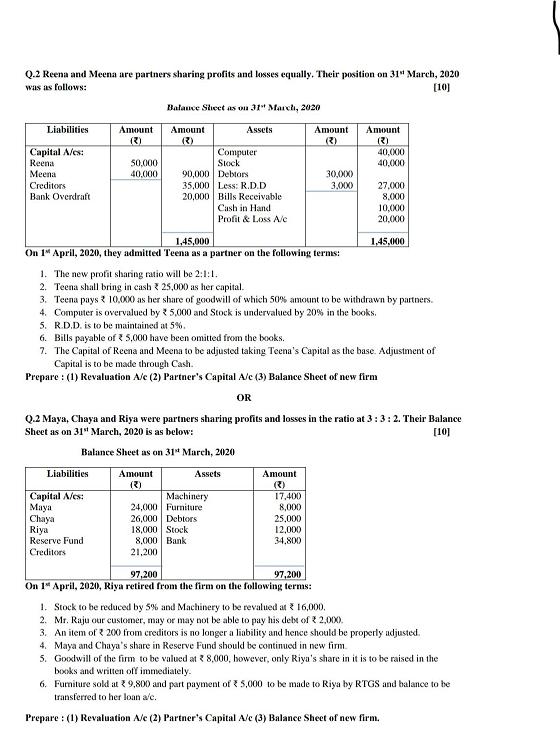

Q.2 Reena and Meena are partners sharing profits and losses equally. Their position on 31 March, 2020 was as follows: [10] Balance Sleet as

Q.2 Reena and Meena are partners sharing profits and losses equally. Their position on 31" March, 2020 was as follows: [10] Balance Sleet as on 31" March, 2020 Amount (3) Liabilities Amount Amount Assets Amount (3) Capital A/es: Reena Computer Stock 40,000 40,000 50,000 Meena 90,000 Debtors 35,000 Less: R.D.D 40,000 30,000 Creditors 3,000 27,000 8,000 20,000 Bills Receivable Cash in Hand Bank Overdraft 10,000 20,000 Profit & Loss A/c 1,45,000 On 1* April, 2020, they admitted Teena as a partner on the following terms: 1,45,000 1. The new profit sharing ratio will be 2:1:1. 2. Teena shall bring in cash ? 25,000 as her capital. 3. Teena pays ? 10,000 as her share of goodwill of which 50% amount to be withdrawn by partners. 4. Computer is overvalued by ? 5,000 and Stock is undervalued by 20% in the books. 5. R.D.D. is to be maintained at 5%. 6. Bills payable of 5,000 have been omitted from the books. 7. The Capital of Reena and Meena to be adjusted taking Teena's Capital as the base. Adjustment of Capital is to be made through Cash. Prepare : (1) Revaluation A/e (2) Partner's Capital A/e (3) Balance Sheet of new firm OR Q.2 Maya, Chaya and Riya were partners sharing profits and losses in the ratio at 3:3:2. Their Balance Sheet as on 31" March, 2020 is as below: [10] Balance Sheet as on 31* March, 2020 Liabilities Amount Assets Amount Capital A/es: Maya Chaya Riya Reserve Fund Machinery 24,000 Furniture 26,000 Debtors 18,000 Stock 8,000 Bank 21,200 17,400 8,000 25,000 12,000 34,800 Creditors 97,200 97,200 On 1* April, 2020, Riya retired from the firm on the following terms: 1. Stock to be reduced by 5% and Machinery to be revalued at { 16,000. 2. Mr. Raju our customer, may or may not be able to pay his debt of 2 2,000. 3. An item of ? 200 from creditors is no longer a liability and hence should be properly adjusted. 4. Maya and Chaya's share in Reserve Fund should be continued in new firm. 5. Goodwill of the firm to be valucd at ? 8,000, however, only Riya's share in it is to be raised in the books and written off immediately. 6. Fumiture sold at ?9,800 and part payment of 5,000 to be made to Riya by RTGS and balance to be transferred to her loan a'e. Prepare : (1) Revaluation A/e (2) Partner's Capital Ale (3) Balance Sheet of new firm.

Step by Step Solution

★★★★★

3.50 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started