Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sampson Orange Juice Company normally takes 20 days to pay for its average daily credit purchases of $6,000. Its average daily sales are $7,000,

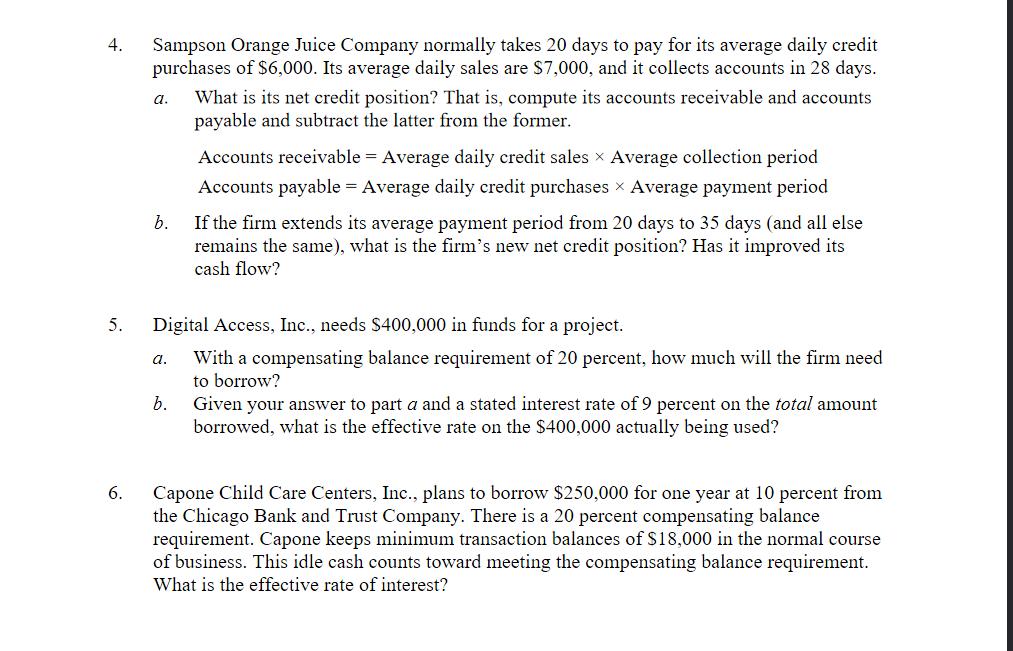

Sampson Orange Juice Company normally takes 20 days to pay for its average daily credit purchases of $6,000. Its average daily sales are $7,000, and it collects accounts in 28 days. 4. What is its net credit position? That is, compute its accounts receivable and accounts payable and subtract the latter from the former. . Accounts receivable = Average daily credit sales x Average collection period Accounts payable = Average daily credit purchases x Average payment period b. If the firm extends its average payment period from 20 days to 35 days (and all else remains the same), what is the firm's new net credit position? Has it improved its cash flow? 5. Digital Access, Inc., needs S400,000 in funds for a project. With a compensating balance requirement of 20 percent, how much will the firm need to borrow? . b. Given your answer to part a and a stated interest rate of 9 percent on the total amount borrowed, what is the effective rate on the $400,000 actually being used? Capone Child Care Centers, Inc., plans to borrow $250,000 for one year at 10 percent from the Chicago Bank and Trust Company. There is a 20 percent compensating balance requirement. Capone keeps minimum transaction balances of S18,000 in the normal course of business. This idle cash counts toward meeting the compensating balance requirement. 6. What is the effective rate of interest?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started