Answered step by step

Verified Expert Solution

Question

1 Approved Answer

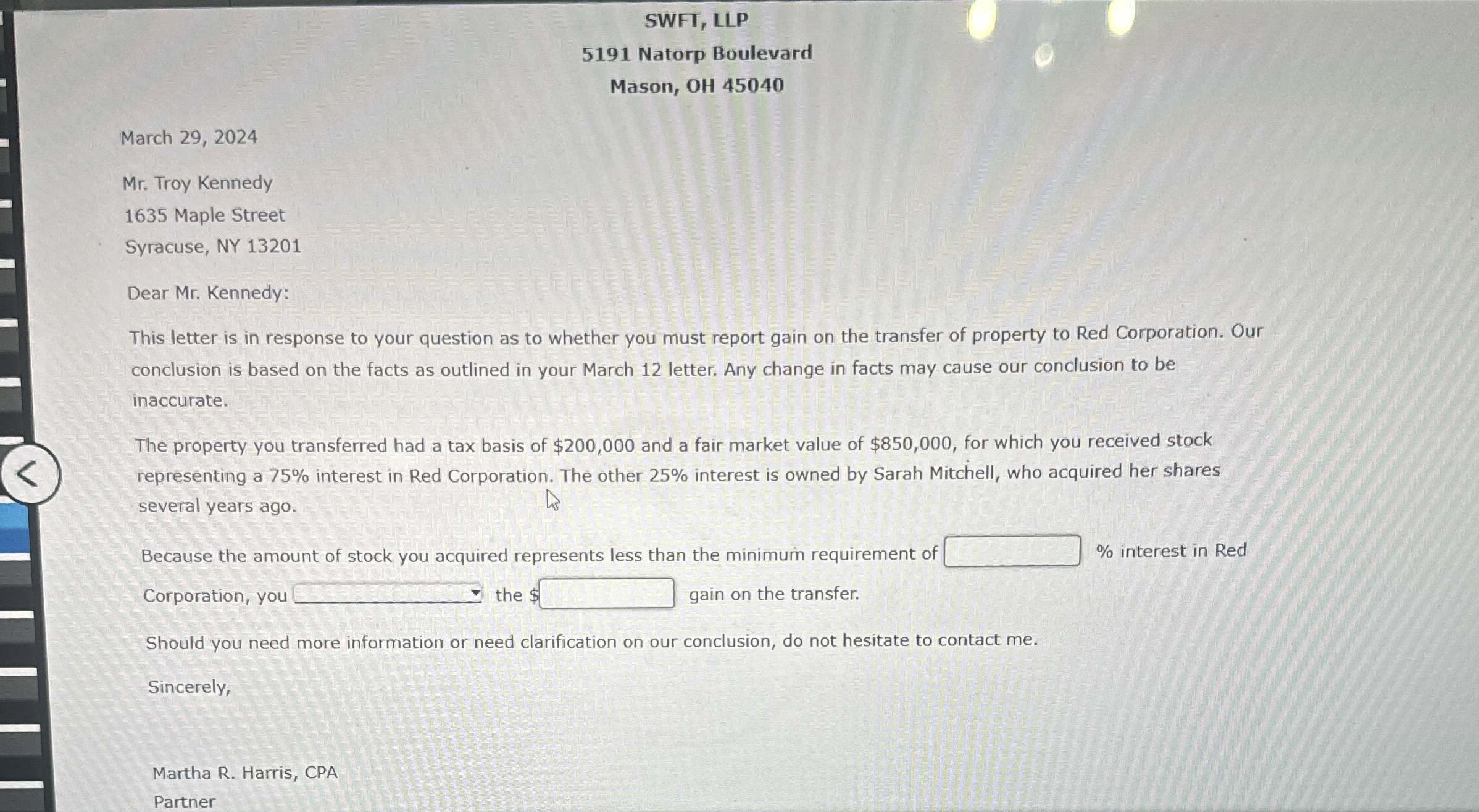

5 1 9 1 Natorp Boulevard Mason, OH 4 5 0 4 0 March 2 9 , 2 0 2 4 Mr . Troy Kennedy

Natorp Boulevard

Mason, OH

March

Mr Troy Kennedy

Maple Street

Syracuse, NY

Dear Mr Kennedy:

This letter is in response to your question as to whether you must report gain on the transfer of property to Red Corporation. Our

conclusion is based on the facts as outlined in your March letter. Any change in facts may cause our conclusion to be

inaccurate.

The property you transferred had a tax basis of $ and a fair market value of $ for which you received stock

representing a interest in Red Corporation. The other interest is owned by Sarah Mitchell, who acquired her shares

several years ago.

Because the amount of stock you acquired represents less than the minimum requirement of

interest in Red

Corporation, you

the :

gain on the transfer.

Should you need more information or need clarification on our conclusion, do not hesitate to contact me

Sincerely,

Martha R Harris, CPA

Partner

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started