Answered step by step

Verified Expert Solution

Question

1 Approved Answer

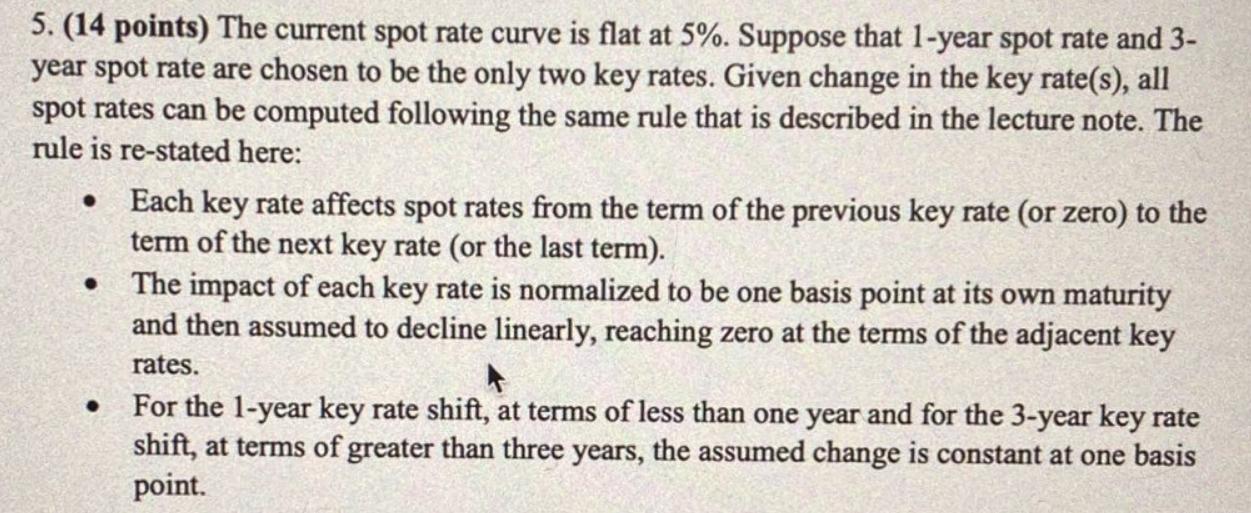

5. (14 points) The current spot rate curve is flat at 5%. Suppose that 1-year spot rate and 3- year spot rate are chosen

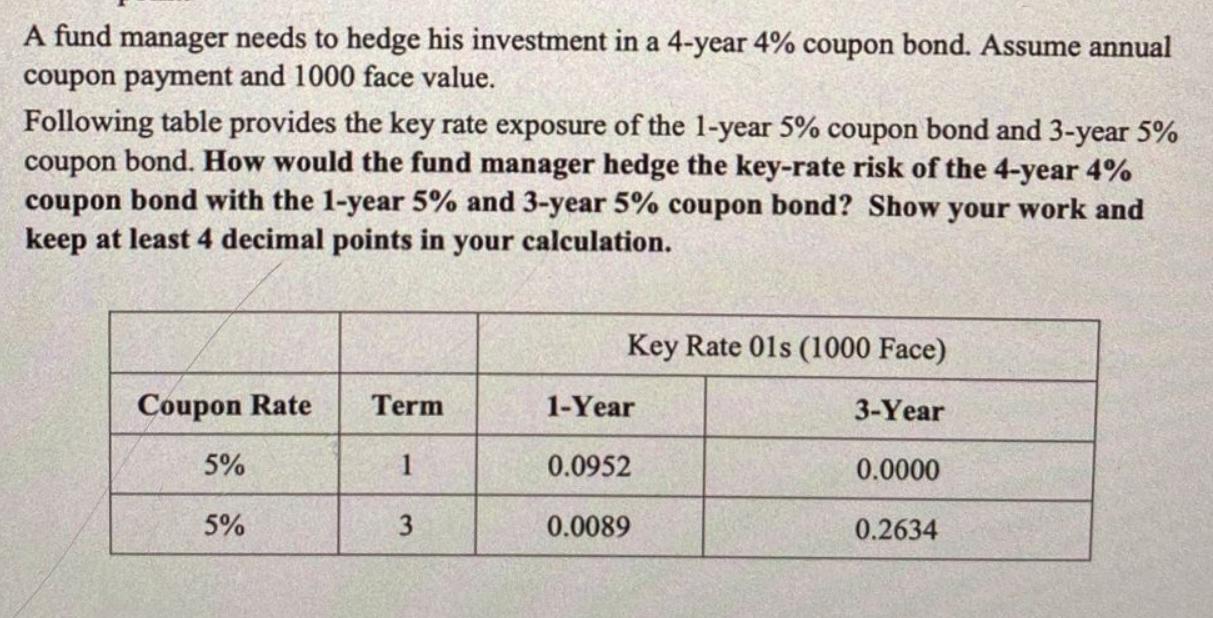

5. (14 points) The current spot rate curve is flat at 5%. Suppose that 1-year spot rate and 3- year spot rate are chosen to be the only two key rates. Given change in the key rate(s), all spot rates can be computed following the same rule that is described in the lecture note. The rule is re-stated here: Each key rate affects spot rates from the term of the previous key rate (or zero) to the term of the next key rate (or the last term). The impact of each key rate is normalized to be one basis point at its own maturity and then assumed to decline linearly, reaching zero at the terms of the adjacent key rates. For the 1-year key rate shift, at terms of less than one year and for the 3-year key rate shift, at terms of greater than three years, the assumed change is constant at one basis point. A fund manager needs to hedge his investment in a 4-year 4% coupon bond. Assume annual coupon payment and 1000 face value. Following table provides the key rate exposure of the 1-year 5% coupon bond and 3-year 5% coupon bond. How would the fund manager hedge the key-rate risk of the 4-year 4% coupon bond with the 1-year 5% and 3-year 5% coupon bond? Show your work and keep at least 4 decimal points in your calculation. Coupon Rate 5% 5% Term 1 3 Key Rate 01s (1000 Face) 3-Year 0.0000 1-Year 0.0952 0.0089 0.2634

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To hedge the keyrate risk of the 4year 4 coupon bond the fund manager can use a combination of the 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started