Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5 16 Daylight Robotics Corporation, a manufacturer of specialized robotics and automated tools, currently has $6,500,000 in Total Assets. Of that amount, Capital Assets

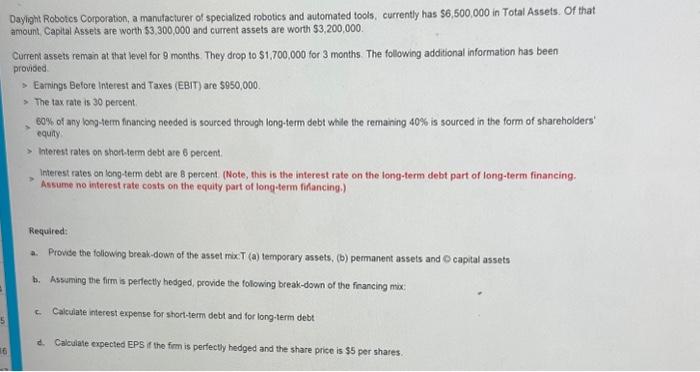

5 16 Daylight Robotics Corporation, a manufacturer of specialized robotics and automated tools, currently has $6,500,000 in Total Assets. Of that amount, Capital Assets are worth $3,300,000 and current assets are worth $3,200,000. Current assets remain at that level for 9 months. They drop to $1,700,000 for 3 months. The following additional information has been provided. > Earnings Before Interest and Taxes (EBIT) are $950,000. > The tax rate is 30 percent. 60% of any long-term financing needed is sourced through long-term debt while the remaining 40% is sourced in the form of shareholders' equity. > Interest rates on short-term debt are 6 percent. > Interest rates on long-term debt are 8 percent. (Note, this is the interest rate on the long-term debt part of long-term financing. Assume no interest rate costs on the equity part of long-term financing.) Required: Provide the following break-down of the asset mix T (a) temporary assets, (b) permanent assets and capital assets b. Assuming the firm is perfectly hedged, provide the following break-down of the financing mix c. Calculate interest expense for short-term debt and for long-term debt d. Calculate expected EPS if the firm is perfectly hedged and the share price is $5 per shares.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Breakdown of the asset mix Total Assets 6500000 Current Assets 3200000 Remains at this level for 9 months then drops to 1700000 for 3 months Capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started