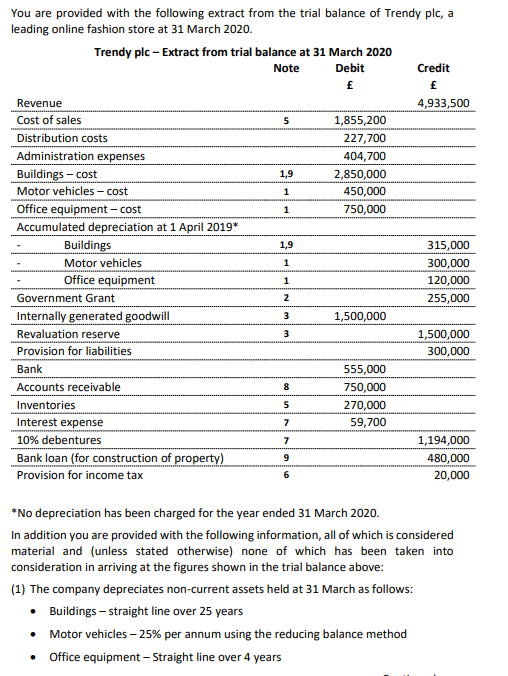

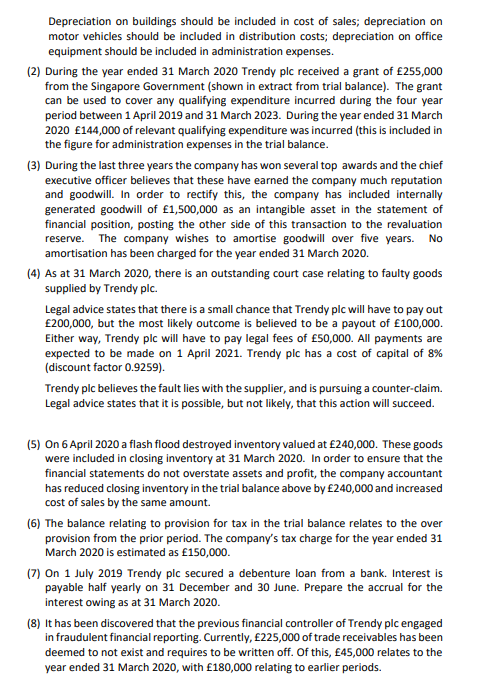

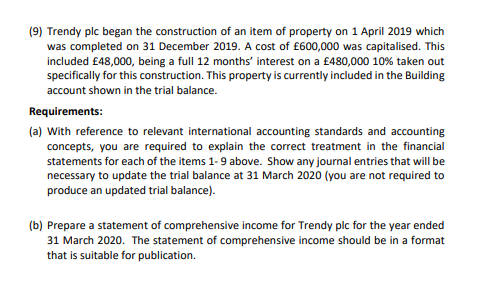

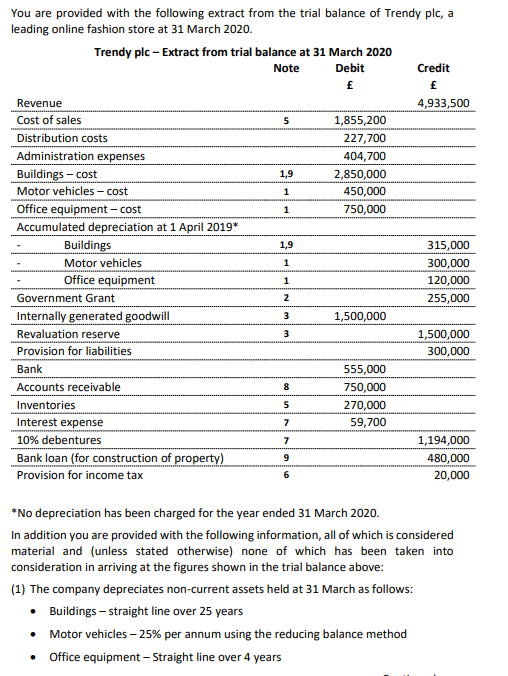

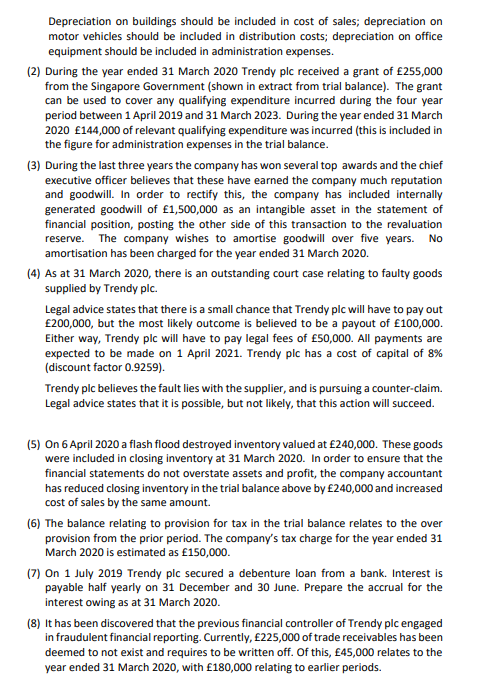

5 1,9 1 1 You are provided with the following extract from the trial balance of Trendy plc, a leading online fashion store at 31 March 2020. Trendy plc - Extract from trial balance at 31 March 2020 Note Debit Credit Revenue 4,933,500 Cost of sales 1,855,200 Distribution costs 227,700 Administration expenses 404,700 Buildings - cost 2,850,000 Motor vehicles - cost 450,000 Office equipment -cost 750,000 Accumulated depreciation at 1 April 2019* Buildings 315,000 Motor vehicles 300,000 Office equipment 120,000 Government Grant 255,000 Internally generated goodwill 1,500,000 Revaluation reserve 1,500,000 Provision for liabilities 300,000 Bank 555,000 Accounts receivable 750,000 Inventories 270,000 Interest expense 59,700 10% debentures 1,194,000 Bank loan (for construction of property) 480,000 Provision for income tax 20,000 1,9 1 1 2 3 3 8 5 7 7 9 6 *No depreciation has been charged for the year ended 31 March 2020. In addition you are provided with the following information, all of which is considered material and (unless stated otherwise) none of which has been taken into consideration in arriving at the figures shown in the trial balance above: (1) The company depreciates non-current assets held at 31 March as follows: Buildings - straight line over 25 years Motor vehicles 25% per annum using the reducing balance method Office equipment - Straight line over 4 years Depreciation on buildings should be included in cost of sales; depreciation on motor vehicles should be included in distribution costs; depreciation on office equipment should be included in administration expenses. (2) During the year ended 31 March 2020 Trendy plc received a grant of 255,000 from the Singapore Government (shown in extract from trial balance). The grant can be used to cover any qualifying expenditure incurred during the four year period between 1 April 2019 and 31 March 2023. During the year ended 31 March 2020 144,000 of relevant qualifying expenditure was incurred (this is included in the figure for administration expenses in the trial balance. (3) During the last three years the company has won several top awards and the chief executive officer believes that these have earned the company much reputation and goodwill. In order to rectify this, the company has included internally generated goodwill of 1,500,000 as an intangible asset in the statement of financial position, posting the other side of this transaction to the revaluation reserve. The company wishes to amortise goodwill over five years. No amortisation has been charged for the year ended 31 March 2020. (4) As at 31 March 2020, there is an outstanding court case relating to faulty goods supplied by Trendy plc Legal advice states that there is a small chance that Trendy plc will have to pay out 200,000, but the most likely outcome is believed to be a payout of 100,000. Either way, Trendy plc will have to pay legal fees of 50,000. All payments are expected to be made on 1 April 2021. Trendy plc has a cost of capital of 8% (discount factor 0.9259). Trendy plc believes the fault lies with the supplier, and is pursuing a counter-claim. Legal advice states that it is possible, but not likely, that this action will succeed. (5) On 6 April 2020 a flash flood destroyed inventory valued at 240,000. These goods were included in closing inventory at 31 March 2020. In order to ensure that the financial statements do not overstate assets and profit, the company accountant has reduced closing inventory in the trial balance above by 240,000 and increased cost of sales by the same amount. (6) The balance relating to provision for tax in the trial balance relates to the over provision from the prior period. The company's tax charge for the year ended 31 March 2020 is estimated as 150,000. (7) On 1 July 2019 Trendy plc secured a debenture loan from a bank. Interest is payable half yearly on 31 December and 30 June. Prepare the accrual for the interest owing as at 31 March 2020. (8) It has been discovered that the previous financial controller of Trendy plc engaged in fraudulent financial reporting. Currently, 225,000 of trade receivables has been deemed to not exist and requires to be written off. Of this, 45,000 relates to the year ended 31 March 2020, with 180,000 relating to earlier periods. (9) Trendy plc began the construction of an item of property on 1 April 2019 which was completed on 31 December 2019. A cost of 600,000 was capitalised. This included 48,000, being a full 12 months' interest on a 480,000 10% taken out specifically for this construction. This property is currently included in the Building account shown in the trial balance. Requirements: (a) With reference to relevant international accounting standards and accounting concepts, you are required to explain the correct treatment in the financial statements for each of the items 1-9 above. Show any journal entries that will be necessary to update the trial balance at 31 March 2020 (you are not required to produce an updated trial balance). (b) Prepare a statement of comprehensive income for Trendy plc for the year ended 31 March 2020. The statement of comprehensive income should be in a format that is suitable for publication