Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. (26 points) EIS, Inc, a U.S.-based multinational, is considering launching a new project line in its subsidiary in Italy. EIS, as the parent

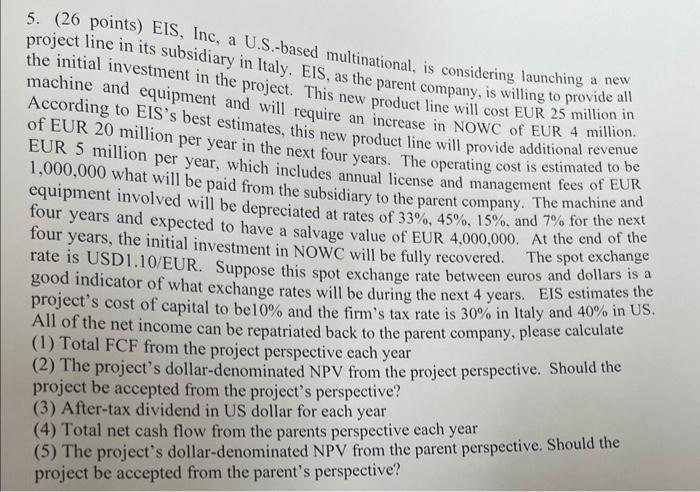

5. (26 points) EIS, Inc, a U.S.-based multinational, is considering launching a new project line in its subsidiary in Italy. EIS, as the parent company, is willing to provide all the initial investment in the project. This new product line will cost EUR 25 million on machine and equipment and will require an increase in NOWC of EUR 4 millione According to EIS's best estimates, this new product line will provide additional revenue of EUR 20 million per year in the next four years. The operating cost is estimated tour EUR 5 million per year, which includes annual license and management fees of EUR 1,000,000 what will be paid from the subsidiary to the parent company. The machine and equipment involved will be depreciated at rates of 33%, 45%, 15%, and 7% for the next four years and expected to have a salvage value of EUR 4,000,000. At the end of the four years, the initial investment in NOWC will be fully recovered. The spot rate is USD1.10/EUR. Suppose this spot exchange rate between euros and dollars is a good indicator of what exchange rates will be during the next 4 years. EIS estimates the project's cost of capital to be 10% and the firm's tax rate is 30% in Italy and 40% in US. All of the net income can be repatriated back to the parent company, please calculate (1) Total FCF from the project perspective each year (2) The project's dollar-denominated NPV from the project perspective. Should the project be accepted from the project's perspective? (3) After-tax dividend in US dollar for each year (4) Total net cash flow from the parents perspective each year (5) The project's dollar-denominated NPV from the parent perspective. Should the project be accepted from the parent's perspective?

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Total FCF from the project perspective each year Year 0 Initial investment in NOWC EUR 4000000 Total cash outflow EUR 4000000 Year 1 Revenue EUR 20000000 Operating cost EUR 5000000 Depreciation EUR ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started