Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. 31 6. 31 7. 31 8. 31 9. 31 10. 31 1. The insurance policy has a one-year term beginning March 1, 2024. At

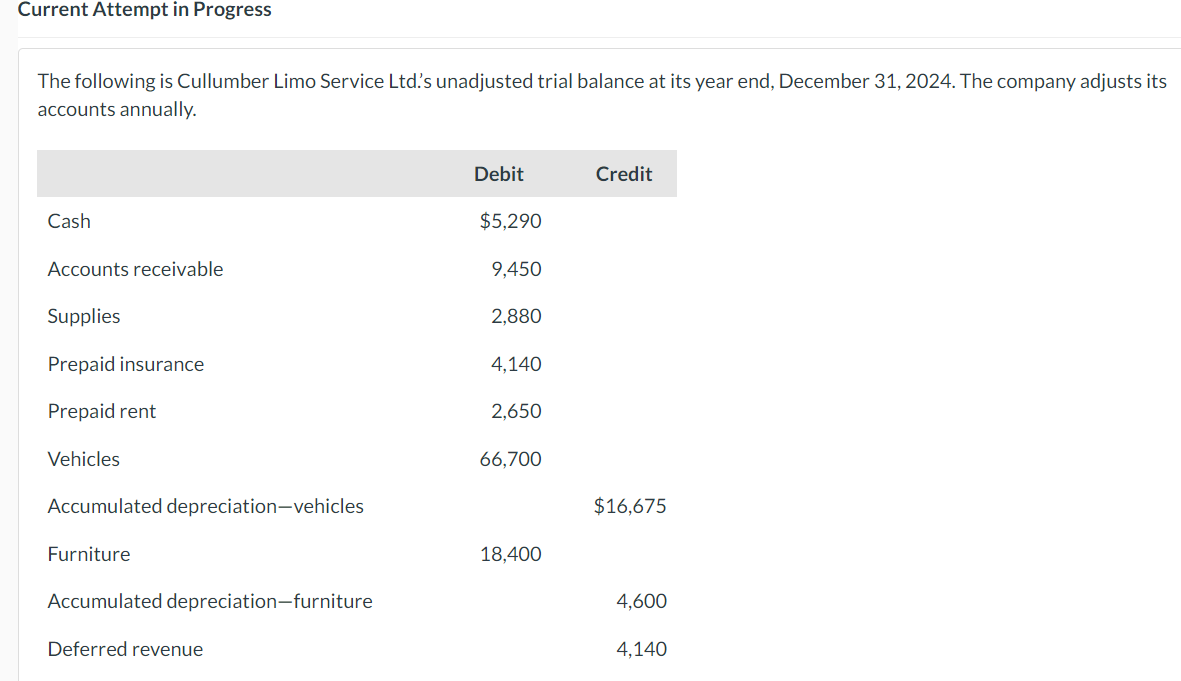

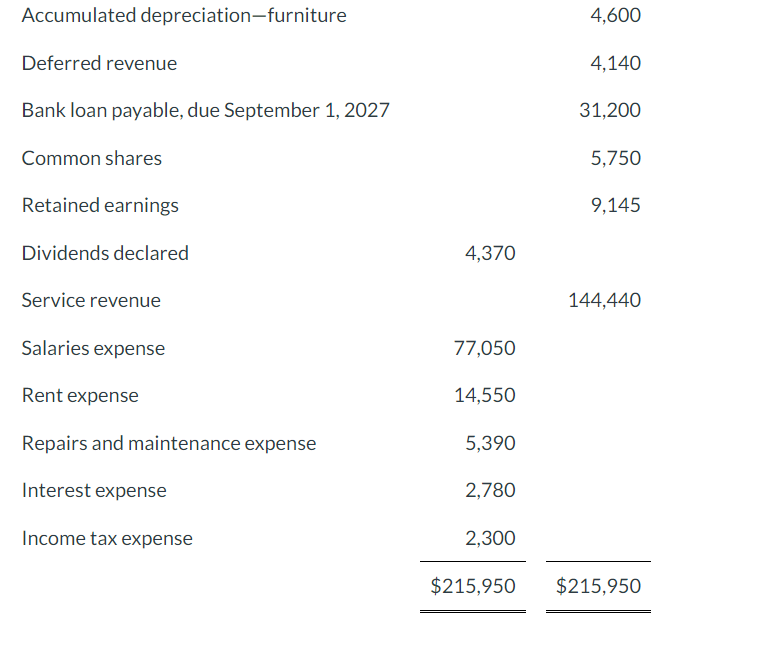

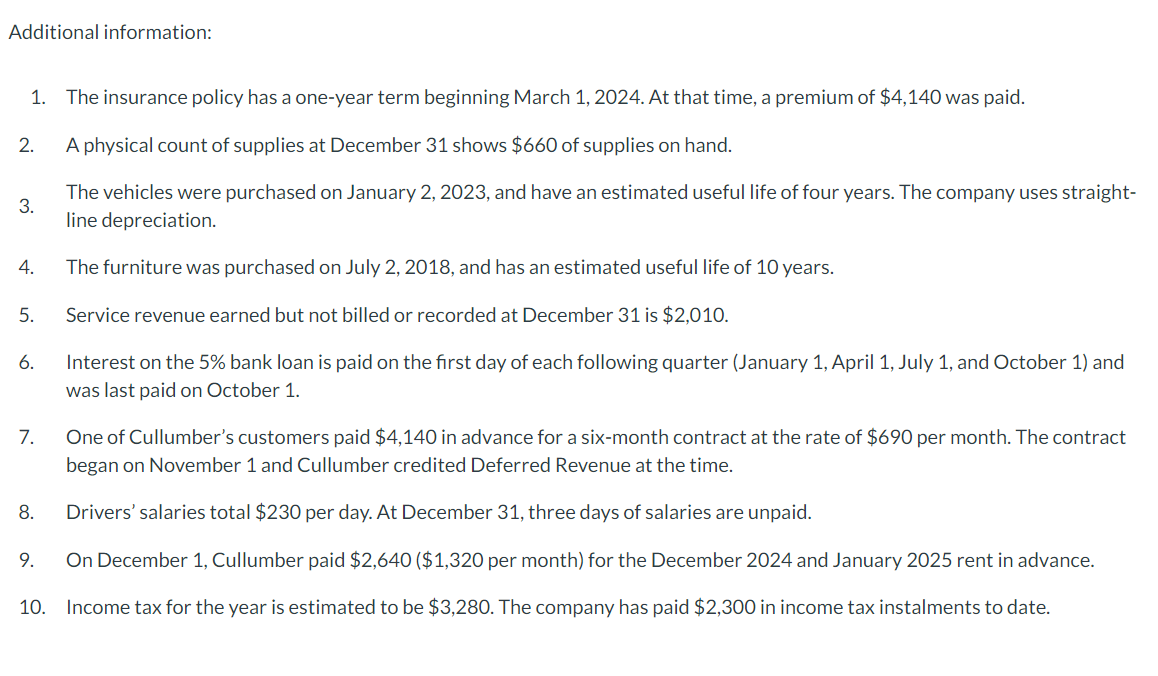

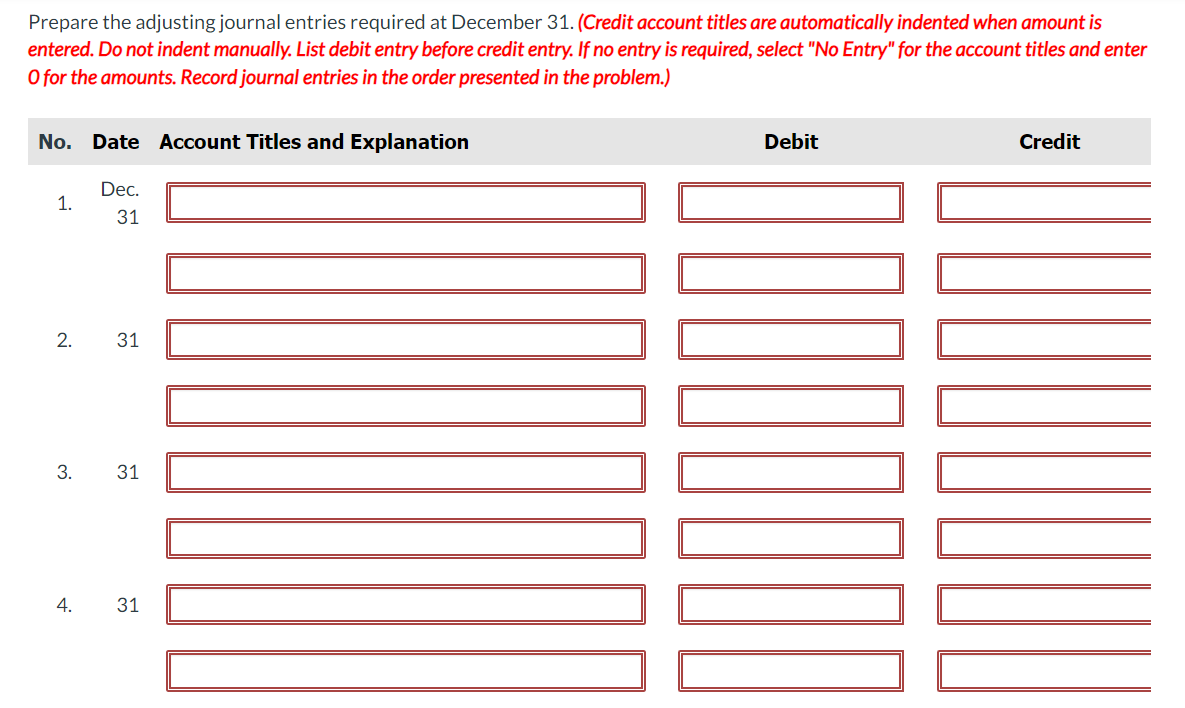

5. 31 6. 31 7. 31 8. 31 9. 31 10. 31 1. The insurance policy has a one-year term beginning March 1, 2024. At that time, a premium of $4,140 was paid. 2. A physical count of supplies at December 31 shows $660 of supplies on hand. 3. The vehicles were purchased on January 2,2023 , and have an estimated useful life of four years. The company uses straightline depreciation. 4. The furniture was purchased on July 2,2018 , and has an estimated useful life of 10 years. 5. Service revenue earned but not billed or recorded at December 31 is $2,010. 6. Interest on the 5% bank loan is paid on the first day of each following quarter (January 1, April 1, July 1, and October 1) and was last paid on October 1. 7. One of Cullumber's customers paid $4,140 in advance for a six-month contract at the rate of $690 per month. The contract began on November 1 and Cullumber credited Deferred Revenue at the time. 8. Drivers' salaries total $230 per day. At December 31, three days of salaries are unpaid. 9. On December 1, Cullumber paid \$2,640 (\$1,320 per month) for the December 2024 and January 2025 rent in advance. 10. Income tax for the year is estimated to be $3,280. The company has paid $2,300 in income tax instalments to date. 8. 31 9. 31 10. 31 Current Attempt in Progress The following is Cullumber Limo Service Ltd.'s unadjusted trial balance at its year end, December 31, 2024. The company adjusts its accounts annually. Prepare the adjusting journal entries required at December 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) \begin{tabular}{llr} Accumulated depreciation-furniture & 4,600 \\ Deferred revenue & 4,140 \\ Bank loan payable, due September 1, 2027 & 31,200 \\ Common shares & & 5,750 \\ Retained earnings & 4,370 & \\ Dividends declared & & \\ Service revenue & 7,145 \\ Salaries expense & 14,050 & \\ Rent expense & 14,550 & \\ Repairs and maintenance expense & 5,390 & \\ Interest expense & 2,780 & \\ Income tax expense & 2,300 & \\ & $215,950 & $215,950 \\ \hline \hline \end{tabular}

5. 31 6. 31 7. 31 8. 31 9. 31 10. 31 1. The insurance policy has a one-year term beginning March 1, 2024. At that time, a premium of $4,140 was paid. 2. A physical count of supplies at December 31 shows $660 of supplies on hand. 3. The vehicles were purchased on January 2,2023 , and have an estimated useful life of four years. The company uses straightline depreciation. 4. The furniture was purchased on July 2,2018 , and has an estimated useful life of 10 years. 5. Service revenue earned but not billed or recorded at December 31 is $2,010. 6. Interest on the 5% bank loan is paid on the first day of each following quarter (January 1, April 1, July 1, and October 1) and was last paid on October 1. 7. One of Cullumber's customers paid $4,140 in advance for a six-month contract at the rate of $690 per month. The contract began on November 1 and Cullumber credited Deferred Revenue at the time. 8. Drivers' salaries total $230 per day. At December 31, three days of salaries are unpaid. 9. On December 1, Cullumber paid \$2,640 (\$1,320 per month) for the December 2024 and January 2025 rent in advance. 10. Income tax for the year is estimated to be $3,280. The company has paid $2,300 in income tax instalments to date. 8. 31 9. 31 10. 31 Current Attempt in Progress The following is Cullumber Limo Service Ltd.'s unadjusted trial balance at its year end, December 31, 2024. The company adjusts its accounts annually. Prepare the adjusting journal entries required at December 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) \begin{tabular}{llr} Accumulated depreciation-furniture & 4,600 \\ Deferred revenue & 4,140 \\ Bank loan payable, due September 1, 2027 & 31,200 \\ Common shares & & 5,750 \\ Retained earnings & 4,370 & \\ Dividends declared & & \\ Service revenue & 7,145 \\ Salaries expense & 14,050 & \\ Rent expense & 14,550 & \\ Repairs and maintenance expense & 5,390 & \\ Interest expense & 2,780 & \\ Income tax expense & 2,300 & \\ & $215,950 & $215,950 \\ \hline \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started