Answered step by step

Verified Expert Solution

Question

1 Approved Answer

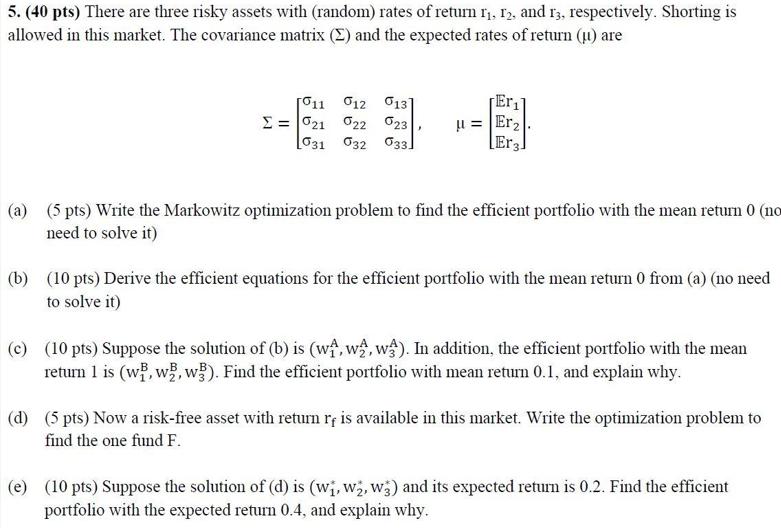

5. (40 pts) There are three risky assets with (random) rates of return 11, 12, and 13, respectively. Shorting is allowed in this market.

5. (40 pts) There are three risky assets with (random) rates of return 11, 12, and 13, respectively. Shorting is allowed in this market. The covariance matrix (2) and the expected rates of return (u) are 011 012 013] =21 22 23 031 032 033 Eri Erz Er (a) (5 pts) Write the Markowitz optimization problem to find the efficient portfolio with the mean return 0 (no need to solve it) (b) (10 pts) Derive the efficient equations for the efficient portfolio with the mean return 0 from (a) (no need to solve it) (c) (10 pts) Suppose the solution of (b) is (w, w, w). In addition, the efficient portfolio with the mean return 1 is (w, w, w). Find the efficient portfolio with mean return 0.1, and explain why. (d) (5 pts) Now a risk-free asset with return rf is available in this market. Write the optimization problem to find the one fund F. (e) (10 pts) Suppose the solution of (d) is (w, w2, w3) and its expected return is 0.2. Find the efficient portfolio with the expected return 0.4, and explain why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started