Question

5. 6. 4. (a) 1. 2. 3. PART B: QUESTION 1 SR Home Decor Enterprise was established in the year 2019 and provide interior consultation

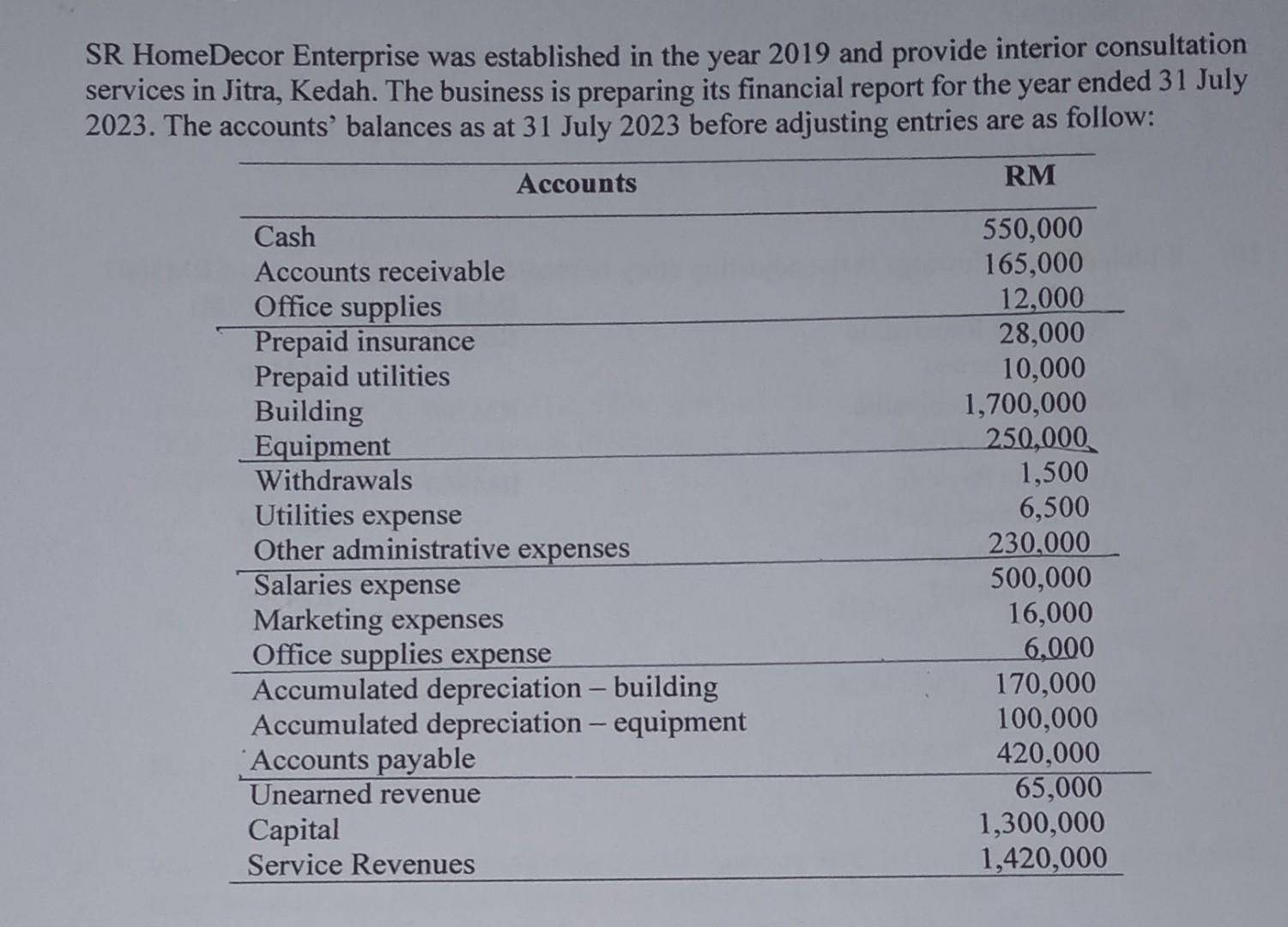

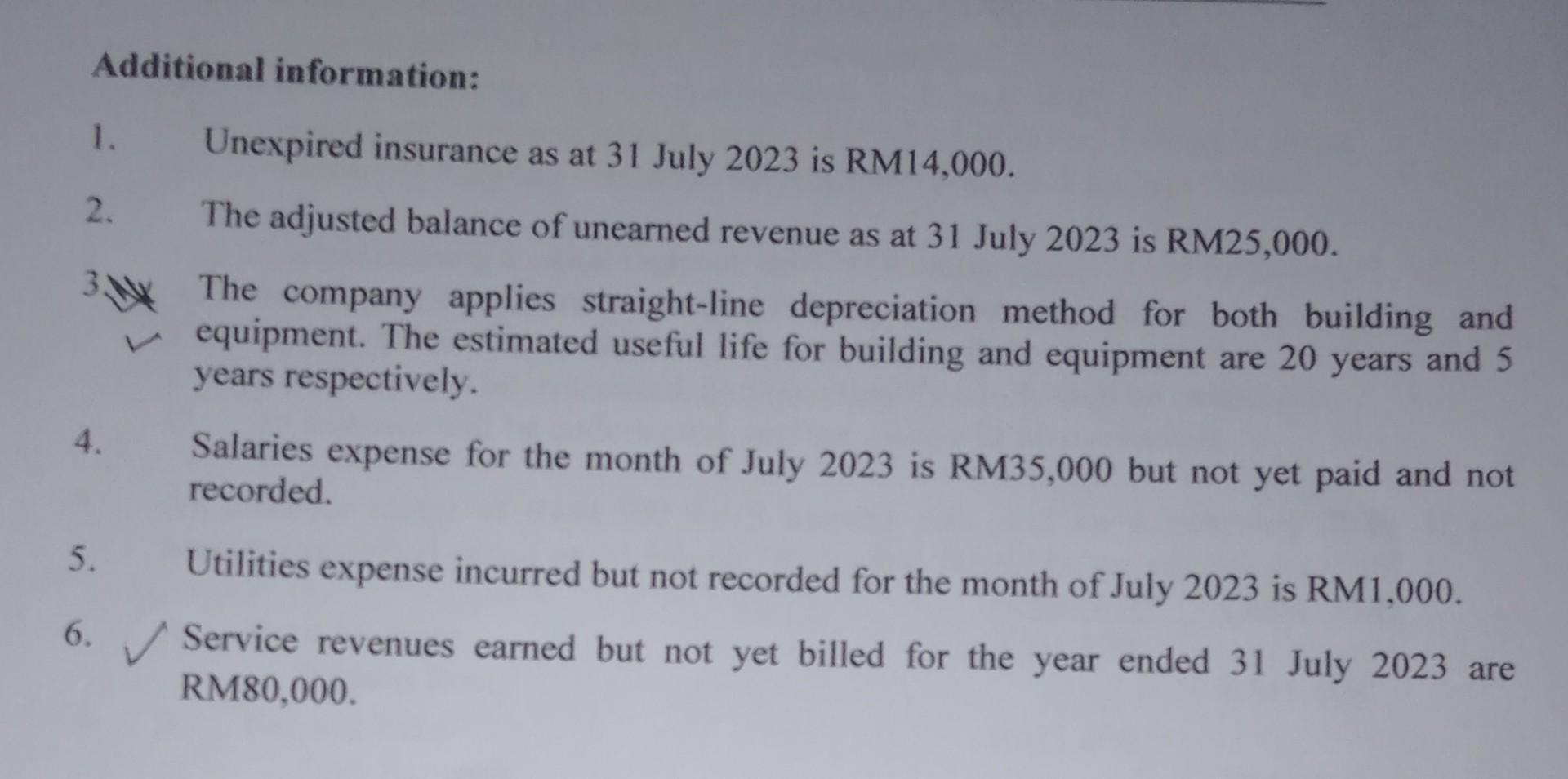

5. 6. 4. (a) 1. 2. 3. PART B: QUESTION 1 SR Home Decor Enterprise was established in the year 2019 and provide interior consultation services in Jitra, Kedah. The business is preparing its financial report for the year ended 31 July 2023. The accounts' balances as at 31 July 2023 before adjusting entries are as follow: Accounts Cash Accounts receivable Office supplies Prepaid insurance Prepaid utilities Building Equipment Withdrawals Additional information: Utilities expense Other administrative expenses Salaries expense Marketing expenses Office supplies expense Accumulated depreciation - building Accumulated depreciation - equipment Accounts payable Unearned revenue REQUIRED: Capital Service Revenues RM 550,000 165,000 12,000 28,000 10,000 1,700,000 250,000 1,500 6,500 230,000 500,000 16,000 6,000 170,000 100,000 420,000 65,000 1,300,000 1,420,000 Unexpired insurance as at 31 July 2023 is RM14,000. The adjusted balance of unearned revenue as at 31 July 2023 is RM25,000. The company applies straight-line depreciation method for both building and equipment. The estimated useful life for building and equipment are 20 years and 5 years respectively. Salaries expense for the month of July 2023 is RM35,000 but not yet paid and not recorded. Utilities expense incurred but not recorded for the month of July 2023 is RM1,000. Service revenues earned but not yet billed for the year ended 31 July 2023 are RM80,000. Prepare the relevant adjusting entries for the year ended 31 July 2023.

SR HomeDecor Enterprise was established in the year 2019 and provide interior consultation services in Jitra, Kedah. The business is preparing its financial report for the year ended 31 July 2023. The accounts' halances as at 21 Iulv 2023 hefore adiusting entries are as follow: Additional information: 1. Unexpired insurance as at 31 July 2023 is RM14,000. 2. The adjusted balance of unearned revenue as at 31 July 2023 is RM25,000. The company applies straight-line depreciation method for both building and equipment. The estimated useful life for building and equipment are 20 years and 5 years respectively. 4. Salaries expense for the month of July 2023 is RM35,000 but not yet paid and not recorded. 5. Utilities expense incurred but not recorded for the month of July 2023 is RM1,000. 6. Service revenues earned but not yet billed for the year ended 31 July 2023 are RM80,000. REQUIRED: (a) Prepare the relevant adjusting entries for the year ended 31 July 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started