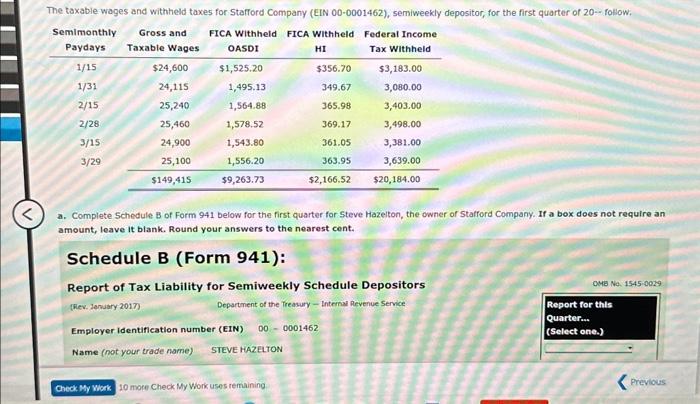

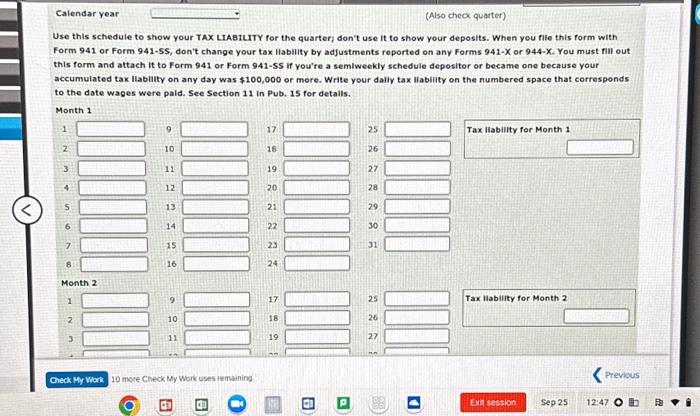

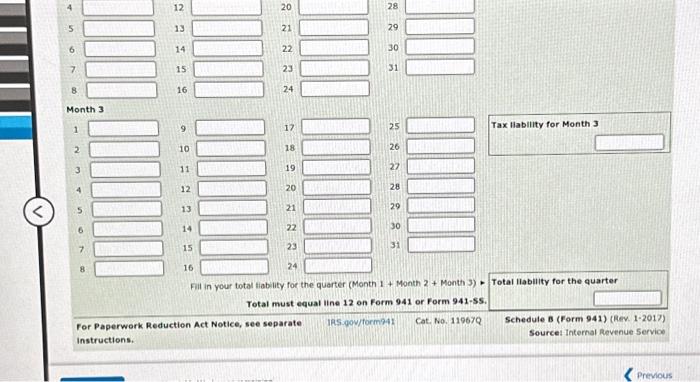

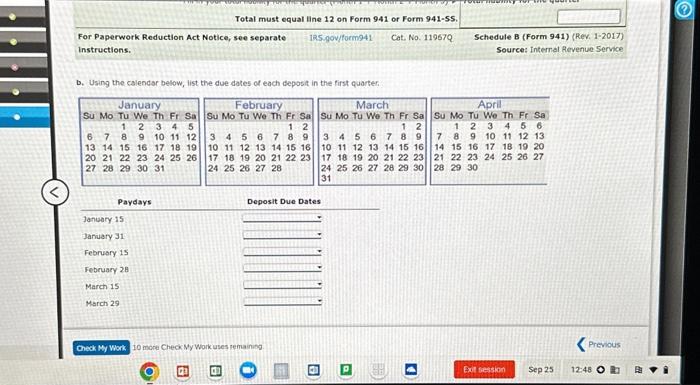

5 6 7. 8 8 Month 3 1 2 3 4 5 6 7 8 12 13 14 15 16 20 21 22. 23 24 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 28 29 30 31 25 Tax llability for Month 3 26 27 28 29 30 31 Fill in your total tiability for the quarter (Month 1+ Month 2+ Month 3) - Total llability for the quarter Total must equal ine 12 on Form 941 or Form 94155. For Paperwork Reduction Act Notice, see separate instructions. Schedule B (Form 941) (hev. 1-2017) Source: Internal Revenue Service Use this schedule to show your TAX LIABrLITY for the quartery don't use it to show your deposits. When you file this form with Form 941 or Form 941 -SS, don't change your tax llability by adjustments reported on any Forms 941X or 944X. You must fill out this form and attach it to Form 941 or Form 941-SS if you're a semiweekly schedule depositor or became one because your accumulated tax llablilty on any day was $100,000 or more. Write your dally tax liability on the numbered space that corresponds to the date wages were pald. See Section 11 in Pub. 15 for detalls. b. Using the calendar below, list the due dates of each deposit in the first quarter. 10 more Cheok Ny Work uses remainusg a. Complete Schedule B of Form 941 below for the first quarter for Steve Hazelton, the owner of Stafford Company. If a box does not require an amount, leave it blank. Round your answers to the nearest cent. 10 more Check My Work uses remaining 5 6 7. 8 8 Month 3 1 2 3 4 5 6 7 8 12 13 14 15 16 20 21 22. 23 24 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 28 29 30 31 25 Tax llability for Month 3 26 27 28 29 30 31 Fill in your total tiability for the quarter (Month 1+ Month 2+ Month 3) - Total llability for the quarter Total must equal ine 12 on Form 941 or Form 94155. For Paperwork Reduction Act Notice, see separate instructions. Schedule B (Form 941) (hev. 1-2017) Source: Internal Revenue Service Use this schedule to show your TAX LIABrLITY for the quartery don't use it to show your deposits. When you file this form with Form 941 or Form 941 -SS, don't change your tax llability by adjustments reported on any Forms 941X or 944X. You must fill out this form and attach it to Form 941 or Form 941-SS if you're a semiweekly schedule depositor or became one because your accumulated tax llablilty on any day was $100,000 or more. Write your dally tax liability on the numbered space that corresponds to the date wages were pald. See Section 11 in Pub. 15 for detalls. b. Using the calendar below, list the due dates of each deposit in the first quarter. 10 more Cheok Ny Work uses remainusg a. Complete Schedule B of Form 941 below for the first quarter for Steve Hazelton, the owner of Stafford Company. If a box does not require an amount, leave it blank. Round your answers to the nearest cent. 10 more Check My Work uses remaining