Answered step by step

Verified Expert Solution

Question

1 Approved Answer

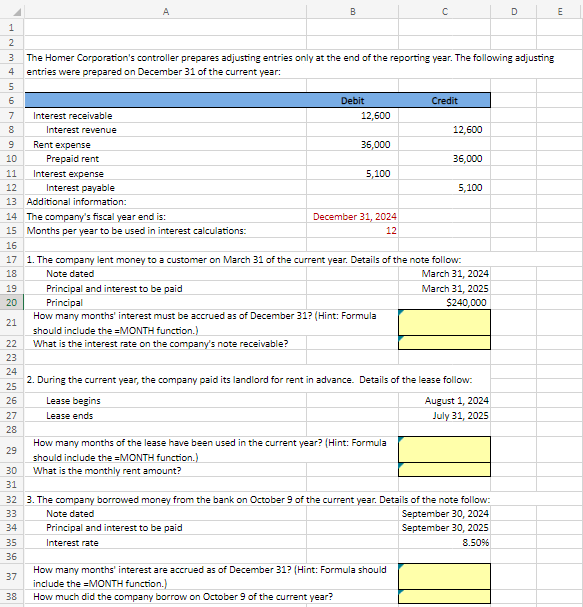

5 6 7 8 9 10 11 12 Interest payable 13 Additional information: 1 2 3 The Homer Corporation's controller prepares adjusting entries only

5 6 7 8 9 10 11 12 Interest payable 13 Additional information: 1 2 3 The Homer Corporation's controller prepares adjusting entries only at the end of the reporting year. The following adjusting 4 entries were prepared on December 31 of the current year: Interest receivable Interest revenue 27 28 Rent expense 14 The company's fiscal year end is: 15 Months per year to be used in interest calculations: 16 29 30 31 Prepaid rent Interest expense A 35 36 37 38 B should include the =MONTH function.) What is the interest rate on the company's note receivable? Lease begins Lease ends Debit 12,600 36,000 5,100 Principal and interest to be paid Principal How many months' interest must be accrued as of December 31? (Hint: Formula Principal and interest to be paid Interest rate December 31, 2024 12 17 1. The company lent money to a customer on March 31 of the current year. Details of the note follow: Note dated 18 19 20 21 22 23 24 C How many months of the lease have been used in the current year? (Hint: Formula should include the =MONTH function.) What is the monthly rent amount? 2. During the current year, the company paid its landlord for rent in advance. Details of the lease follow: 25 26 August 1, 2024 July 31, 2025 Credit 12,600 How many months' interest are accrued as of December 31? (Hint: Formula should include the =MONTH function.) How much did the company borrow on October 9 of the current year? 36,000 5,100 32 3. The company borrowed money from the bank on October 9 of the current year. Details of the note follow: 33 Note dated September 30, 2024 34 September 30, 2025 8.50% March 31, 2024 March 31, 2025 $240,000 D E

Step by Step Solution

★★★★★

3.49 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to use the information provided in the question to calculate the vario...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started