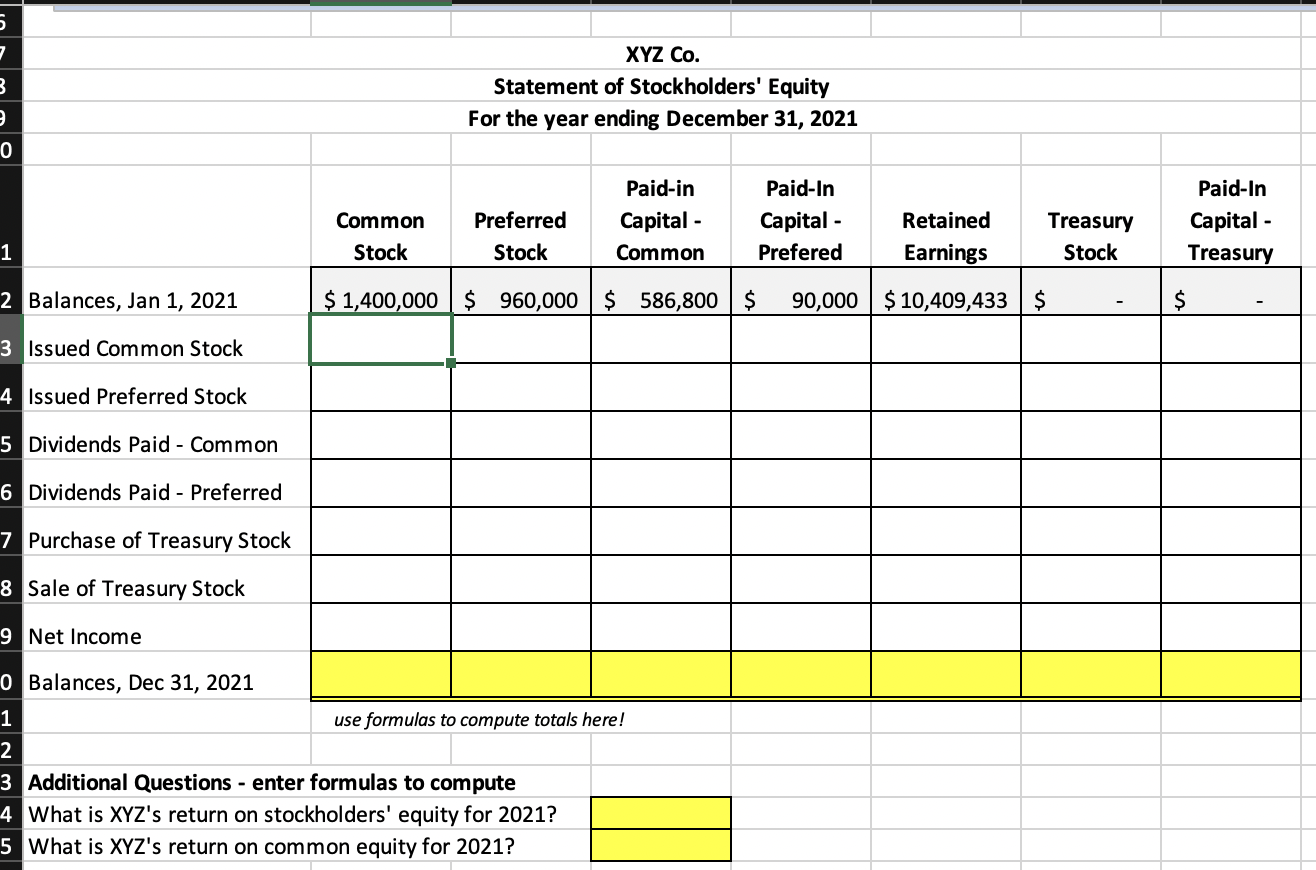

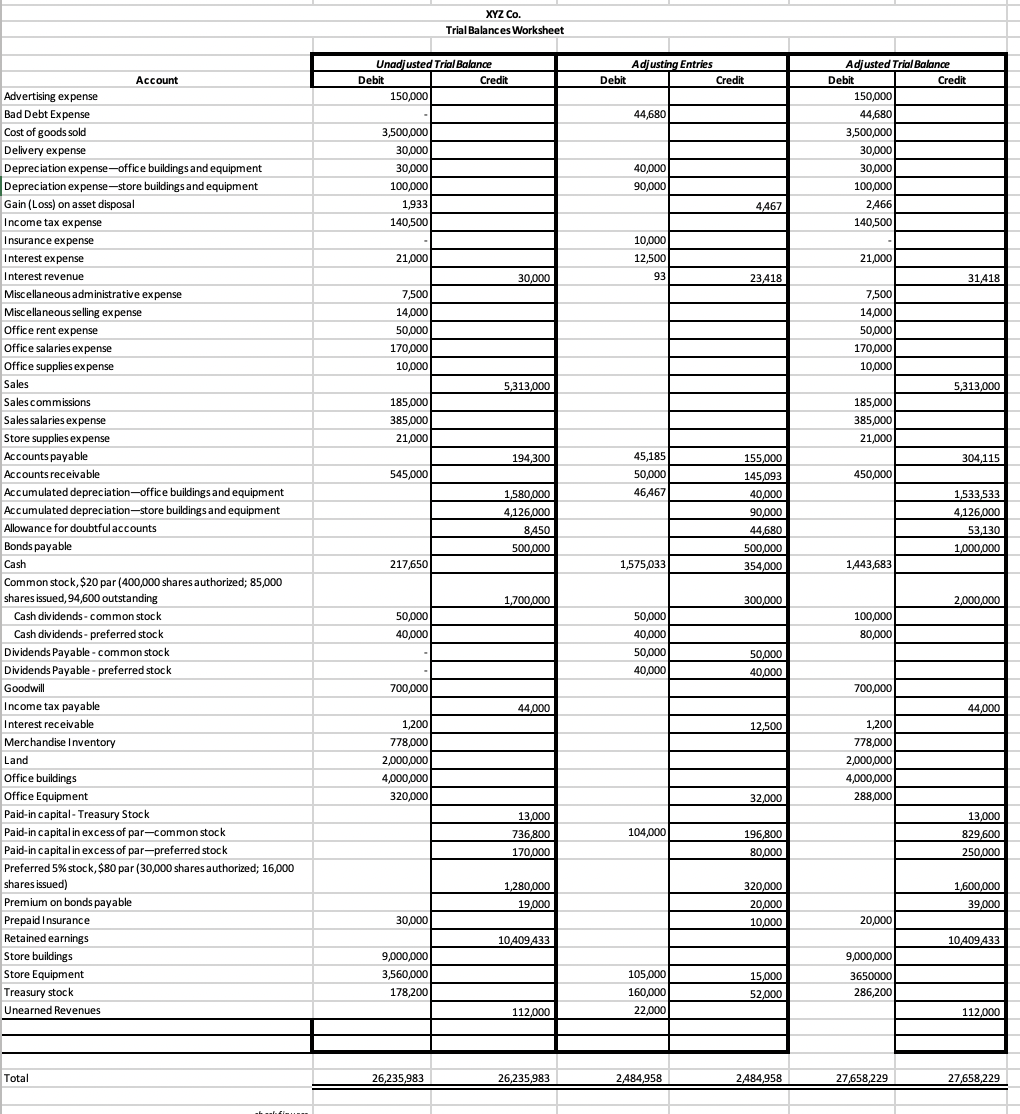

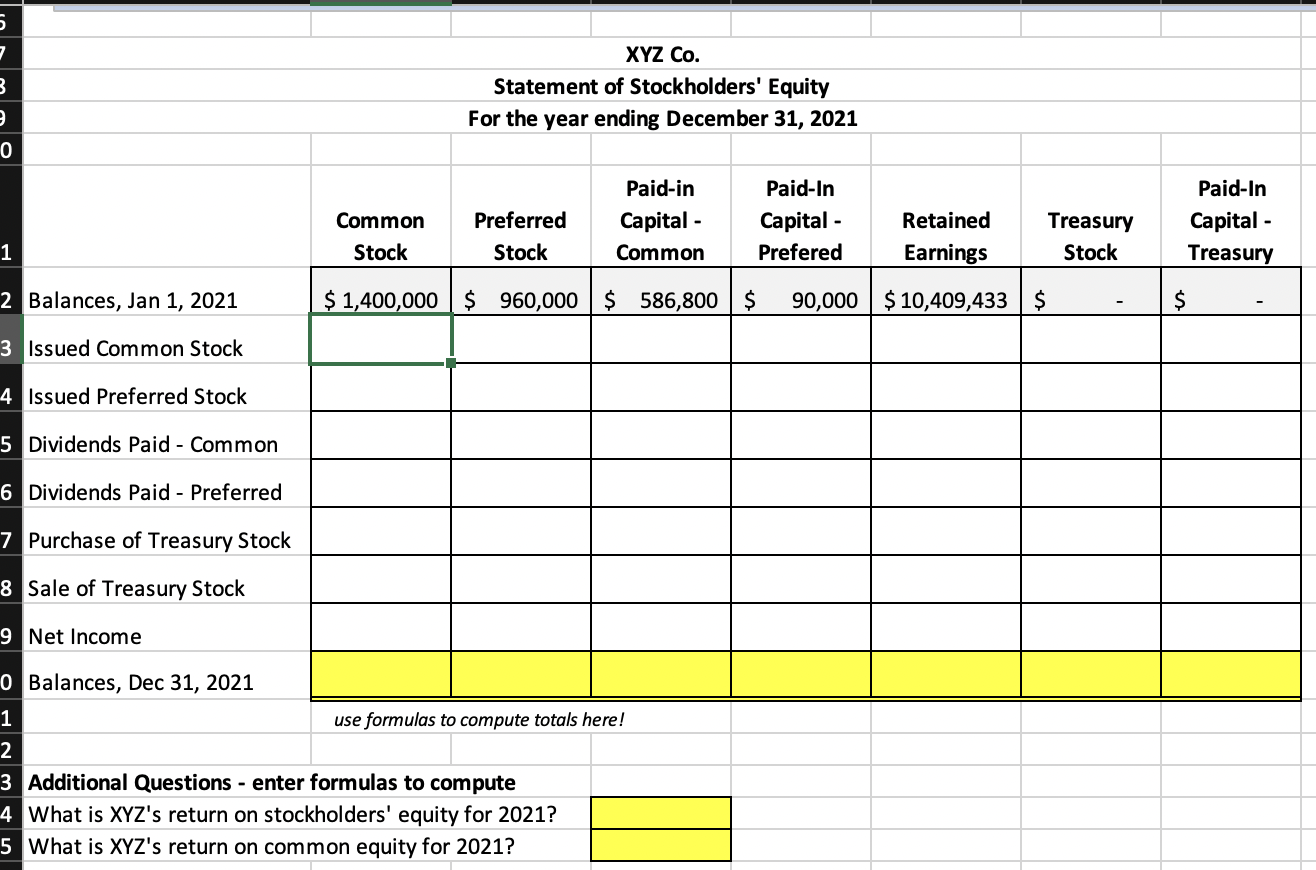

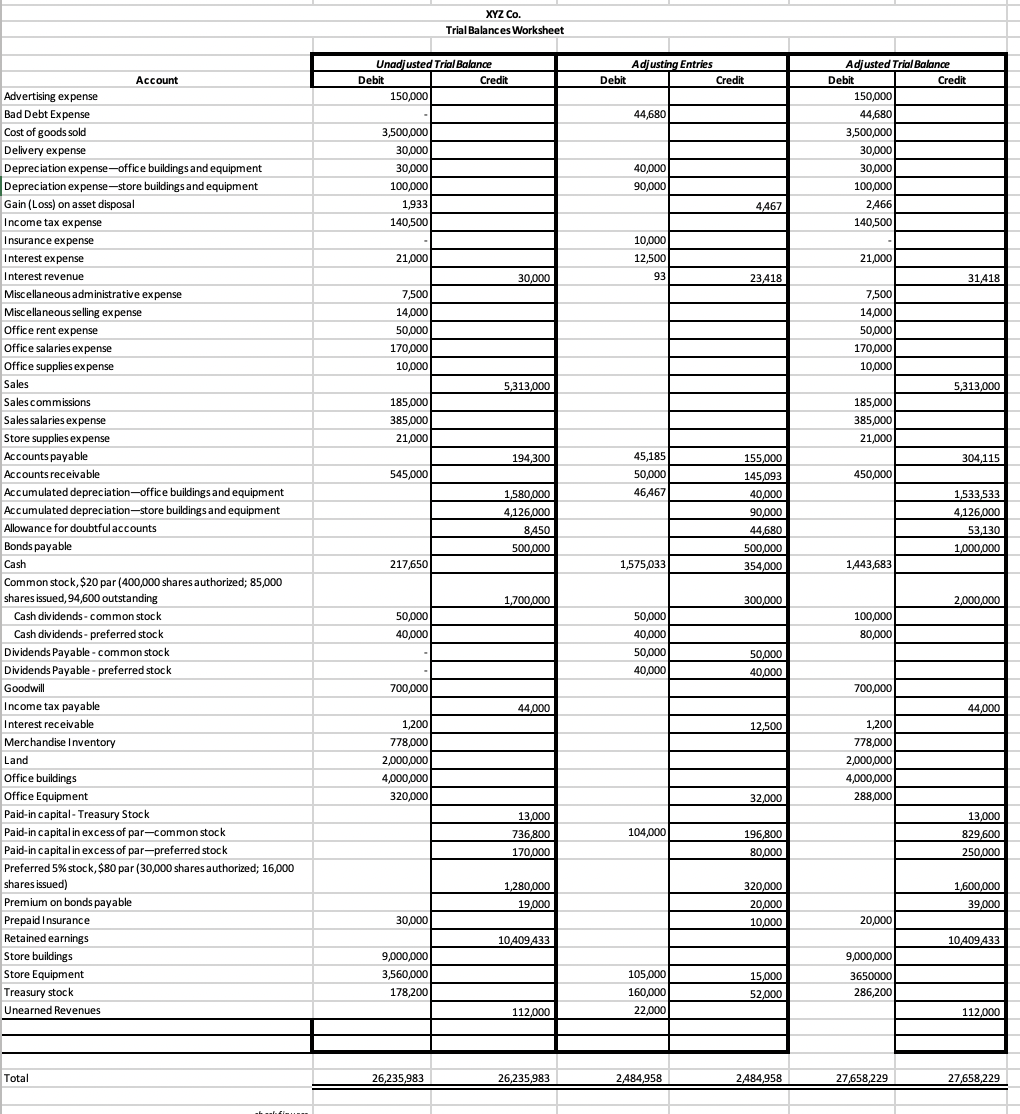

5 7 3 2 XYZ Co. Statement of Stockholders' Equity For the year ending December 31, 2021 0 Common Stock Preferred Stock Paid-in Capital - Common Paid-In Capital - Prefered Retained Earnings Treasury Stock Paid-In Capital - Treasury 1 2 Balances, Jan 1, 2021 $ 1,400,000 $ 960,000 $ 586,800 $ 90,000 $ 10,409,433 $ $ 3 Issued Common Stock 4 Issued Preferred Stock 5 Dividends Paid - Common 6 Dividends Paid - Preferred 7 Purchase of Treasury Stock 8 Sale of Treasury Stock 9 Net Income 0 Balances, Dec 31, 2021 1 use formulas to compute totals here! 2 3 Additional Questions - enter formulas to compute 4 What is XYZ's return on stockholders' equity for 2021? 5 What is XYZ's return on common equity for 2021? XYZ Co. Trial Balances Worksheet Unadjusted Trial Balance Debit Credit 150,000 Adjusting Entries Debit Credit 44,680 3,500,000 30,000 30,000 100,000 1,933 140,500 Adjusted Trial Balance Debit Credit 150,000 44,680 3,500,000 30,000 30,000 100,000 2,466 140,500 40,000 90,000 4,467 21,000 10,000 12,500 93 21,000 30,000 23,418 31,418 7,500 14,000 50,000 170,000 10,000 7,500 14,000 50,000 170,000 10,000 5,313,000 5,313,000 185,000 385,000 21,000 185,000 385,000 21,000 194,300 304,115 545,000 45,185 50,000 46467 450,000 Account Advertising expense Bad Debt Expense Cost of goods sold Delivery expense Depreciation expense-office buildings and equipment Depreciation expense-store buildings and equipment Gain (Loss) on asset disposal Income tax expense Insurance expense Interest expense Interest revenue Miscellaneous administrative expense Miscellaneous selling expense Office rent expense Office salaries expense Office supplies expense Sales Sales commissions Sales salaries expense Store supplies expense Accounts payable Accounts receivable Accumulated depreciation-office buildings and equipment Accumulated depreciation-store buildings and equipment Allowance for doubtful accounts Bonds payable Cash Common stock, $20 par (400,000 shares authorized; 85,000 shares issued, 94,600 outstanding Cash dividends- common stock Cash dividends-preferred stock Dividends Payable - common stock Dividends Payable-preferred stock Goodwill Income tax payable Interest receivable Merchandise Inventory Land Office buildings Office Equipment Paid-in capital - Treasury Stock Paid-in capital in excess of par-common stock Paid-in capital in excess of par-preferred stock Preferred 5% stock, $80 par (30,000 shares authorized; 16,000 shares issued) Premium on bonds payable Prepaid Insurance Retained earnings Store buildings Store Equipment Treasury stock Unearned Revenues 1,580,000 4,126,000 8,450 500,000 155,000 145,093 40,000 90,000 44,680 500,000 354,000 1,533,533 4,126,000 53,130 1,000,000 217,650 1,575,033 1,443,683 1,700,000 300,000 2,000,000 50,000 50,000 100,000 80,000 40,000 40,000 50,000 50,000 40,000 40,000 700,000 700,000 44,000 44,000 12,500 1,200 778,000 2,000,000 4,000,000 320,000 1,200 778,000 2,000,000 4,000,000 288,000 32,000 13,000 736,800 170,000 104,000 196,800 80,000 13,000 829,600 250,000 1,280,000 19,000 320,000 20,000 10,000 1,600,000 39,000 30,000 20,000 10,409,433 10,409,433 9,000,000 9,000,000 3,560,000 178,200 3650000 105,000 160,000 22,000 15,000 52,000 286,200 112,000 112,000 Total 26,235,983 26,235,983 2,484,958 2,484,958 27,658,229 27,658,229