Answered step by step

Verified Expert Solution

Question

1 Approved Answer

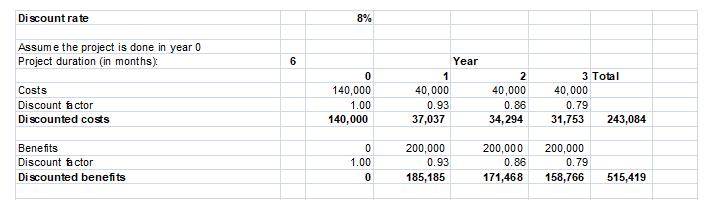

5. A 6-month project has been proposed. The discount rate set by management for this type of project is 8%. See below for the projects

5. A 6-month project has been proposed. The discount rate set by management for this type of project is 8%. See below for the project’s financial analysis, then answer the questions that follow:

a. What is the project’s net present value (NPV)?

b. Based only on the project’s NPV, should this project be eligible for further consideration? Why or why not? Explain fully in your own words.

Di scount rate 8% Assume the project is done in year 0 Project duration (in months): Year 2 3 Total Costs 140,000 40,000 40,000 40,000 Discount ctor 1.00 0.93 0.86 0.79 Di scounted costs 140,000 37,037 34,294 31,753 243,084 Benefits 200,000 200,000 0.86 200,000 Discount actor 1.00 0.93 0.79 Di scounted benefits 185,185 171,468 158,766 515,419

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Before performing the calculations corresponding to the NPV it should be clarified that the attached table shows a cash flow in which it is necessary ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started