Answered step by step

Verified Expert Solution

Question

1 Approved Answer

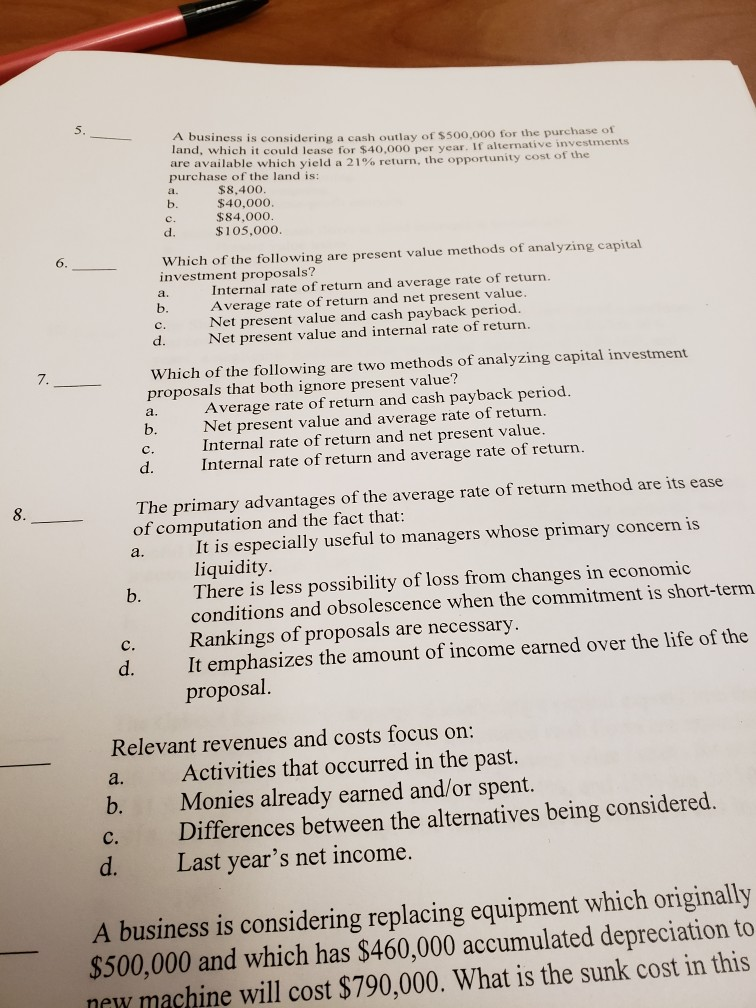

5 A business is considering a cash outlay of s500,000 for the purch Tand, which it could lease for $40,000 per are available ase of

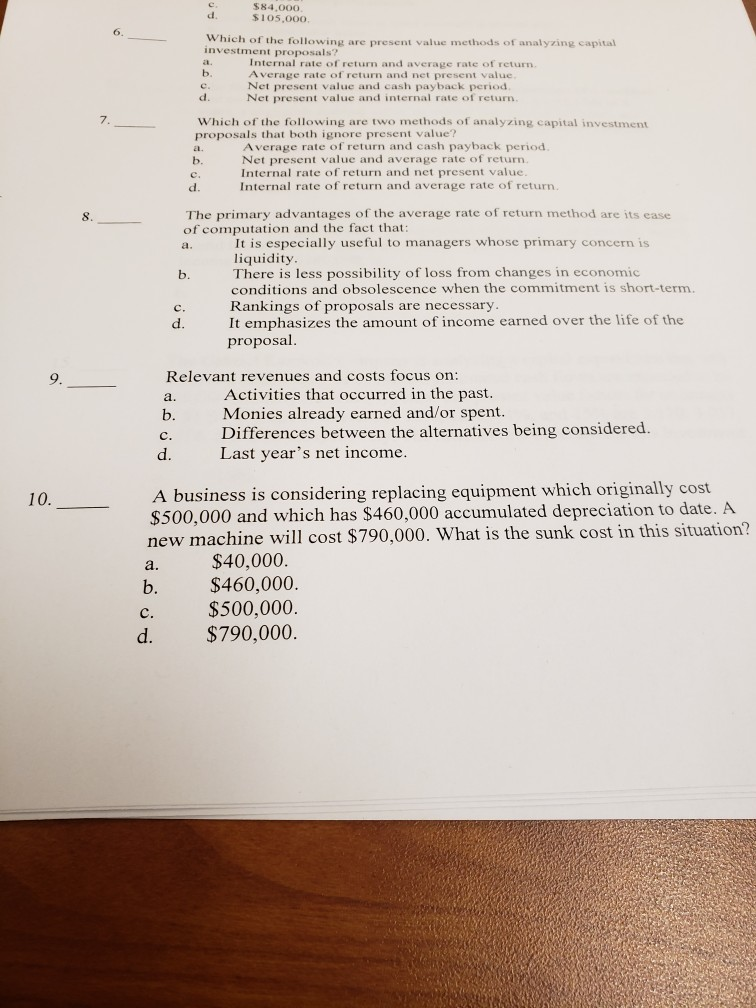

5 A business is considering a cash outlay of s500,000 for the purch Tand, which it could lease for $40,000 per are available ase of year. If alternative investments which yield a 21% return, the opportunity cost of the purchase of the land is: $8.400. $40,000 $84,000. $105,000. d. Which of the following are present value methods of analyzing capital investment proposals? Internal rate of return and average rate of return. Average rate of return and net present value Net present value and cash payback period Net present value and internal rate of return. b. c. d. Which of the following are two methods of analyzing capital investment proposals that both ignore present value? a. Average rate of return and cash payback period. b. Net present value and average rate of return. c. Internal rate of return and net present value. 7. d. Internal rate of return and average rate of return. The primary advantages of the average rate of return method are its ease of computation and the fact that: a. It is especially useful to managers whose primary concern is liquidity There is less possibility of loss from changes in economic conditions and obsolescence when the commitment is short-term Rankings of proposals are necessary It emphasizes the amount of income earned over the life of the proposal b. c. Relevant revenues and costs focus on: a. Activities that occurred in the past. b. Monies already earned and/or spent. c. Differences between the alternatives being considered. d. Last year's net income. A business is considering replacing equipment which originally $500,000 and which has $460,000 accumulated depreciation to new machine will cost $790,000. What is the sunk cost in this $84,000 $105,00O Which of the following are present value methods of analyzing capital investment proposals? Internal rate of return and average rate of return. Average rate of return and net present value Net present value and cash payback period Net present value and internal rate of return Which of the following are two methods of analyzing capital investment proposals that both ignore present value? Average rate of return and cash payback period Net present value and average rate of return. Internal rate of return and net present value Internal rate of return and average rate of return b. The primary advantages of the average rate of return method are its ease of computation and the fact that It is especially useful to managers whose primary concern is liquidity There is less possibility of loss from changes in economic conditions and obsolescence when the commitment is short-term. Rankings of proposals are necessary It emphasizes the amount of income earned over the life of the proposal b. c. d. Relevant revenues and costs focus on Activities that occurred in the past. Monies already earned and/or spent. Differences between the alternatives being considered. Last year's net income. a. b. c. d. A business is considering replacing equipment which originally cost $500,000 and which has $460,000 accumulated depreciation to date. A 10. new machine will cost $790,000. What is the sunk cost in this situation? a. $40,000. b. $460,000. c. $500,000. d. $790,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started