Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. A company does not plan to pay dividends until 3 years from now. The first dividend will be $5 (i.e. D3=$5). After that,

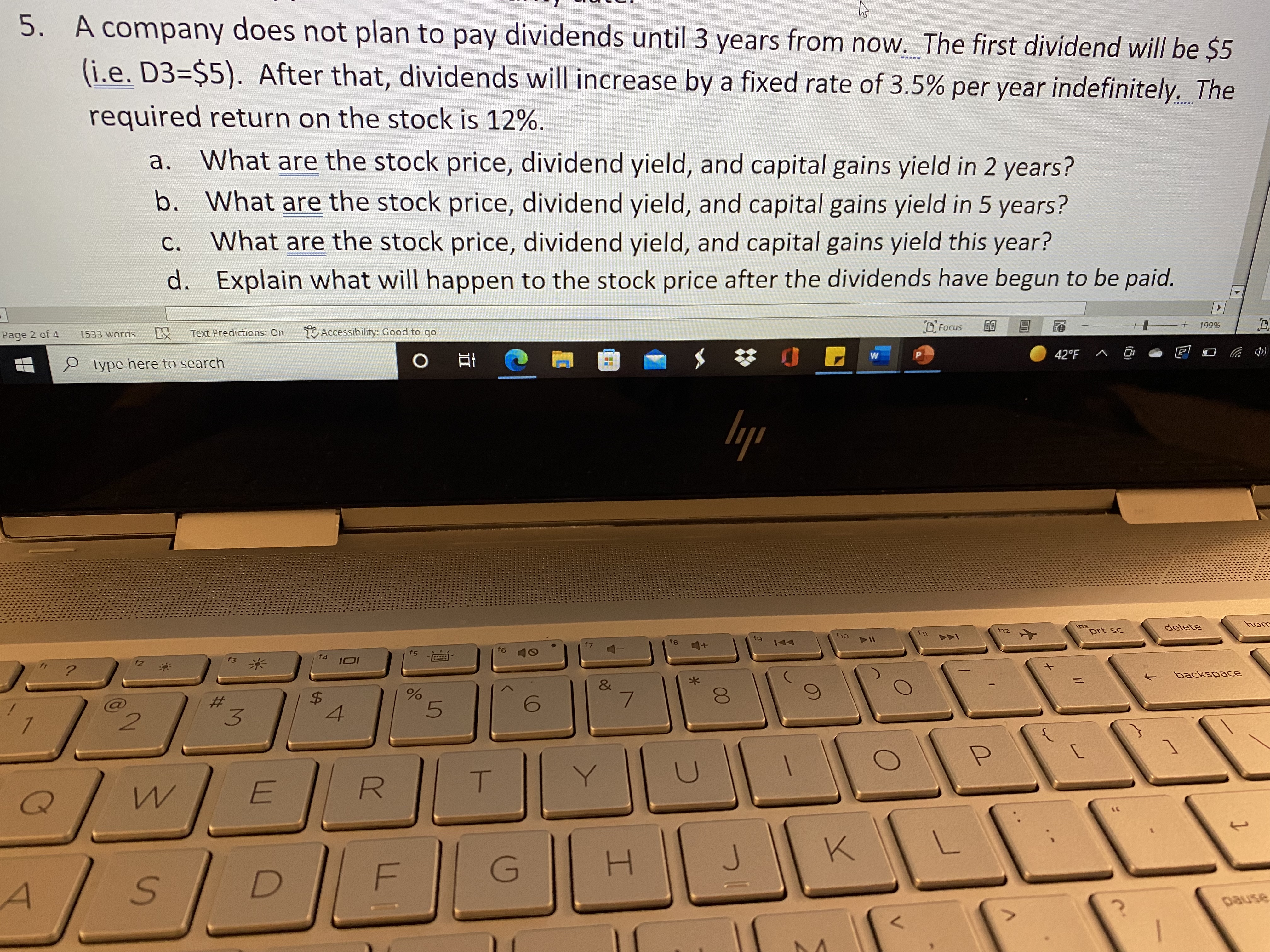

5. A company does not plan to pay dividends until 3 years from now. The first dividend will be $5 (i.e. D3=$5). After that, dividends will increase by a fixed rate of 3.5% per year indefinitely. The required return on the stock is 12%. a. What are the stock price, dividend yield, and capital gains yield in 2 years? b. What are the stock price, dividend yield, and capital gains yield in 5 years? C. What are the stock price, dividend yield, and capital gains yield this year? d. Explain what will happen to the stock price after the dividends have begun to be paid. Page 2 of 4 1533 words LX Type here to search Text Predictions: On Accessibility: Good to go DFOCUS O W 42F ^ ly ins f12 F11 prt sc + 199% D delete hom t backspace f10 fg fg 1 ? 2 # f3 * 3 $ f5 f4 IOI 4 % 5 f6 40 6 & 7 * 00 9 YUTOP H K T R W E / pause 7 A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started