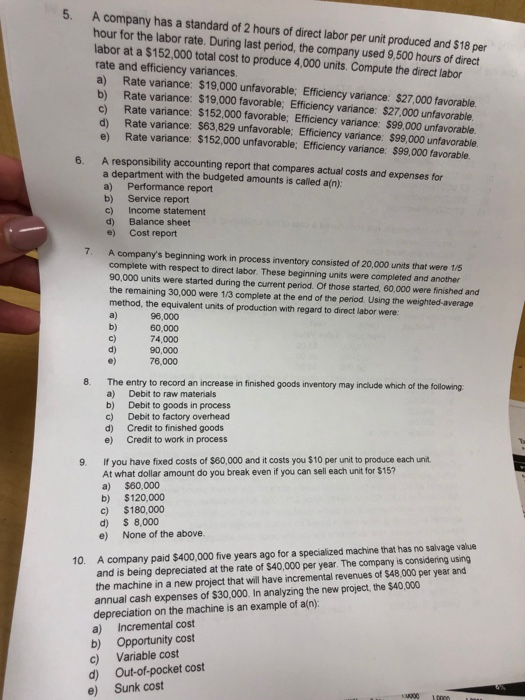

5 A company has a standard of 2 hours of direct labor per unit produced and $18 per hour for the labor rate. During last period, the company used 9,500 hours of direct abor at a $152,000 total cost to produce 4,000 units. Compute the direct labor rate and efficiency variances a) Rate variance: $19,000 unfavorable; Efficiency variance: $27,000 favorable. b) Rate variance: $19,000 favorable: Efficiency variance: $27,000 unfavorable c) Rate variance: $152,000 favorable; Efficiency variance: $99,000 unfavorable d) Rate variance: $63,829 unfavorable Efficiency variance: $99,000 unfavorable e) Rate variance: $152,000 unfavorable: Efficiency variance: $99,000 favorable A responsibility accounting report that compares actual costs and expenses for a department with the budgeted amounts is called a(n): a) Performance report b) Service report c) Income statement d) Balance sheet e) Cost report 6. 7. A company's beginning work in process inventory consisted of 20,000 units that were 1/5 complete with respect to direct labor. These beginning units were compieted and another 90,000 units were started during the current period. Of those started, 60,000 were finished and the remaining 30,000 were 1/3 complete at the end of the period. Using the weighted-average method, the equivalent units of production with regard to direct labor were: a) b) c) d) e) 96,000 60,000 74,000 90,000 76,000 8. The entry to record an increase in finished goods inventory may include which of the following a) Debit to raw matenials b) c) d) e) Debit to goods in process Debit to factory overhead Credit to finished goods Credit to work in process 9. If you have fixed costs of $80,000 and it costs you $10 per unit to produce each unit. At what dollar amount do you break even if you can sell each unit for $15 a) $60,000 b) $120,000 c) $180,000 d) $ 8,000 e) None of the above. A company paid $400,000 five years ago for a specialized machine that has no salvage value and is being depreciated at the rate of $40,000 per year. The company is considering using the machine in a new project that will have incremental revenues of $48,000 per year and annual cash expenses of $30,000. In analyzing the new project, the $40,000 10. depreciation on the machine is an example of a(n) a) Incremental cost b) Opportunity cost c) Variable cost d) Out-of-pocket cost e) Sunk cost